Note that last candle, which closes the stock at $695 – the days high. Did someone really just pay $695 for $TSLA shares? pic.twitter.com/zi5UrJopbq — Joe Weisenthal (@TheStalwart) December 18, 2020 TESLA TRADING VOLUME AT 180 MILLION AS STOCK SETTLES AT END OF SESSION, TURNOVER AT $122 BILLION — *Walter Bloomberg (@DeItaone) December 18, 2020 […]

S&P500

TSLA into the S&P500

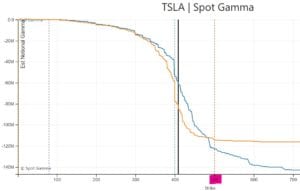

In TSLA the largest gamma area was $600 heading into today. The stock traded down to $605 earlier this AM, $620 now. The largest volume & OI region is >=$650 44% of TSLA gamma exp on close of12/18, by which time ~$50bn of TSLA stock needs to be bought by S&P indexers

TSLA Timeline into the S&P500 Add

TSLA will be added to the S&P500 Index next week, and will be approximately 1.5% of the index. We covered the mechanics of this add, here. The chart below highlights the key recent events, and some relevant future dates. The “$” markets indicate where Musk has received a bonus in the form of TSLA options. […]

TSLA Added to the S&P500

Last night the S&P announced that TESLA (TSLA) would be added to the S&P500 (SPX) Index by Monday 12/21. What this effectively means is that anyone that has funds (pensions & other large asset managers) indexed to the S&P500 will need to purchase TSLA stock, and will sell whichever stock(s) TSLA is replacing(TBD). As TSLA […]

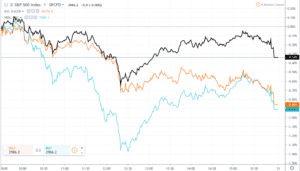

Gamma Effect Seen In Index Movement

Lets classify this as what it is: speculation (at best) but its quite interesting on days like yesterday when the S&P is down only 34bps while Nasdaq and DOW were down ~90bps. Yes, Boeing (BA) hurt the DOW in particular but that wouldn’t explain the Nasdaq performance. The theory that should be bookmarked here is […]

FED, TRUMP, Gamma Trap: Crazy Trading Day 8/23/19

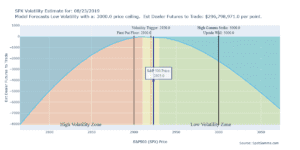

Fed gave a speech that was “volatility dampening” at 10AM. Trump didn’t like what the Fed had to say so he started tweet-trashing the Fed and China triggering a “gamma trap“. Stock markets were just at the volatility trigger level of 2920 (black horizontal line) so the gap down flipped the trigger and dealers were […]

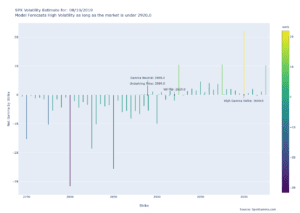

Gamma Market From 8/16/19

Volatility will continue to reign until (if) the market recaptures 2920. There is a ton of fuel ready to burn and one headline (or tweet) will send the market flying. The only recommendation that is safe here is to not sell any options, being short volatility is very dangerous here, as a >3% rally is […]

Dealer Futures Flow 8/14/19

Here is a chart estimating the futures action with the S&P500 at 2850. If markets head lower it looks like dealers will sell more futures, compounding the move down. The same works in a rally, but instead of selling those dealers will be buying. All this flips when/if the market moves over the VFLIP line […]