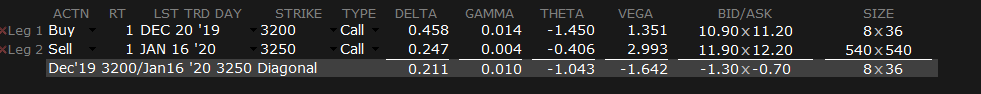

December OPEX has a many strikes that have large open interest (OI). For calls there are many in the money strikes as you can see in the grid below with OI greater than 20k or 40k – the 3000k strike has 125k contracts. There is large size in puts as well, but these are currently out of the money. These contracts could have a large impact on the way the market is moving into Fridays OPEX. The key to understanding the impact is:

- Whether those calls were bought or sold to market makers

- When/how these contracts will be rolled

If the bulk of these calls were sold to dealers, that means dealers are long these in the money calls and have them hedged. When these call positions are closed or expired dealers may have short delta hedges on that they would have to close. This could equate to several billion dollars in futures depending on how these call positions net out.

Conversely if these are net long call positions, dealers would need to close their hedges by selling futures as their current position would be net short calls, hedged long deltas.

Also to note there are large put positions that are out of the money, some just slightly. If the market were to move down this week these could come into play, netting out the impact of the in the money call positions.

We also don’t know when or how these positions will be rolled. If they are closed and rolled out to a lower delta strike that could still cause a delta impact. They may also be taken off over the week, lightening the immediate hedging impact. It could be possible for instance the calls are rolled off and puts are left on, creating a directional risk into the end of the week. As the gamma of these positions pick up into the end of the week a sharp move could force the roll to happen sooner or faster.

You can see how the large open interest for the December OPEX has the potential to cause volatility into the end of this week and out towards the start of next week. The key will be watching options trading volume and open interest updates for signs of position changes.

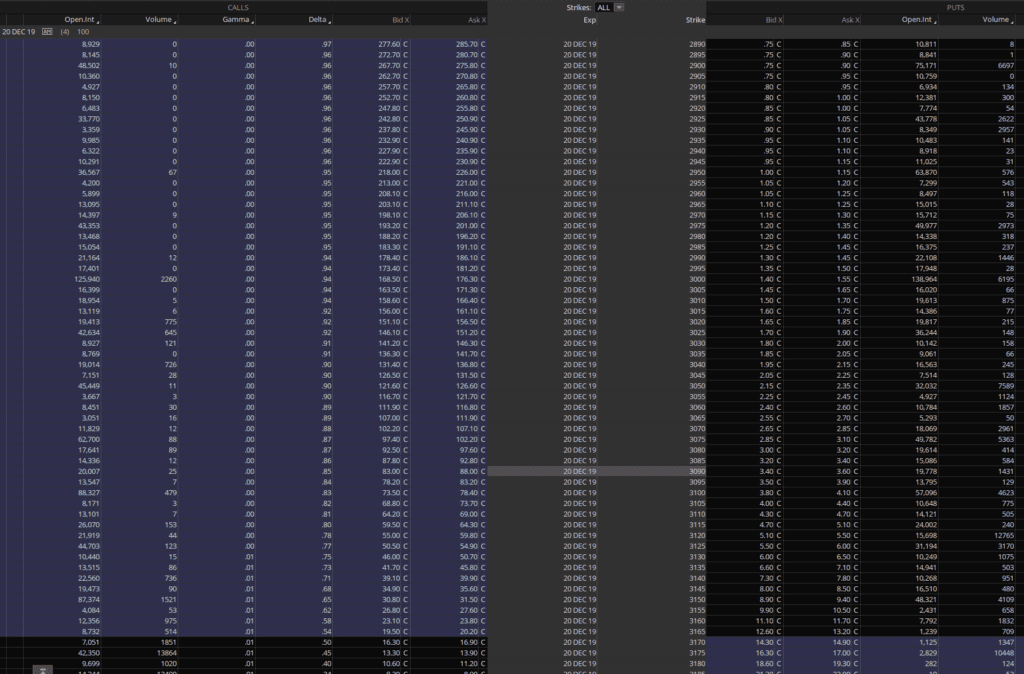

Here is a trade example we are currently seeing: rolling from Dec 3200 to Jan 3250. We don’t know which leg is long or short, but we can tell the potential directional impact. If we assume the Dec is short and being rolled out and up to Jan 3250, it has a delta impact of +20 deltas as you can see in the chart below. For example 1,000 of these spreads trade dealers may have to sell $64 million in futures.