Last night the S&P announced that TESLA (TSLA) would be added to the S&P500 (SPX) Index by Monday 12/21. What this effectively means is that anyone that has funds (pensions & other large asset managers) indexed to the S&P500 will need to purchase TSLA stock, and will sell whichever stock(s) TSLA is replacing(TBD). As TSLA has such a large market cap this is a very large notional change which likely requires a significant amount of the TSLA float.

For funds that are linked to the S&P500 its important that they own the stock on the close of the date that it is added. This is so that they match the S&P500 index to which they are benchmarked. The way they often do this is to purchase shares from a dealer that guarantees them the closing price of Friday 12/18. Therefore the dealers may be purchasing the stock ahead of time so that they can sell (aka “facilitate”) the required shares to those index funds at the close. Again, dealers buy the TSLA shares in the day(s) leading up to the TSLA S&P add, then sell those shares to the large funds at the close of 12/18 (when TSLA is officially added to the S&P500).

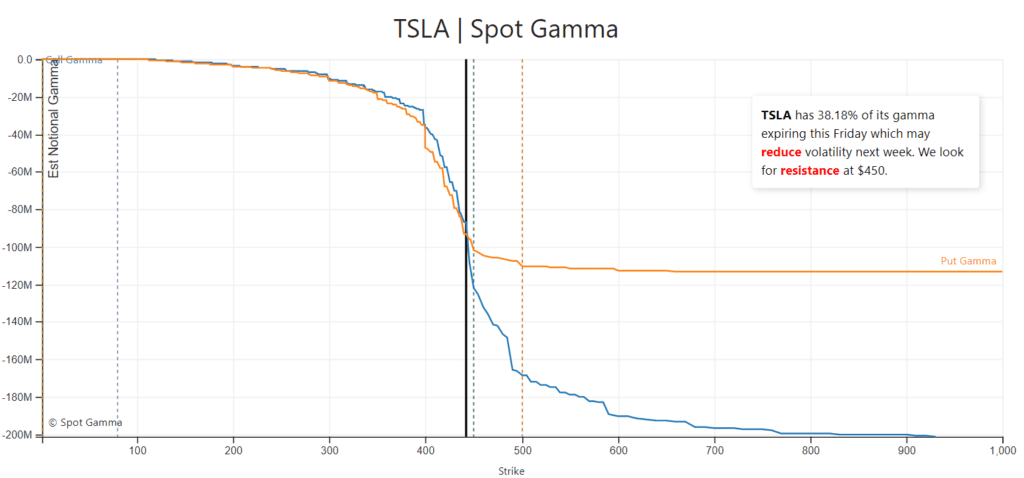

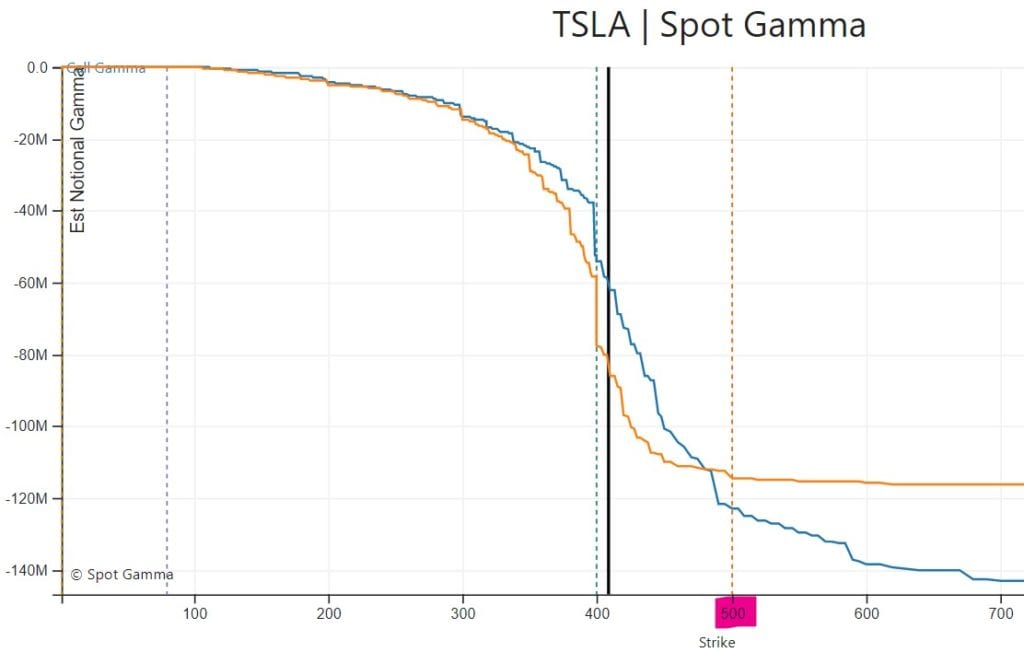

The mechanics of the S&P Index add are a bit slower moving than the feverish call buying by the likes of r/wallstreetbets. The call position coming into 11/17 in TSLA is less aggressive compared to August positioning, with the 500 strike being the largest call level. As you can see in the chart below the amount of call gamma(blue line) is roughly equivalent to the put gamma (orange line).

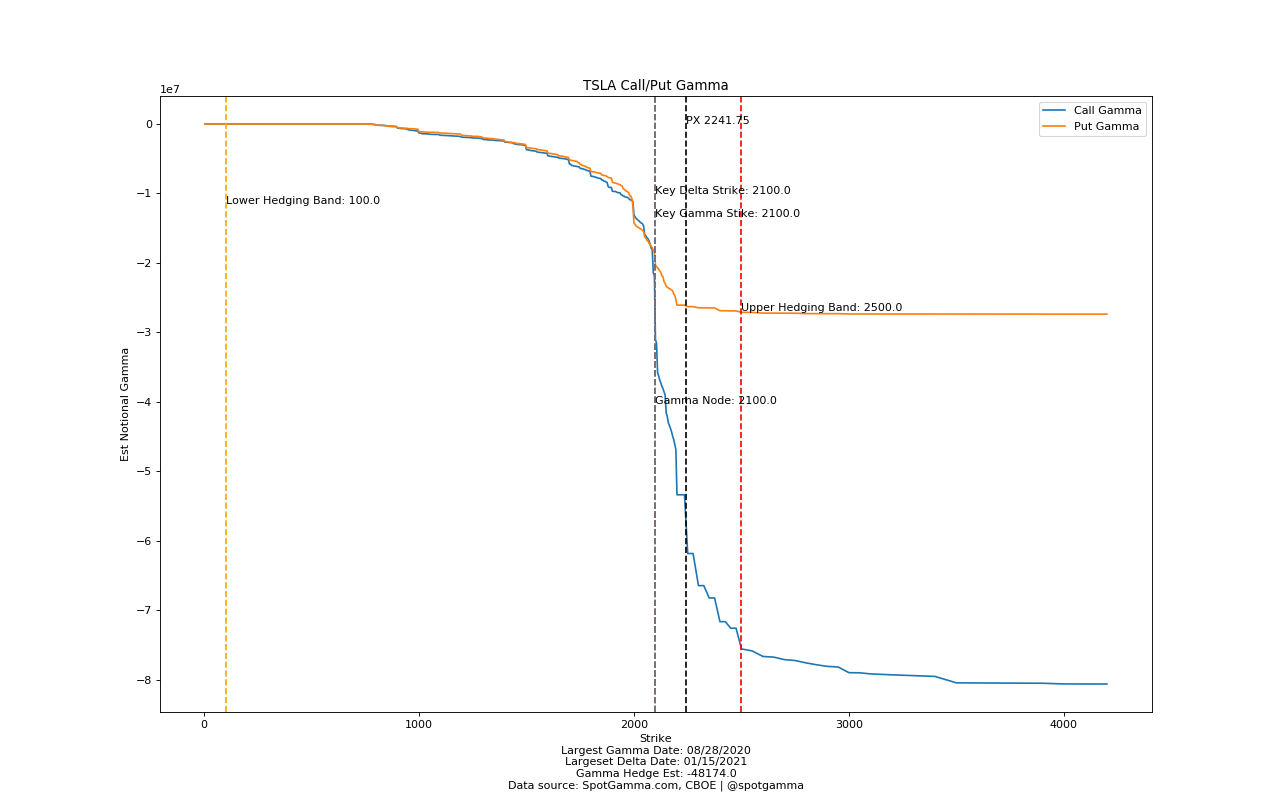

If call positions were much larger than puts we would see that blue line extend far below the orange line, as it did in August (chart below) during the massive move higher in TSLA stock. The “gap” between the call and put gamma in August implied that there were a lot more calls at strikes overhead, and this drove dealers to aggressively buy the stock as it went higher.

Our assumption, here in November, is that call buyers will now be aggressively stepping in as a result of the S&P add to shift a divergence between call & put gamma. It will be interesting to see if the stock can reach that large $500 strike as various players step in ahead of the large index add.

We see two sources of buying that may now materialize:

- Call buyers and other short term traders now

- Dealers and Index funds into 12/18

We’ll post an updated TSLA options chart tomorrow.

If you like these charts, consider a trial of our EquityHub.

UPDATE:

Despite the 950k call volume yesterday it looks like the net OI add is about 200k. Regardless todays position looks more bullish than yesterdays, and the stock seems to be shifting a bit higher.