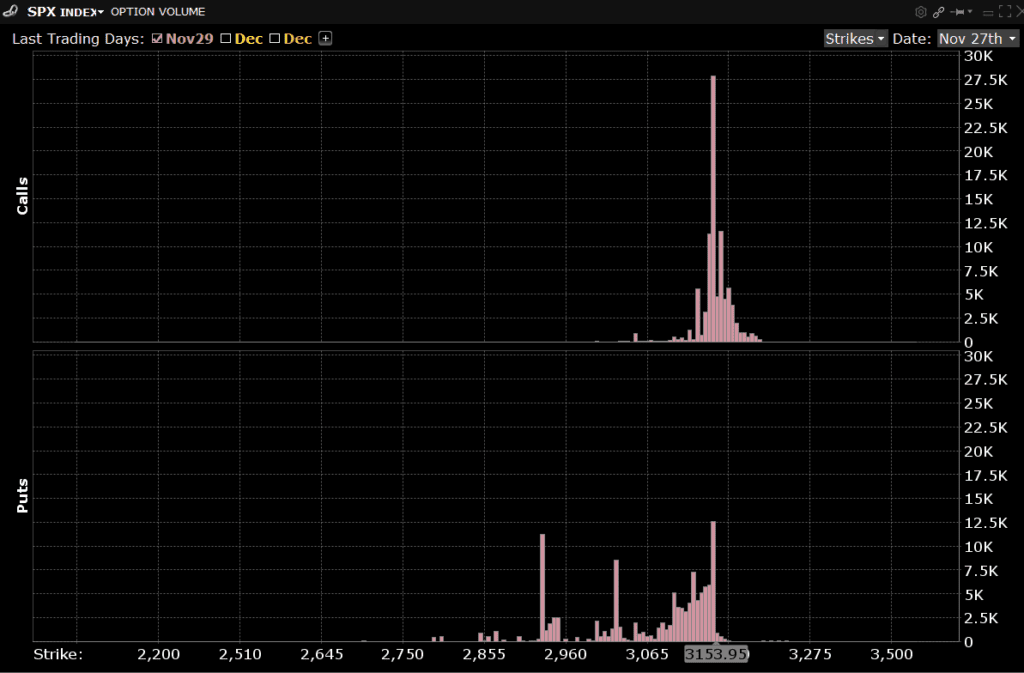

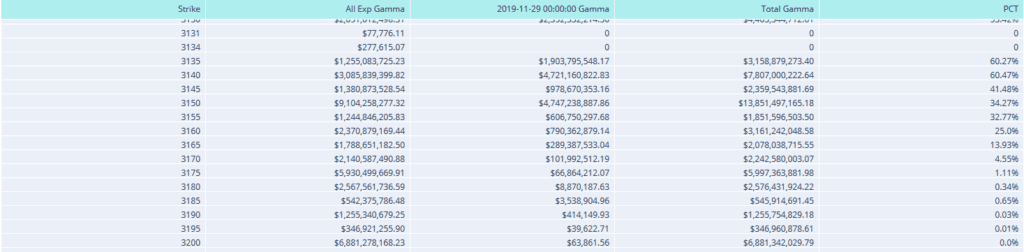

Today is an interesting setup that we’d like to document. Currently its Wednesday afternoon with Thanksgiving tomorrow. Therefore tomorrow US markets are closed and a 1/2 day Friday. We picked up on our charts a large amount of at the money (ATM)/slightly in the money ITM calls expiring on Friday at the close. You can see in the chart below (link here) the large percentage (far right column) of overall gamma that expires on Friday.

This is where deltas can come into play. In this case many of those options are in the money making them have fairly high delta values. What we dont know is:

- Which side the dealer is on (long/short)

- When/how/if these positions will be rolled

If dealers are short these calls then theoretically they are hedged with long futures. So the expiration and/or roll would cause dealer selling in futures. This would be cause the new position (or no position) would have a lower delta than an ITM call.

If dealers are long these calls then they are short futures against them. They would be therefore buying futures on a roll or expiration.

You can see how determining the direction would be very difficult. What we can possibly bet on is that volatility will pick up. Generally when the market gamma is this high (~$2.5bn ref: 3150) we expect a very tight range in the SPX , with the high/low move on the day about 50bps. Plus implied volatility in options is very low. Fridays ATM call/put has an implied vol of 5 which implies an expected move in SPY of about 60 cents by Fridays close.

Lets say we have 25,000 contracts with a 100 delta that needs to be rolled. That would be about $7.8 billion to trade. Not an overwhelming sum, but its lighter holiday volume. Sprinkle in month end and the idea is that volatility is quite possible under priced for today/Friday.

Update 11/27 close

Not much movement today with SPX closing at 3153 (+40bps). Certainly some of the call positions got rolled for 11/29 but not all of it (chart below). There was a ton of volume today which very well pinned us to 3150. We’ll see what Friday brings.