In our daily observations of (bizarre) market moves (usually in the context of comments from Nomura’s Charlie McElligott and Masanari Takada), we frequently analyze the delta-hedging of option positions by dealers, i.e. gamma, which for a variety of reasons has emerged as one of the dominant drivers of risk assets (at least until the Robin Hood army was unleashed and now appears to have even more of an impact, if only temporarily). But why the focus on gamma, and why is it important, especially in option-expiration weeks? Simply said, as you will read below, “Gamma has the potential to be one of the most important non-fundamental flows in equity markets (particularly when “short gamma” causes volatility to accelerate), but tracking gamma is complex and dynamic.”

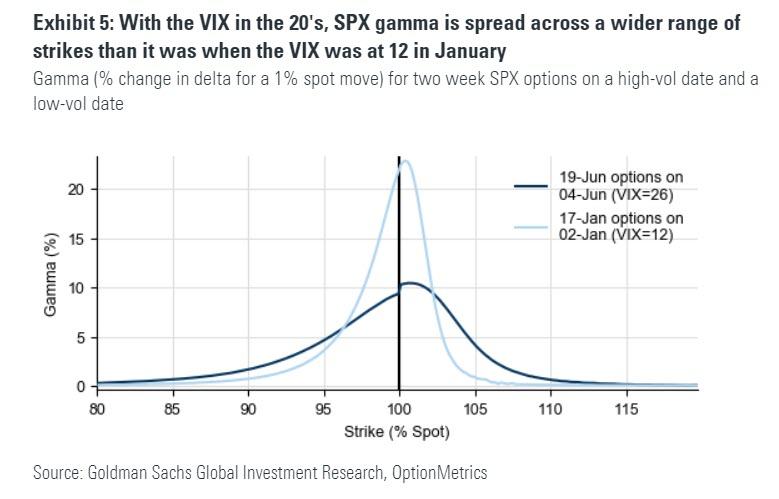

So, in response to many reader inquiries, and requests for a primer of why this data is important, overnight Goldman’s equity derivatives strategist Rocky Fishman has published what may be the definitive “Q&A on Gamma and Option-Driven flows”, which we hope will answer many readers questions and provide a framework for how to think – and trade – dealer gamma and option-driven flows in the market.

So, without further ado, here is Goldman’s “greeksplainer” on Gamma and option-driven equity flows.

Q&A on Gamma and Option-Driven Equity Flows

We expect option-driven flows to draw investor attention in the coming weeks given the 19-Jun expiration is 15% larger than a normal Mar/Jun/Sep quarterly expiration, activity in very short-dated options has risen, and liquidity metrics remain weakened. Gamma refers to the change in an option’s exposure to its underlying market as it moves from out-of-the-money to in-the-money, which can lead market participants to offset this change by trading the underlying shares. Gamma has the potential to be one of the most important non-fundamental flows in equity markets (particularly when “short gamma” causes volatility to accelerate), but tracking gamma is complex and dynamic. We take a conservative approach to assessing gamma positioning, as we believe errant assumptions can readily lead to overestimation of the effect of gamma.

Why is option gamma important for equity investors to follow?

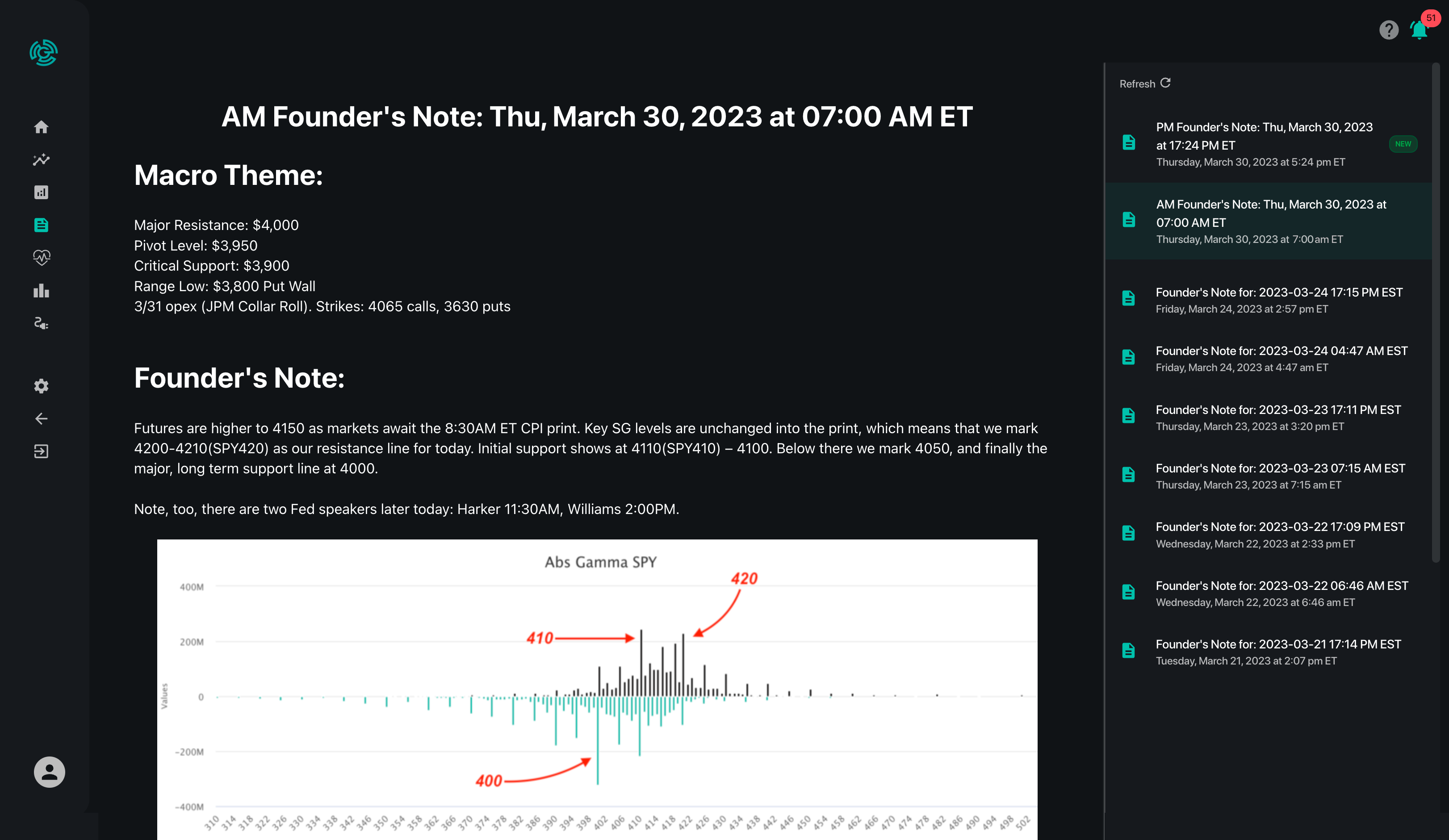

Gamma – the potential delta-hedging of option positions – is one of the larger sources of non-fundamental economic activity in global markets. Market makers who delta-hedge their option positions are economically driven to trade substantial amounts of underlying shares or futures, strictly as a result of the price of the underlying itself changing, not as a result of fundamental news and without regard to the liquidity available. As a result, gamma can cause markets to overreact to fundamental news (“short gamma”) or to under react to fundamental news (“long gamma”). Gamma appears to have been rising in importance over the last couple of years: SPX options alone currently have open interest of around 20% of the market cap of the S&P 500 – a number that has been growing over many years. Quarterly option expiration weeks have historically had 10-20% more SPX option trading volume than other weeks. Perhaps more important than the actual trading of option market participants, gamma can become part of the market’s narrative, particularly when liquidity is thin, so investors would benefit from the hard numbers quantifying gamma.

How can gamma impact market volatility?

To the extent “the street” (see below) is sufficiently short gamma, option traders will be economically driven to sell equities when they are falling and buy them when they are rising, making market moves in both directions start to go faster and driving up volatility. When long gamma, the opposite happens: option traders buy dips and sell rallies, slowing down market moves.

How big is the SPX options market, and how much gamma do listed options have?

Because of its size and visibility, this note focuses on S&P 500 options markets, though gamma is important across option markets across asset classes. Some “headline” numbers for SPX options:

20% of SPX market cap.

The SPX options market currently has open interest of options corresponding to $5.2tln or 20% of the index’s market cap. The total includes $3tln of put options and $2tln of call options.

SPX+SPY+ES=$7tln.

Options on the SPY ETF and on E-mini SPX futures (“ES”) add an additional $1.6tln of open interest, for total of nearly $7tln SPX-linked open interest, or 25% of the SPX’s market cap.

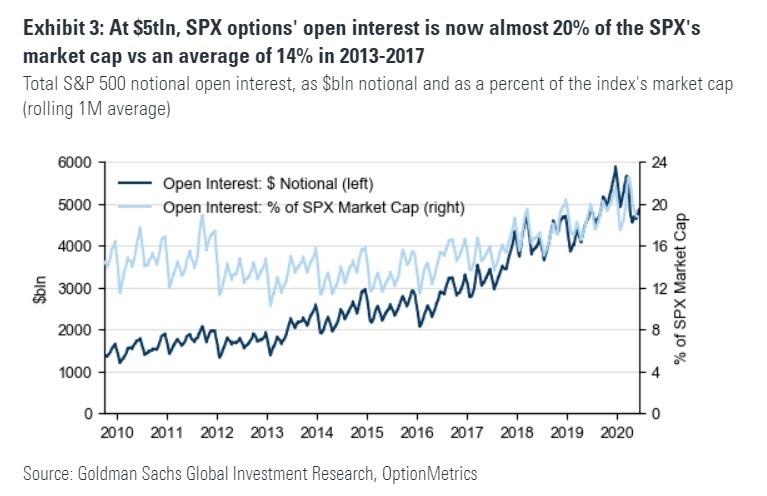

$80bln gross gamma.

SPX options alone now have $80bln of gross gamma, meaning that for every 1% the SPX moves, the total of each individual option’s delta change is $80bln.

Why is the impact of gamma likely far smaller than “headline” totals would indicate?

In our view, gamma impact is frequently overstated by market participants. We see several reasons why delta-hedging flows are usually far smaller than inferring gamma impact from open interest data might indicate:

Investors both buy and sell options.

Selling put options as an alternative to outright long positions, and selling call options to express an “anti-bull” view are both strategies widely employed by investors. These offset flows of buying options.

Many strategies involve both buying and selling options.

A put spread, for example, has two legs with partially offsetting gamma positions.

Combos are a zero-gamma use of option markets.

A material percentage of index option activity (as opposed to options on futures, ETFs, or stocks) is in “combos”: trading a put and call in opposite directions at the same strike to create a long or short position in the underlying. Combos are often used to delta-hedge index option positions, since they can be a better fit for margin and settlement purposes than futures or ETFs. These add gross gamma but have no net gamma.

If many investors roll their in-the-money options, they can collectively resemble delta-hedgers.

In equities, few option users have a true buy-and-hold (or sell-and-hold) approach. When put option buyers start to go in-the-money after the market has fallen, hedgers will typically either sell the options or roll them to lower strikes, in effect reducing the negative delta of their hedges. When viewed as a group, these option holders have delta-hedging-like activity that offsets some dealer activity, potentially significantly reducing the impact of dealer gamma.

How can investors track net gamma positioning? How can one know if “the street” is long gamma or short gamma, and to what extent?

At times market participants’ narrative will include the view that “the street” is long gamma, leading to lower-than-expected realized volatility, or that “the street” is short gamma, leading to higher-than-expected realized volatility. The assumption in these views is that “the street” delta-hedges their option positions (but their counterparties do not), and therefore will exacerbate market moves when short gamma and dampen market moves when long gamma.

Determining “the street’s” net gamma position is difficult, because listed option markets are anonymous, because many investors both buy and sell options, and because approaches to managing the delta risk inherent in options vary from investor to investor. That said, to formulate an informed guess of net gamma positioning, we recommend monitoring the following:

Gross open interest and gamma.

Needless to say, gamma is most likely to be important when there is a large base of option open interest, and particularly when that open interest has a high percentage of gamma per unit of open interest (e.g. by being short-dated and near-the-money).

Strike distribution.

Gamma is most likely to be relevant when open interest is concentrated in specific strikes, particularly near-the-money strikes.

Option pricing.

Investors who are short gamma have a more risky position than long gamma holders, and as a result are typically willing to pay a premium to close the positions. A bump in option pricing at a specific area of the market has the potential to point toward short gamma – both at trade initiation time and also throughout the life of the trade.

Trader positioning.

Option traders at large banks and market makers have the widest visibility into the aggregate positioning of “the street”, because they see a large percentage of market-wide option flow. Their own gamma positioning is therefore a helpful indicator of street-wide positioning.

Put vs. call ratios.

High implied volatility skew is one indication that there is a market-wide preference for buying put options (e.g. as hedges) and selling call options (e.g. in overwriting strategies). All else equal, larger-than-usual put option positioning is therefore likely to coincide with “the street” being short gamma and call-heavy positioning is likely to coincide with “the street” being long gamma. This is just one datapoint in a mosaic, though, since reality is more complex: investors also sell puts for yield and buy calls for leverage.

Intraday return patterns.

At times, gamma can leave a footprint on markets via time-of-day return patterns. If “the street” is short gamma”, markets dropping should lead to selling and markets rising should lead to buying (and the opposite if long gamma). To the extent this flow is impactful, markets trending during the day (e.g. several intraday periods in a row moving in the same direction is a sign of short gamma. The dislocation between close-to-close volatility and intraday-to-intraday volatility in the days around March expiry was a sign of dominant short gamma positioning, in our view.

Assessing the importance of gamma

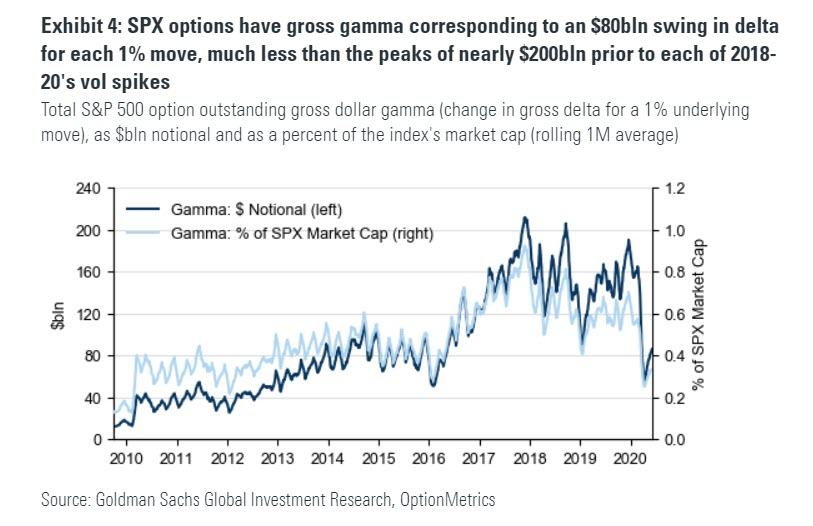

So how does a high volatility environment change the impact of gamma?

High volatility functionally makes shorter-dated options behave like longer-dated options. High volatility “flattens the curve” of gamma, spreading gamma across a wider range of strike prices.[1] Expressed differently, delta shifts from near-zero to near 100% across a wider range of strikes when volatility is high than when it is low. Because SPX open interest is typically concentrated around near-the-money strikes, total gamma tends to be a lower percentage of open interest when volatility is high than when it is low. That said, to the extent that high volatility also brings lower liquidity, the market impact of a given unit of gamma is likely to be higher when volatility is high.

Is US equity index gamma more important than it used to be?

In our view, yes, for three reasons:

- Option market has been growing relative to the overall equity market size.

The SPX option market has been growing relative to the index itself. Option open interest has averaged 20% of the SPX market cap over the last six months, corresponding to a large gross gamma of 0.3% delta shift per 1% SPX move. - Demands for near-instantaneous liquidity have grown.

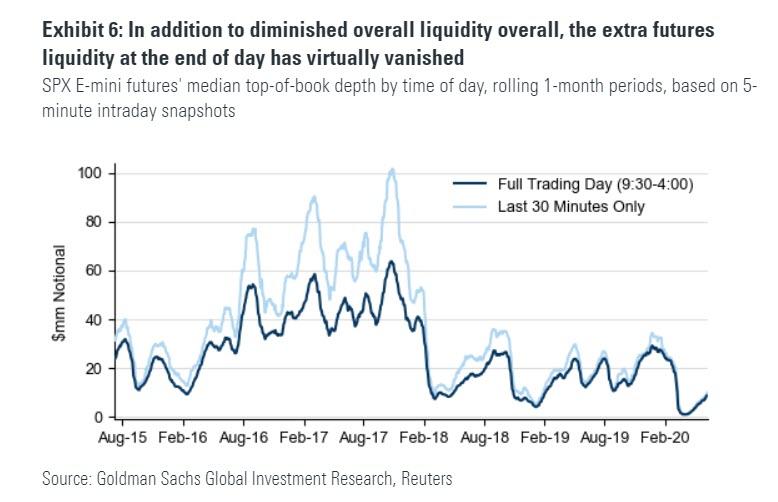

Delta-hedging of options is one of several strategies that demand liquidity in response to market price moves (and is more time-sensitive than others). Managed volatility, trend-following, and other systematic asset allocation strategies demand liquidity when market prices move sharply. Furthermore, volatility is an input to risk management rules, meaning that investors of all sorts would be likely to cut risk when volatility rises. As a result, the trading generated by gamma (particularly short gamma) can at times be part of a crowded set of directional flows. - Liquidity itself has weakened, particularly at the end of each trading day.

Datapoints indicating weakening liquidity, including SPX futures’ top-of-book depth, leave the potential for gamma-driven flow to move markets more than it might have previously. This issue has been exacerbated at the end of each trading day, because some delta-hedgers focus their hedging at the close (e.g. to match variance swap payouts), and the “extra” top-of-book depth at the close of each trading day has just about disappeared.

Sources of Gamma

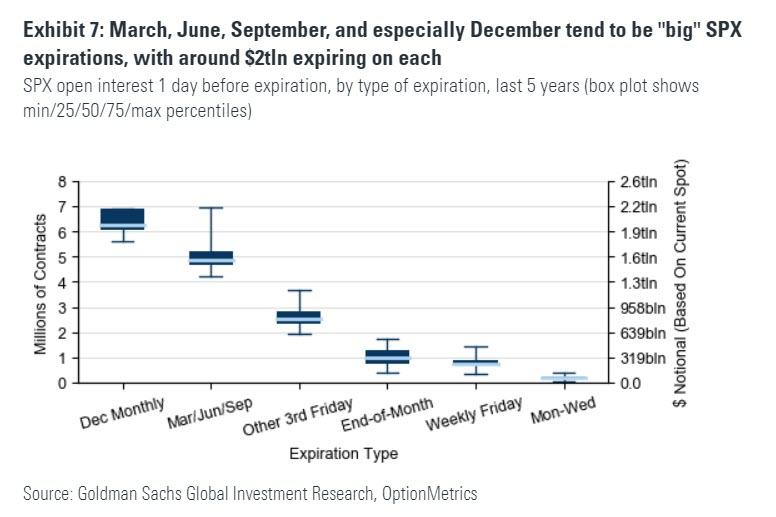

Why are there “big” expirations? Which option expirations tend to be the most important for gamma?

SPX options are now listed with expirations every Monday, Wednesday, and Friday, so on the surface it can be surprising that activity is concentrated in certain expirations. However, for longer-dated options (generally beyond the first two months of expirations), options are only listed with either third Friday or end-of-month maturities. Quarterly (Mar/Jun/Sep/Dec) third Friday option maturities tend to be listed even farther in the future than other dates, and also have the advantage of having futures contracts with the same expiration. December options are listed even further out than other quarterlies. Currently, the only listed SPX maturities with more than 12 months to expiration are the Jun-2021, Dec-2021, and Dec-2022 third Fridays. Because they are listed for so long, quarterly, and in particular December, expirations are “big”, and can often build up to around $2tln of open interest. The “cleaning up” of this positioning can in itself be a catalyst for heightened investor activity as they realign portfolios for the following months.

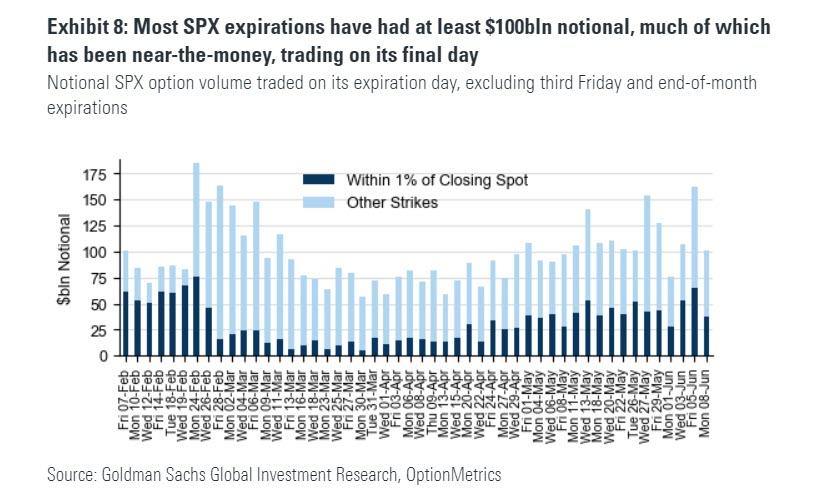

How materially does the rising activity in soon-to-expire options affect net gamma?

The frequent calendar of SPX expirations and growing activity in SPX options that expire the same trading day has left the soon-to-expire option market as an important, but difficult-to-track (because it expires before showing up in open interest data), contributor to SPX gross gamma. (Gamma is one reason for this market’s growth: soon-to-expire options have very high gamma per unit of premium spent). This flow is important to the SPX gamma picture because gamma is heaviest for options that are close to expiration and near-the-money. In 2Q2020, 20% of SPX option volume has had less than 24 hours to maturity. The majority of recent SPX expirations have had at least $100bln notional trading on their expiration day, of which almost half has been within 1% of the final spot level. While volume is different from open interest (i.e. spreads can add to volume but not add significant net gamma), the options transacted likely have on the order of $20-50bln of gamma on a typical day – at times half of the gamma outstanding from longer-dated maturities.

Is short gamma caused by vol selling? Does vol selling create high volatility?

No. Investors who sell options to generate yield and do not delta-hedge those options leave the counterparty who bought the options (typically a delta-hedging entity) long the option, and therefore long gamma. The delta-hedging of a long gamma position actually has the potential to reduce market volatility, because these entities would be economically driven to buy equities when they fall and sell equities when they rise. That said, to the extent option sellers buy further out-of-the-money options to cover tail risk (e.g. via iron condor strategies), they have the potential to look like option buyers when markets move toward and beyond these distant strikes. Additionally, at times option sellers will close or “roll” options that have become in-the-money; those trades are short gamma-like and can exacerbate market volatility.

Does gamma exist outside of option markets?

The technical definition of gamma – delta that varies as a function of market pricing – is unique to option markets. However, the term gamma is also colloquially used to refer to non-option strategies that are economically driven to trade in response to price movements. Strategies that buy when markets are rising and sell when they are falling are called short gamma, and the opposite are called long gamma. Levered and inverse ETPs, including levered and inverse VIX ETPs, are an example of a short gamma product.

Mapping Gamma Across the Vol Surface

Are there spot price ranges in which “the street” is short gamma or long gamma? Where does gamma “flip”?

As options approach expiration, near-the-money options’ gamma rises, while far out-of-the-money options’ gamma falls. This happens because the range of spot prices across which option deltas shift from near-zero to near-100% becomes very narrow as options approach maturity (and at maturity, options on one side of the settlement value have zero delta and the other side have 100% delta). When a maturity with large open interest is approaching maturity, its gamma will be driven by options within a narrow range of strike prices. Should “the street” be short those options, it might lead to an overall short gamma position, yet if the spot price moves away from that strike range, a different group of options, which “the street” might be long, could begin to dominate gamma positioning.

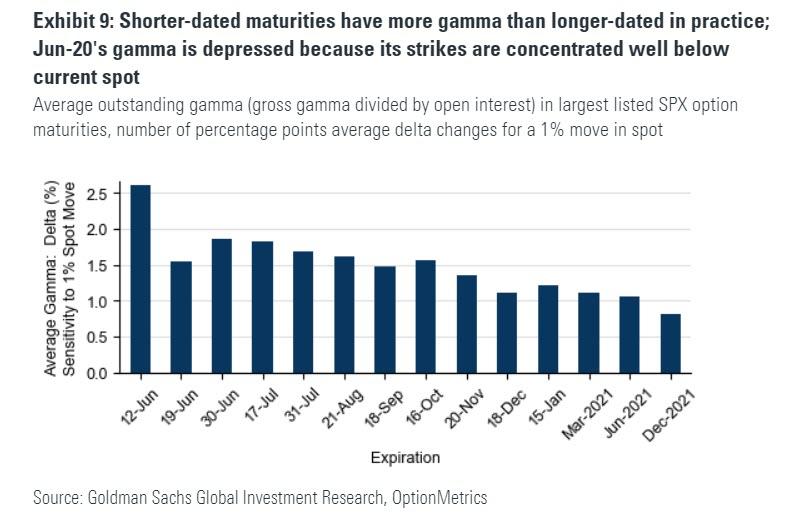

Do short-dated options have more gamma than long-dated options?

In theory, no, but in practice, yes. A strip of out-of-the-money options of all strikes, weighted according to a mathematical formula that puts more weight on lower-strike options, would have roughly the same gamma regardless of time to maturity. (By trading underlying shares every day to adjust for some points becoming in-the-money after market moves, one could replicate the payout of a variance swap.) If open interest of options were distributed according to that formula, all maturities would have the same gamma relative to their open interest. In practice, though, option activity tends to be concentrated in near-the-money strikes, and near-the-money options have more gamma per dollar of open interest for shorter-dated maturities. The June 2020 SPX maturity currently has outstanding gamma corresponding to a 1.5% change in its delta for each 1% SPX move (depressed in part because of its low-strike concentration); the Dec-2020 maturity has gamma corresponding to a 1.1% change in its delta for each 1% SPX move.

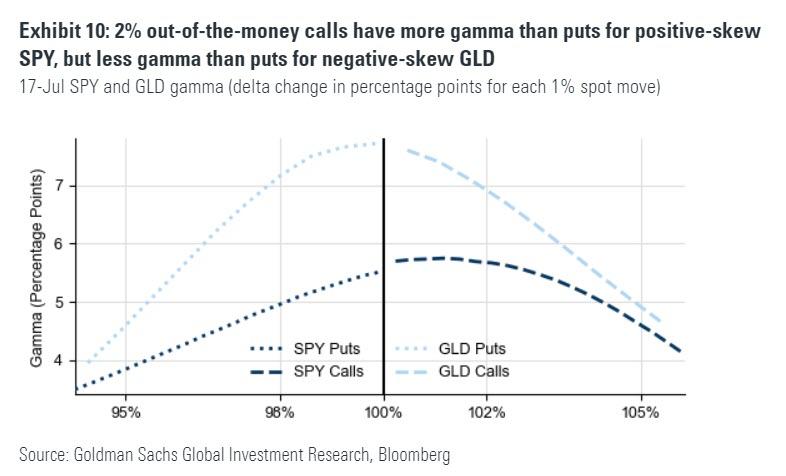

Do puts or calls have more gamma?

For equities, near-the-money calls usually have more gamma than puts of the same % distance from spot, primarily because of skew. Positive skew gives puts higher implied volatility than calls, and there is typically more gamma when implied volatility is lower. Underlyings with negative skew, like the GLD ETF, have higher gamma on the put side than on the call side. Note that at the same strike, a put and call would have the same gamma. Note that puts and calls both have positive gamma, meaning their delta becomes higher as spot rises – puts’ delta becomes less negative, and calls’ delta becomes more positive.

Gamma 101

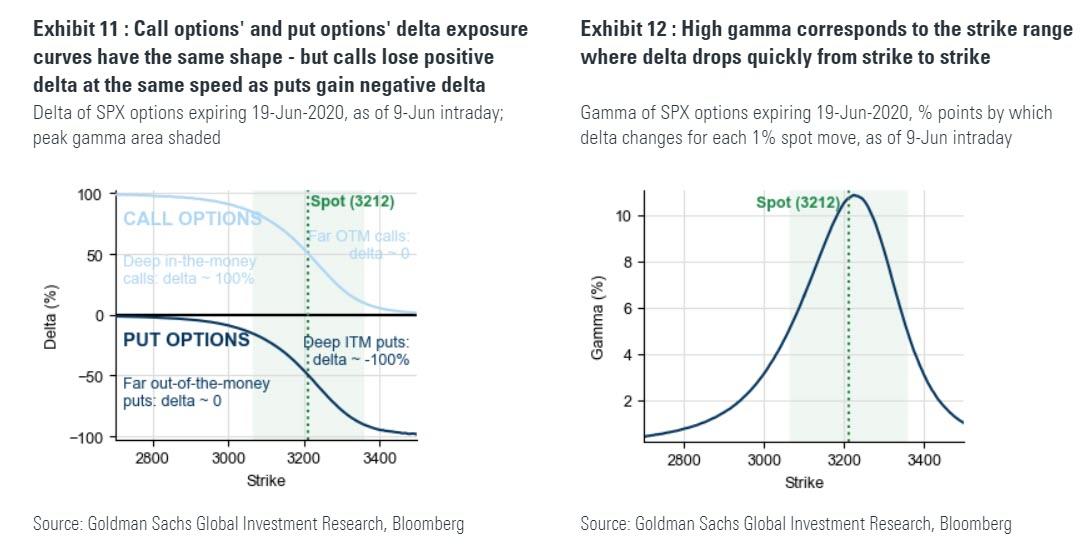

What is gamma? Why do options have gamma?

Each option has a delta, referring to what percentage of an outright long or short position the option is risk-equivalent to (and generally corresponding to the probability of the option expiring in-the-money). Gamma measures how much the delta of a given option is estimated to move should the underlying move up or down. The delta changes because near-the-money options will track the underlying index more closely than out-of-the-money options. At a given strike price, put and call options have the same gamma, in the same direction, because call options gain positive exposure at the same speed as put options lose negative exposure.

For example, with the SPX at 3212, a 19-June 3250-strike call option has a delta of 37%, but if the SPX falls by 1% to 3180, the call’s delta would fall by approximately 5% to 32%.

How is Gamma related to other option market Greeks?

Option markets use the (real-and made-up) Greek letters gamma, delta, vega, theta, and rho to quantify each option’s economic exposure. Gamma is directly related to delta and theta:

Gamma is the first derivative of delta (with respect to underlying price).

Delta is an option’s exposure to the underlying’s moves. Because delta changes as the underlying spot price changes (out-of-the-money options become more sensitive to spot moves as they become closer to in-the-money). Gamma measures the rate of the change in delta as spot moves (d Delta/d Underlying).

Gamma is a benefit paid for by theta.

A delta-hedging option holder buys shares when markets fall and sells shares when they rise; this “buy low, sell high” activity is a source of profits. Because of this, each day when markets do not move is a missed opportunity, so the option price drops. Theta measures the drop in option value each day that the underlying market does not move. There is usually a strong correlation between individual options’ theta and gamma, because the benefit of “buy low, sell high” trades is approximately offset by the cost of time decay when the underlying does not move.

How does the presence of a large put option buyer affect gamma positioning?

An equity investor who protects an equity portfolio by buying a put option is essentially committing to be long equities when they are above the strike price and not long once they trade below it. The investor’s counterparty, in effect, provides that profile by selling stock as the underlying approaches the strike price, potentially buying back shares as the stock rises away from the strike. This management of shares to provide the investor’s long-if-above-strike economics is what we call short gamma, and if large enough can help accelerate market sell-offs. While equity markets do not usually have outsized put buyers relative to the ongoing yield-seeking put sellers, downside gamma can be a bigger issue in oil markets, in which the option portfolios of oil producers can lead to acceleration of downside moves.

Which market participants delta-hedge, and why do they do it?

Derivatives markets are zero-sum, meaning that each trader has a buyer and a seller. In a typical option trade, an end investor is either buying or selling an option with the intention of holding that position, but the other side of the trade is a bank or market maker who does not have an economic need for the option. As long as that that bank or market maker holds the position, that entity will try to minimize any market risk in the position, including by keeping no exposure to the underlying market. To do that, the bank or market maker will delta-hedge the option, by nearly continuously trading stock or futures in a way that keeps zero net exposure to the underlying. Aside from some volatility-specialist entities, end investors do not generally delta-hedge their position, though their rolling of in-the-money positions has the potential to have similar economics to delta-hedging.

Gamma from a broader perspective

Is gamma a desirable exposure to own?

Equity option portfolios can be designed to be either long gamma (exposure to equities falls as spot falls) or short gamma (exposure to equities rises as spot falls). Investors will have different views on the attractiveness of gamma depending on how much they focus on each of these three perspectives:

Value investing.

Investors with the view that markets overreact to fundamental news would prefer to add to long exposure on sell-offs and reduce it on strong rallies. Short gamma positioning can set up investors for this profile.

Utility.

Investors often have stronger aversion to large losses than benefit from large gains. As an example, fully funded pension funds can become under-funded if their equity portfolio values drop enough. Investors with this focus would benefit from long-gamma option positions.

Volatility risk premium.

Volatility focused investors look at how well gamma is “realizing”, generally by comparing short-dated implied volatility metrics with recent realized volatility. If gamma is carrying well on this metric, it is better to own, and if not carrying well, short gamma can generate (risky) income.

How does Gamma connect the March 2020, February 2018, and October 1987 volatility events?

Each of these events (among many others) was an example of a mismatch between investment strategies demanding near-instantaneous liquidity and markets not being able to supply that liquidity. In each, simply the sharp fall in equity prices caused selling of equities that potentially exacerbated volatility. In March, the dislocation between close-to-close realized volatility and volatility measured from prices collected at other times of day indicates likely short gamma-like activity creating impactful end-of-day flows. In the VIX spike of February 2018, VIX futures rising pushed more buying of VIX futures, a short gamma-like feedback loop. In the 1987 crash, portfolio insurance strategies sold equities in response to equities falling, also creating a short gamma-like self-reinforcing loop in markets.