Charlie McElligott talks several macro themes, and digs into deal gamma around the 44:30 mark. Topics include gamma flips, CTA deleveraging levels, and the large gamma dynamic.

gamma flip

When YOLO goes “YOL-Oh No!”

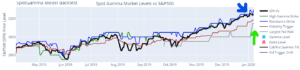

Summary: Issue: SpotGamma believes that current markets reflect a great amount of risk and face the prospect of a violent drawdown. This is due to the following: Hedging: Low levels of options-based hedging. Short-Selling: Low levels of stock shorting. Speculation: High levels of margin used to buy stocks. Remedies: SpotGamma levels continue to be […]

June Selloff Review

Markets were unable to hold gains on Friday after a sharp selloff on Thursday. While we initially opened over the gamma flip zone, markets broke that 3075 area and immediately sold down to the 3000 strike. This 3000 level is where we calculated the most options gamma and served as support. All of these levels […]

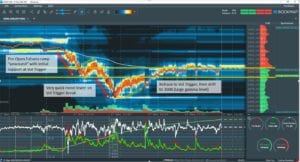

The Volatility Trigger for ES Futures Traders

Wednesday 5/27 was a great example of how the Volatility Trigger can be a key level in trading. The concept of the volatility trigger is that when the market moves below the Trigger, options dealers are short gamma. This may mean that they start to sell futures as the market moves lower, and but futures […]

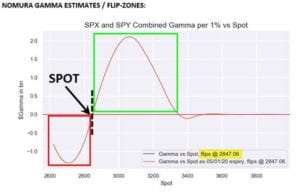

Nomura Draws the Market Gamma Line

We produced these levels in real time for subscribers, but if you’re a bit behind here is the update from Nomura via ZH. This note comes after the SPX tested 2950, and sold off toward the 2800 level on Friday 5/1/20. The gap also shocked the also just-established Dealer “Long Gamma” position (when ref was […]

Is Nomura Reading SpotGamma Notes?

No, I’m sure they arent. But there are a lot of overlap. From our recent subscriber notes: 2950 should now set up as the High Gamma strike resistance with 2900 the first line of support. As we are in positive gamma territory we see decreased risk of a sharp sustained drop from this level – […]

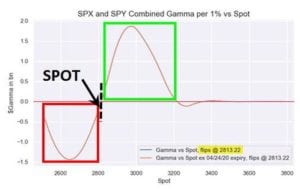

Nomura’s Gamma Estimate April 2020

Zerohedge gives us Nomuras gamma estimate for 4/24/20 with an estimate gamma flip point of around 2800 in the SPX. Note this is a COMBINED SPY/SPX estimate. As Nomura’s Charlie McElligott notes, the S&P 2,800 has emerged as the “Neutral Gamma” zone for the market “and again, is likely to remain that way, as the […]

Zero Gamma = Zero Gravity

We posted a few days ago about the “right” tail risk and the possibility of a market rally. In a note to subscribers we added to this, suggesting the market may be in an airpocket. Specifically: “zero gravity”. Most of you are probably familiar with those flights which take you to the edge of space […]

SpotGamma 2/24/20 AM Report

We’ve moved well through the zero gamma area and are testing the first “put wall” and “absolute gamma strike”. Puts are now in control of gamma which indicates more volatility ahead. I would not look at the put wall as a solid support line, but more of a pivot or “band” around which larger moves […]

Possible Gamma Flip Setup 1/7/2020

We’ve been tracking very high levels of call gamma the last several weeks that has recently stalled as we’ve hit heavy resistance around 3250 (blue arrow in chart below). During the last several days the zero gamma flip point has moved higher to ~3185 as you can see (green arrow): Iran has started launching missiles, […]