Intrigued by the record amount of call buying we decided to take a look at options in one of the more speculative names: MGM. There wasnt much of a scientific process to select a name, we just jumped to Reddit /wallstreetbets and chose the first name they were excited about. It seems like these folks are all making money, good for them.

MGM has had a strong move off of the lows. Still under performing general Indicies like SPX.

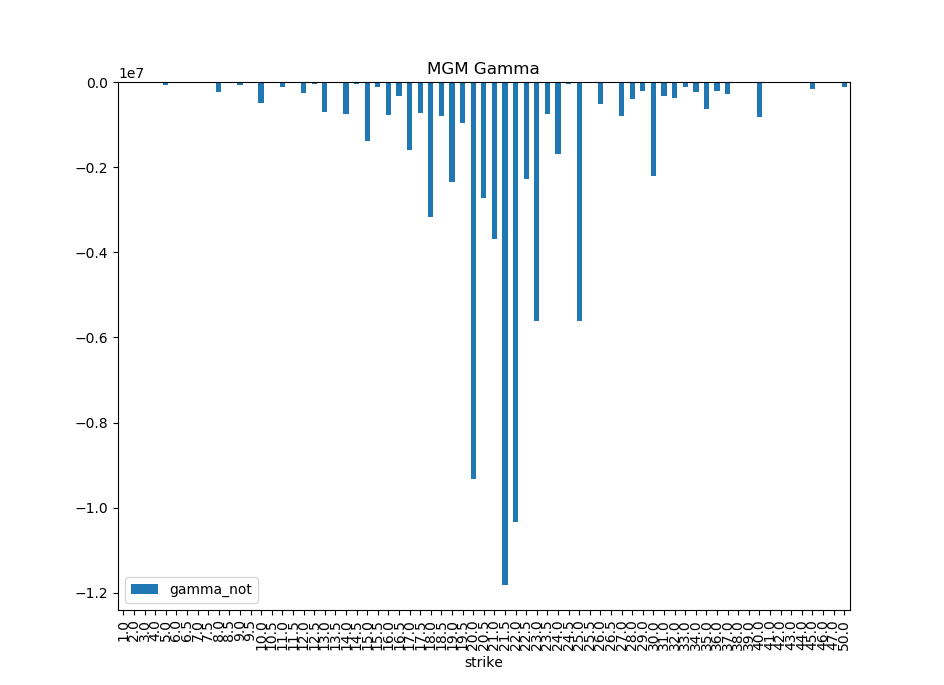

When we dig into the current options positions some interesting stuff comes up:

- Put Call Ratio ~.64

- Gamma weighted Put Call Ratio: ~.23

This indicates that while the put call ratio is high, the gamma weighted ratio is quite a bit higher. This is telling us that the positions that are around where MGM is trading are dominated by calls. You can see in the chart below that the gamma is concentrated around 20-23.

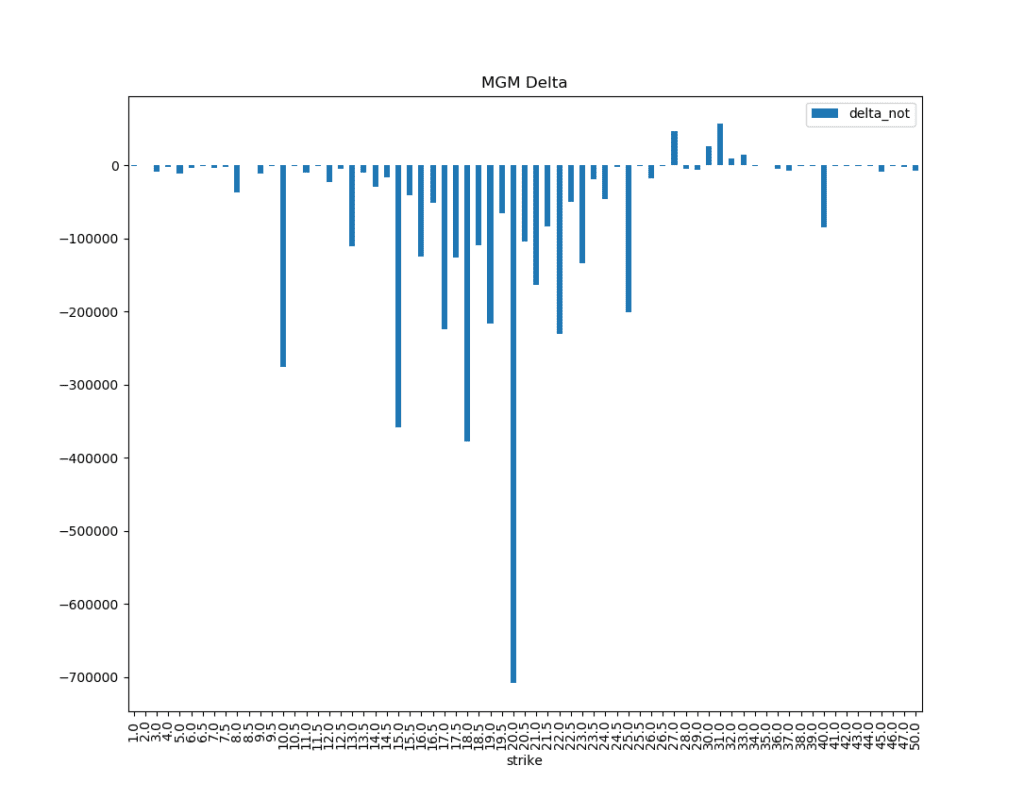

The options delta also tells us a similar story. The 20 strike seems to dominate, suggesting this is a very important level for this stock. MGM stock is currently trading a bit under 22, making this an interesting situation.

We find that 6/19 options expiration is the highest concentration of options for this stock. We see about 25% of the gamma and 20% of the delta will expire on that date. When these options expire, dealers will theoretically remove the stock position used to hedge these options. This could result in a significant amount of shares to trade, and is worth watching.