From ZH In case the market didn’t have enough things to worry about, Goldman has flagged a new scare that could spark a turmoil in today’s option expiration. As Goldman’s Vishal Vivek writes, today’s option expiry “is setting up to be the biggest for single stock options, outside of a January expiration.” Indeed, while open […]

goldman

Nomura + SpotGamma – 2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration

2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration From ZeroHedge:Tue, 12/15/2020 – 11:55 Like all December option expirations, this month’s is large, with $2.5tln of SPX-linked options notional (linked to 8% of the S&P’s market cap) expiring on 18-Dec, but for a December, it is not extreme… Nomura’s Charlie McElligott notes […]

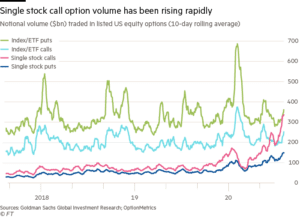

SoftBank unmasked as ‘Nasdaq whale’ that stoked tech rally

From the FT Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.comT&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article […]

Record Call Options at Record Prices

The following charts represent the most important dynamic in equity markets. It can be summarized by this: Massive call demand has pushed call prices way up, driving huge amounts of stock volume. Record levels of single stock call options were purchased into June expiration, reloaded back to record levels in July, and are now rebuilding […]

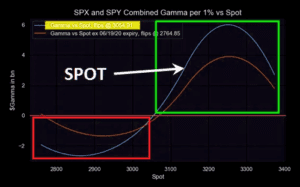

SPX Options Expiration vs Equities

We spend a lot of time talking to our members about the lack of structure in the SPX options market. What we mean is the positioning in SPX options is just very small as seen in this chart below which maps total SPX call & put gamma. This has implications for markets not just at […]

Goldman: All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows

From ZeroHedge: In our daily observations of (bizarre) market moves (usually in the context of comments from Nomura’s Charlie McElligott and Masanari Takada), we frequently analyze the delta-hedging of option positions by dealers, i.e. gamma, which for a variety of reasons has emerged as one of the dominant drivers of risk assets (at least until […]