The following post is courtesy of Michael Kramer of Mott Capital Management. Reach him on Twitter.

Since the big June options expiration, US equity markets have run sharply higher. Starting on June 18, the S&P 500 has gained an unexpected 5%. The move higher has come despite many economic reports suggesting the economy may have hit peak growth rates, coupled with a Fed that may grow more hawkish in the second half of 2021. However, the tranquility and flight higher for stocks may be about to end.

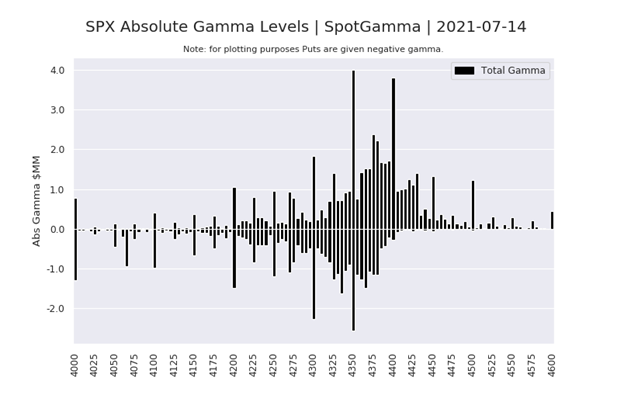

The recent run-up has pushed many key indexes and ETF’s, such as the NASDAQ 100 (QQQ), well into overbought territory. Meanwhile, leadership within the equity market has narrowed, meaning fewer stocks are pushing the market higher. However, come Friday, the equity market will see gamma positions built up over the past month, helping to drive the market higher, melt away. So, the S&P 500 will lose that big center of gamma gravity which has helped keep the index anchored around 4,350 to 4,400 since July 2.

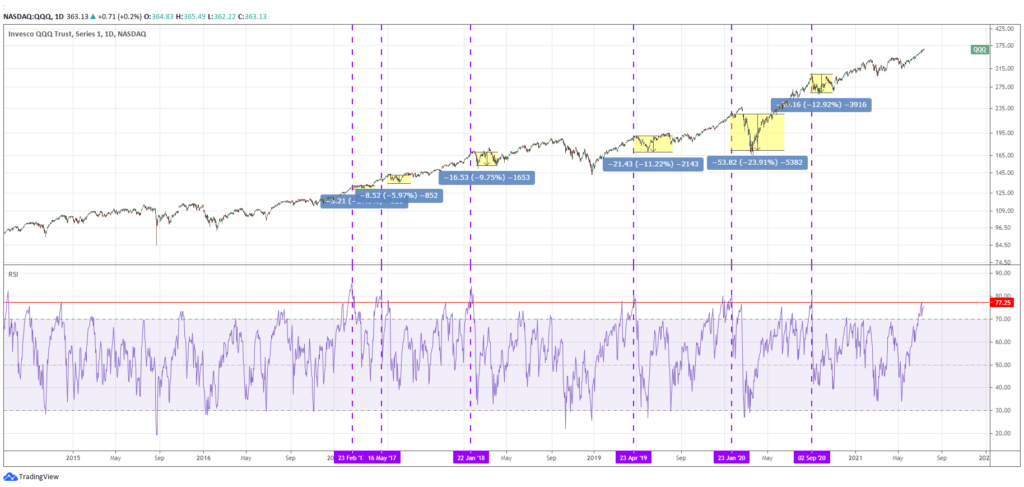

Once the index loses the gamma levels centered around the 4350 to 4400 range, it will allow the markets to move more freely, thus creating greater volatility. Considering how overbought some parts of the market are, like the QQQ ETF, once volatility increases, it could result in a sharp move lower for the entire equity market. The QQQ has a relative strength index of over 75 and was recently as high as 77.25 on July 7. An RSI at this level suggests that the ETF is extremely overbought. Since 2015 the RSI of the QQQ ETF has only exceeded 77 roughly six other times, with four of those times resulting in the ETF falling by 10% or more in the days and weeks that followed.

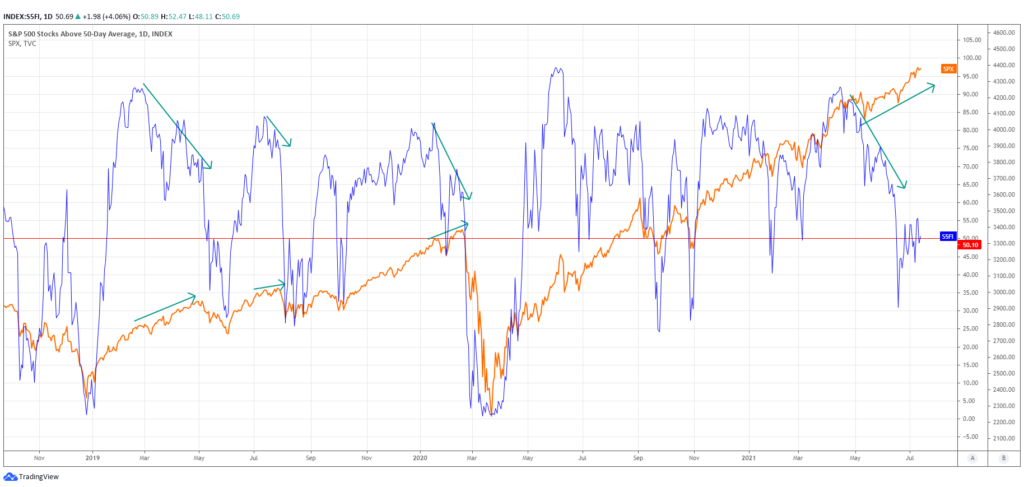

Additionally, the falling participation rate of stocks appears to suggest only a handful of companies are partaking in the recent rally. For example, the percentage of stocks above their 50-day moving average in the S&P 500 has declined since peaking in mid-April, despite the S&P 500 reaching record highs. In the past, the declines in the percentage of stocks above their 50-day moving average have at times signaled a turning point in the index preceding pull-backs.

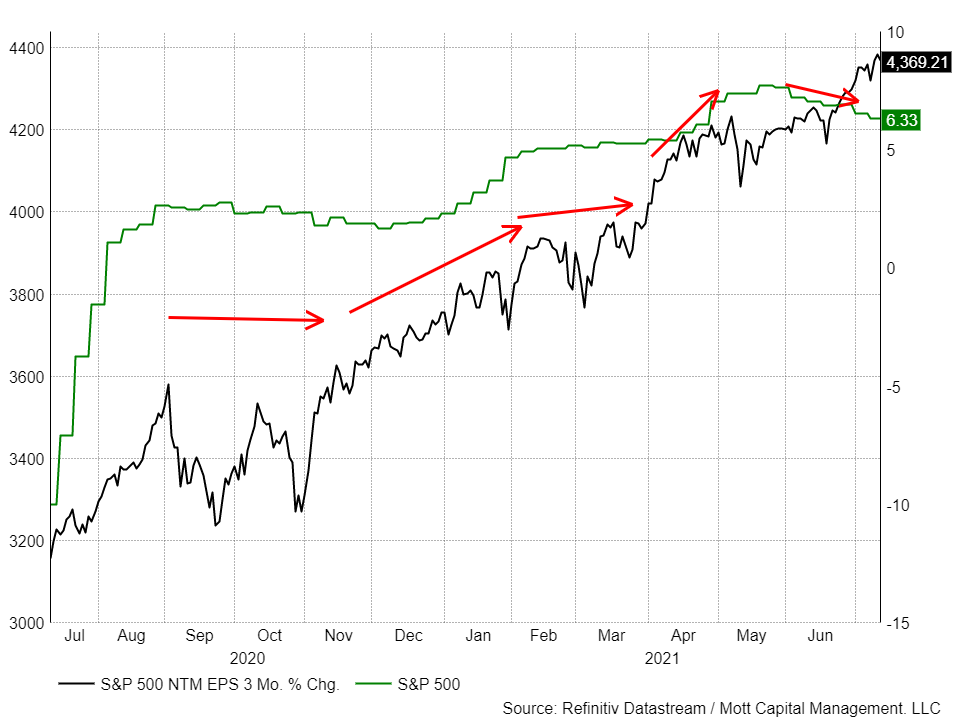

What’s been driving the move higher appears to be centered around expectations that earnings will be strong, which will usher in another round of upward earnings revisions. During periods of positive earnings revisions, the S&P 500 runs up, but when that growth rate flattens, the S&P 500 goes through a period of heightened volatility. That’s what makes this most recent move higher so vulnerable because the current pace of revisions is slowing, after peaking in May, and is diverging from the S&P 500’s recent advance.

All of this makes the timing of the July options expiration perhaps more crucial than usual. For now, the S&P 500, and the entire equity market, has been pinned at these upper levels due to the positioning of the options market. That means this Friday and especially next week could be a very eventful one for the overall market and potentially painful.

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.