SpotGamma was one of the first analysts to flag the rise of ultra short-dated options (dubbed “0DTE”) volumes in the S&P 500 Index, or SPX. We brought this to the attention of the Wall Street Journal back in September of ’22, and since then the volumes tied to short dated expiration options volumes have exploded.

Accordingly, we have produced the following presentation which covers the rise and risk of these 0DTE options flows.

What Does 0DTE Options Volume Mean?

0DTE is an acronym for “zero days to expiration.” Earlier this year the CBOE launched expirations every single business day for SPX Index Options. The week of 11/14 exchanges then launched daily expirations for both SPY and QQQ.

For most stocks, the next available expiration is each Friday – and so 0DTE would refer to the next Friday expiration for tickers like AAPL or TSLA.

How Much has 0DTE Short-Dated Options Volume Increased?

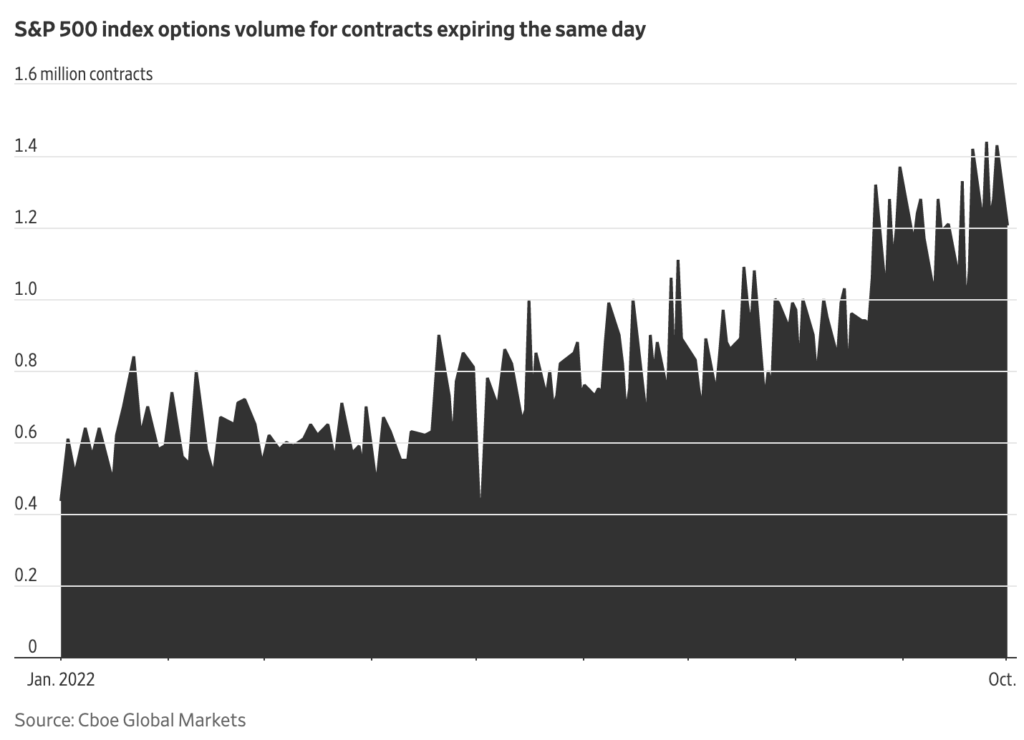

While 0DTE volumes for SPX were typically around 30% of total SPX volume to start 2022, they have increased recently to 50% of total SPX volume. You can see the rise in this 0DTE options volume for SPX in the chart below. Total options volume in the SPX for 2022 is ~2.1mm contracts per day.

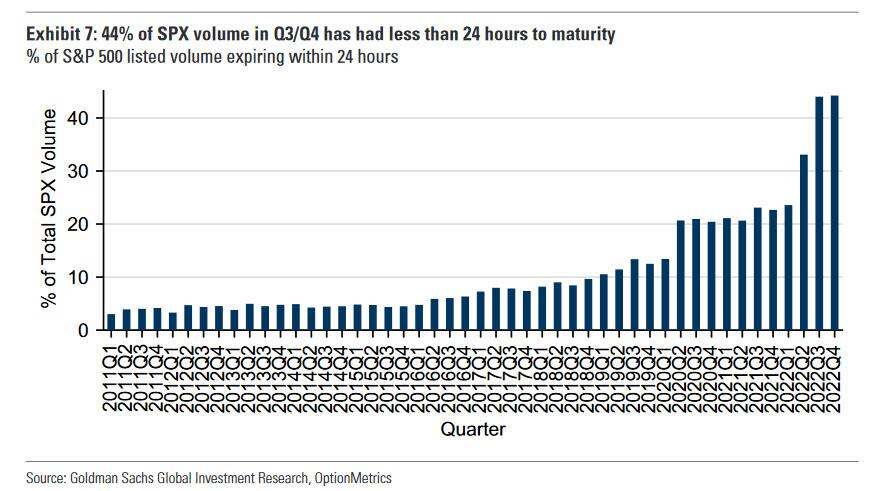

Goldman suggests that options with less that 24 hours to expiration now represent 44% of index trading volume, averaging $470bn notional per day over the month of November.

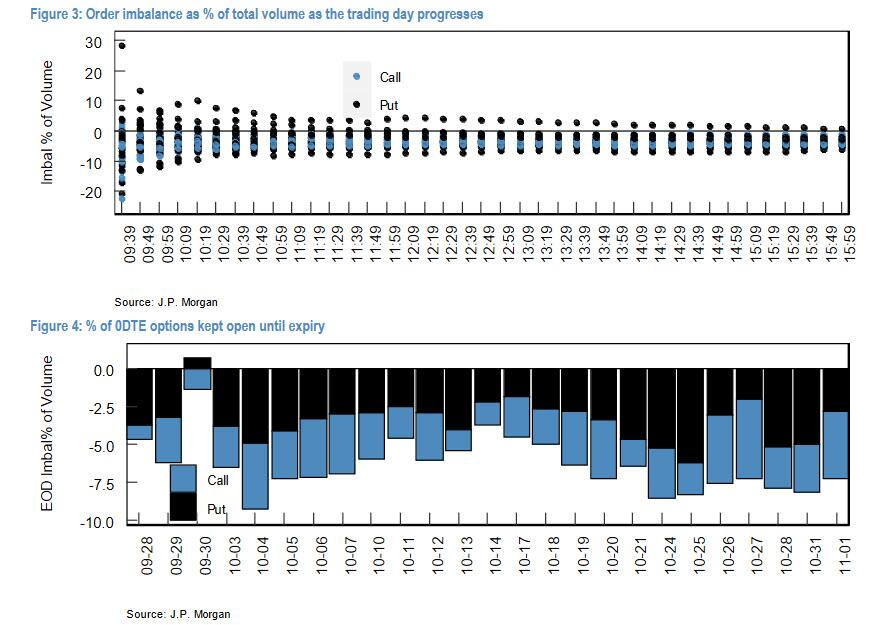

JP Morgan estimates that most of these small options are net sold, which is what we’d anticipate on average. This is because many traders like to sell these short dated options due to the perceived increase in relative time decay.

How Can You Monitor Short Dated “0DTE” Options Flow?

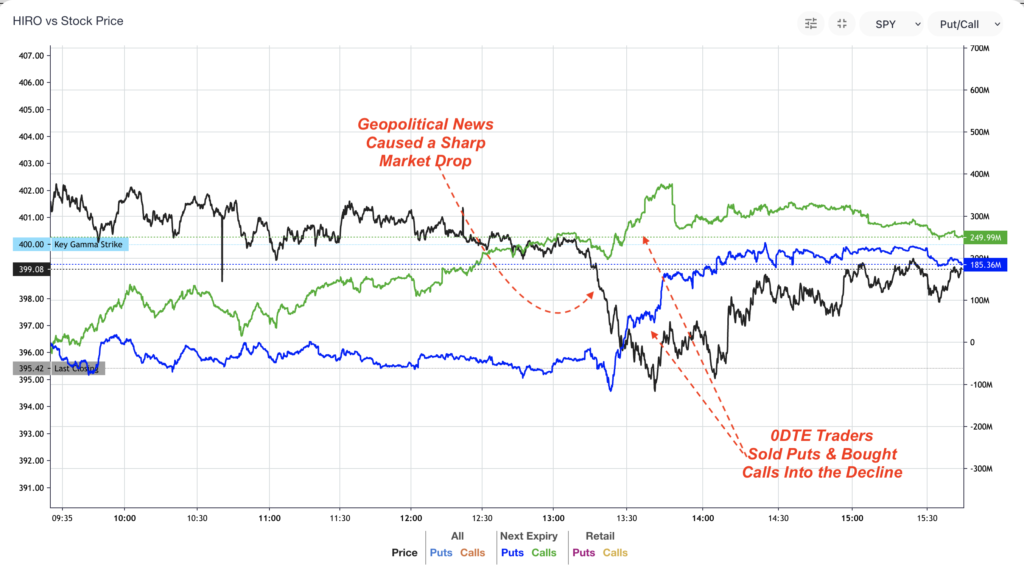

We think it’s critical for traders to be able to monitor this 0DTE flow in real time. For this reason we launched a new “Next Expiration” filter in our HIRO dashboard. This filter reveals the potential impact of these 0DTE options as they occur.

To access this product, sign up for an Alpha plan today.

SpotGamma’s “HIRO” Indicator reads all options trades in real time to determine their potential hedging impact. Recently we’ve added a modified HIRO signal which only monitors trades which occur at a stock’s next available expiration.