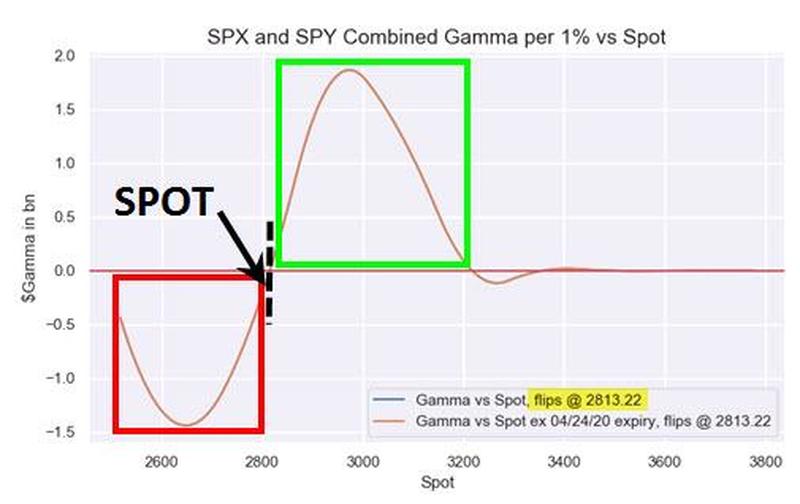

Zerohedge gives us Nomuras gamma estimate for 4/24/20 with an estimate gamma flip point of around 2800 in the SPX. Note this is a COMBINED SPY/SPX estimate.

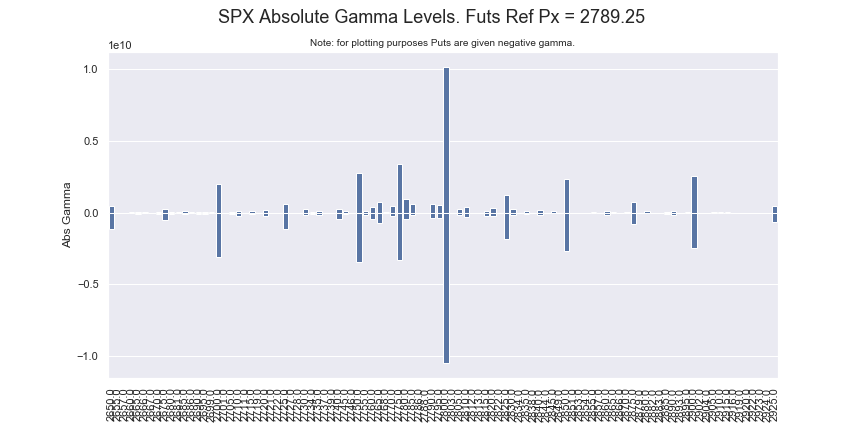

As Nomura’s Charlie McElligott notes, the S&P 2,800 has emerged as the “Neutral Gamma” zone for the market “and again, is likely to remain that way, as the 3 largest aggregated Gamma strikes on the board have the S&P surrounded” as follows: $1.128B at 2750, $1.357 at 2800 and $1.154B at 2850:

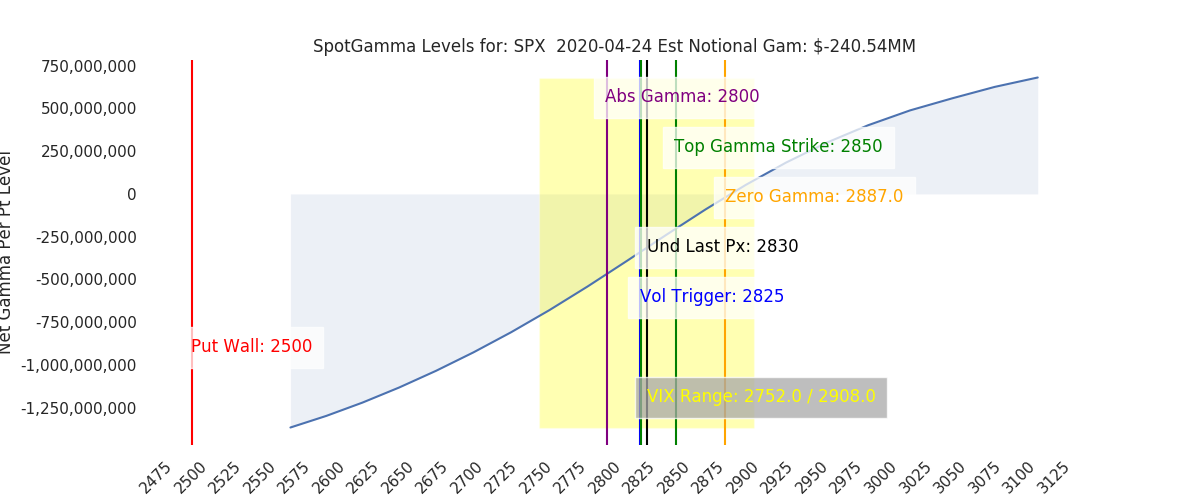

Our SPX (ONLY SPX) estimate shows a much higher zero gamma estimate, of around 2887. However, our proprietary “Volatility Trigger” estimate is 2825. The difference between these levels mark a difference between an “official zero gamma” level and the area at which gamma would shift from markedly negative to simply flat. In other words the area above 2825 still has negative gamma, but a very low amount.

The 2800 strike plays a key roll in the markets at this moment, which a very large amount of gamma associated with it. You can see in the chart below the amount of call and put gamma tied to various strikes.

We think that a combination of large gamma at 2800 and low equity/futures volumes has keep the market tied to that 2800 level. When gamma levels adjust and/or underlying volumes increase we should see a change in market range.