Special Note: You’re invited to join SpotGamma on October 28 as we kick off Hidden Forces Unmasked, our live trader event built to help you protect PnL, outsmart volatility, and spot your next winning setup before the open.

Get first access to our new Options Calculator and supercharged HIRO, along with the full suite of SpotGamma tools, free. Plus, score a shot at exclusive giveaways.

Vol Deflates, GLD Sells Off, and Earnings Season Ramps Up

Markets experienced a dramatic arc last week as SPX bounced between key gamma levels at 6,650 and 6,800, ultimately closing Friday at 6,792. The S&P 500 gained a solid 1.5% for the week.

As we mentioned in our podcast with Excess Returns last weekend, inflated realized vol tends to mean revert following OPEX. As a result, shrinking post-OPEX volatility provided support and stability for last week’s rally. Meanwhile, VIX made a full round trip from 16 (pre-10/10 sell-off) to 28 (10/17 OPEX day) and now back to 16 again.

Dealers remain long gamma in the 6,650 to 6,825 range, which we expect to further stabilize price action between these levels. Above and below this range, dealer gamma flips to negative.

VIX expiration on October 22 created some volatility as positioning shifted for dealers. The “max pain” scenario played out nearly perfectly, with VIX pinning around the 18 strike — which held the largest amount of open interest — near expiry.

Implied volatility has been crushed significantly over the past week, as shown in the SPX Volatility Skew chart below. Notably, 0DTE vol sellers are once again appearing in force on a daily basis, reinforcing the positive dealer gamma that dampens volatility.

Trade Highlights: GLD Round Two

Gold and silver stole headlines again midweek, this time with dramatic moves to the downside. GLD plunged 6%, while SLV dropped 8% on Tuesday.

Notably, GLD’s 1-month realized volatility fell back to historically modest levels following the selloff — vindicating our analysis last week of the “stock up, vol up” paradigm for precious metals.

As an example of how traders could capitalize on this sell-off, the January GLD puts we highlighted in our subscriber webinar gained over 80% within one week — with 60 days still remaining to expiration.

The Week Ahead: FOMC, Tariff Meeting, and Tech Earnings

Next week presents a number of important events that will likely determine the market’s trajectory into year-end:

- Oct 29 (Wed): FOMC, META/MSFT/GOOGL earnings

- Oct 30 (Thu): Trump/Xi meeting, AMZN/AAPL/COIN earnings

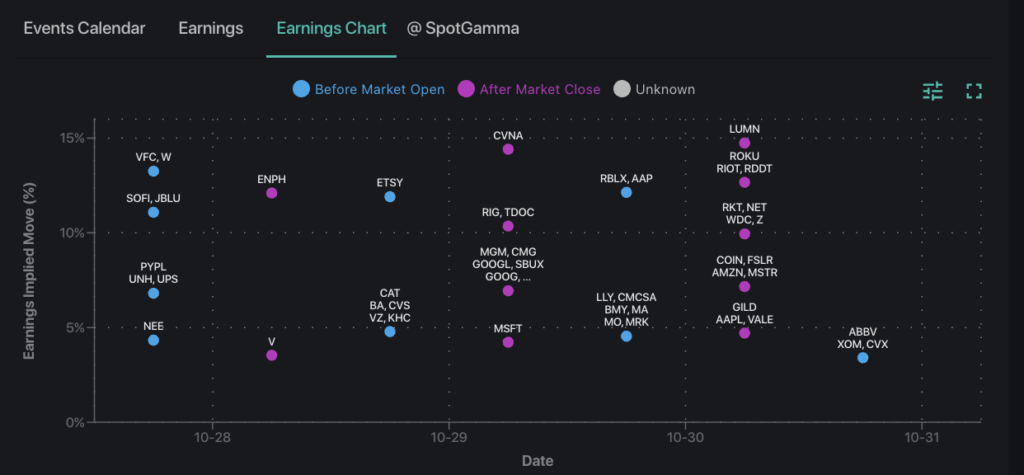

Earnings season intensifies this week with more big tech names reporting. Options markets are pricing in elevated implied moves (6% for META, GOOGL and AMZN; 4% for MSFT and AAPL), suggesting that traders are bracing for single-stock volatility to continue.

For a deeper understanding of how volatility impacts your trading alongside other veiled forces from the options market, join us for Hidden Forces Unmasked on October 28 — where we will share exclusive access to five new tools designed to protect your PnL and optimize your trading.