Friday (4/3/20) was an interesting day in the S&P500 market due to its rotating action around the 2500 strike. We had several data points that led us to believe that this strike would be key to the action on Friday and wanted to highlight those points. Most of these charts are only available to subscribers but we happened to post this signal out on twitter when the SPX was around 2475:

2500 may not go down without a fight. Its the largest OI level and very active with volume today. $SPX pic.twitter.com/3QqqTcdTsi

— spotgamma (@spotgamma) April 3, 2020

You can see in the SPX chart below that 2500 was a “sticky strike” and revisited by the market several times.

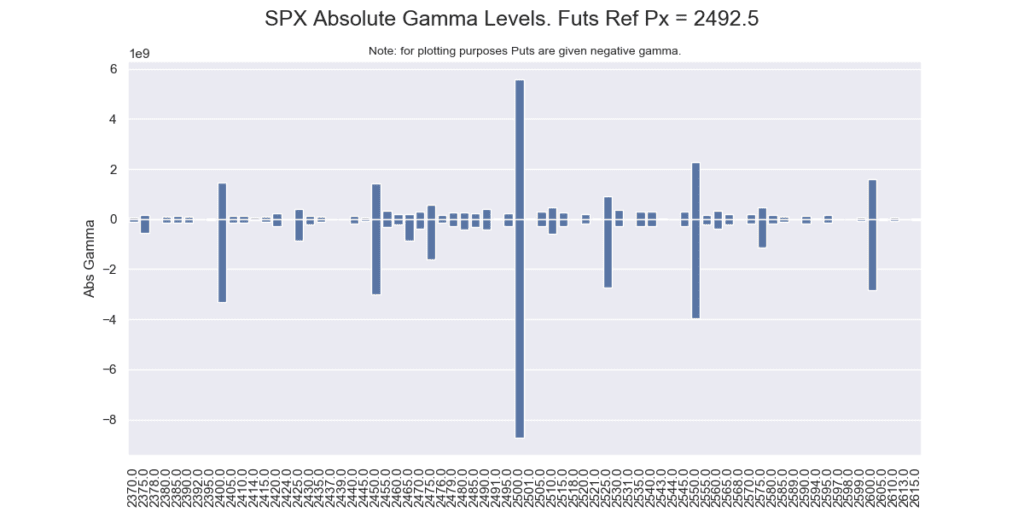

There are two components we feel contributed to this market action: open interest and volume. As you can see in our gamma chart below, the largest gamma strike was at 2500. This is different from looking at open interest by number of contracts because we weight the open interest with gamma. Open interest may be irrelevant if the strike is way out of the money, so we prefer to look at this gamma weighted open interest metric.

We think that these high gamma strikes draw hedging activity that influences the market to revolve around that level. This can create something like a “wide range” options pin wherein we tag the level throughout the day as you can see in the SPX price chart at the top of this post.

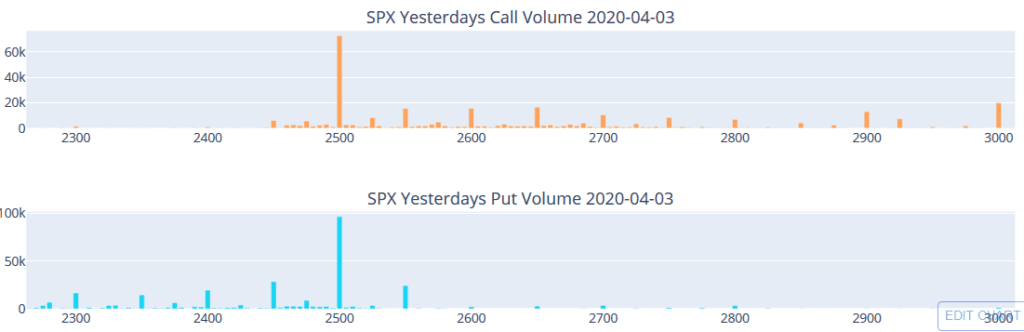

The second key piece of data is volume. This is both options volume and futures/equity volume. If the volume at the high gamma strike (2500 in this example) is high that can create even more hedging activity tied to that strike. You can see in the chart below that 2500 strike volume was quite high on Thursday, but also Friday as well. We provide charts for subscribers that show the daily change in open interest and volume to help identify these situations.

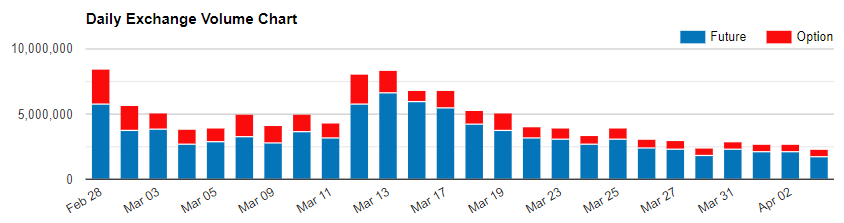

The last piece of this setup is to have light futures/equity volume in comparison to options volume. Lower relative volumes in futures mean that the hedging activities of options traders has more impact on the futures market, as options hedging is a higher percentage of equity/futures volume. You can see in the chart below from the CME that futures volume was down compared to previous days.

Note that our discussion here is in regards to SPX index options, we believe options market makers hedge SPX options with ES futures. Therefore those active in SPY or ES futures trading may be able to incorporate this data into their trading.