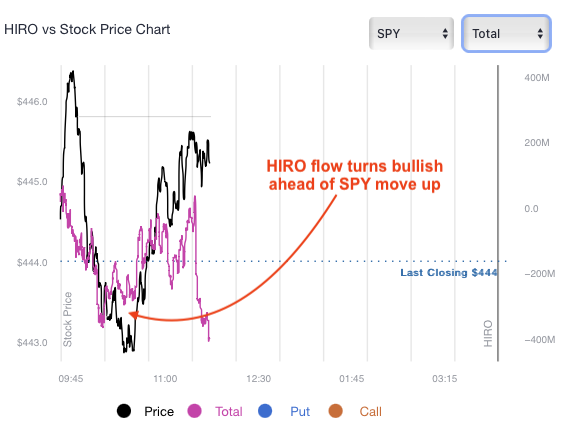

This morning we had a volatile opening, with SPY ripping ~$2 higher before reversing sharply (black line). The HIRO signal (purple) did not move up along with SPY on that opening, suggesting the options market wasn’t “buying” the move.

After that opening rip, SPY sold sharply lower to $443. It was on those lows that we saw the HIRO signal turn bullish, as highlighted with the red arrow. This suggested that the options flow turned bullish with traders buying calls and or selling puts.

Shortly after the HIRO signal turned higher, SPY followed suit with a nice rally back to $445.