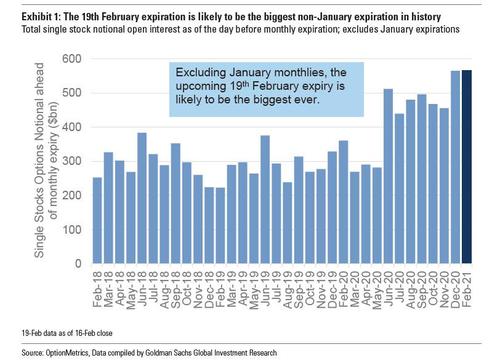

In case the market didn’t have enough things to worry about, Goldman has flagged a new scare that could spark a turmoil in today’s option expiration. As Goldman’s Vishal Vivek writes, today’s option expiry “is setting up to be the biggest for single stock options, outside of a January expiration.”

Indeed, while open interest declined sharply following the 15th January expiration, investors have re-initiated options positions, driven largely by calls (something we addressed two weeks ago in ““Crash Up Time” – S&P Caught In Reverse “Gamma Gravity” As Call Wall Spikes“), and over the past eight months, single stock open interest has increased significantly with nearly $500bn of open interest expiring on the average (non-January) third Friday, up from $300bn in the prior two years.

Further boosting the risk of a spike in vol today is that the S&P currently finds itself in dealer “no man’s land”: as SpotGamma explains, notional gamma levels have reduced quite a bit, with QQQ showing a solid negative gamma position, while the 4k “Call Wall” has contracted to 3950 in SPX, and holds 395 in SPY (SG sees the Call Wall shifting down as a bearish indicator).

This, to SpotGamma, reads like “a great place for volatility” (i.e. a large move up or down) to expand from, as gamma is low and the large trading strikes have consolidated to 3900-3925 while as noted above, we have a near record single stock expiration which “would could add some flows/momentum.”

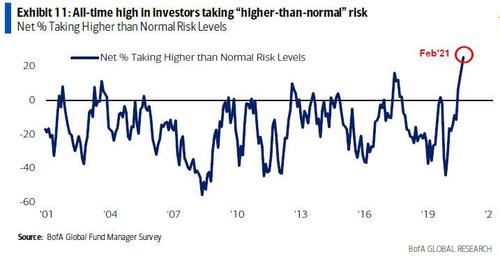

Here, SpotGamma points out a curious divergence in the market – while sentiment as measured by the latest Fund Manager Survey shows near record euphoria…

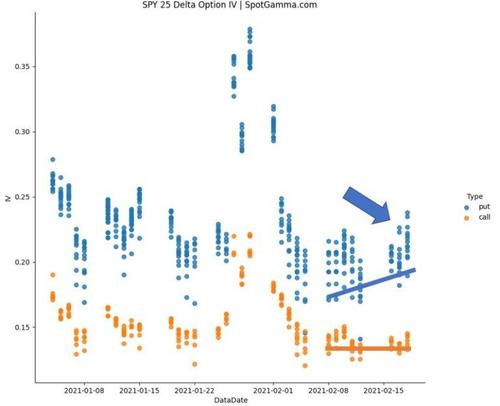

… dealers in particular, and the market in general seems to be increasing the price of downside risk, as can be see in the chart below. These are the implied volatility (IV) levels for 25 delta options with each dot representing a different expiration. As SG explains, “the fact that put IV is increasing is signaling that traders are paying up a bit for downside hedges.” This is perplexing not only given the abovementioned euphoria, but that “the market has held such a tight range this week, just 1% under all time highs.”

In any case, even if there is no vol spike today, SpotGamma warned that following today, following the sharp drop in gamma we do “not have the same support for those big mean reverting swings as seen the last several days.”

* * *

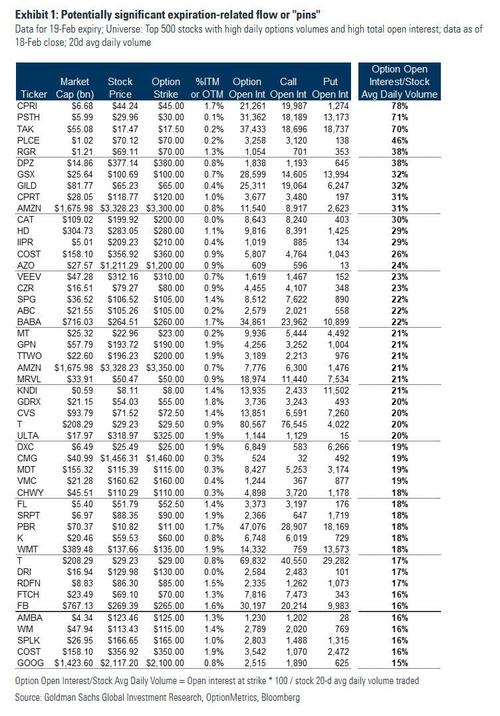

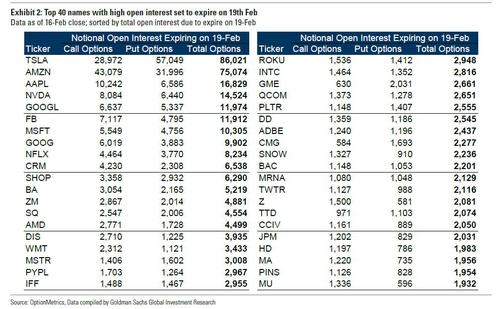

And just to make life for the reddit daytraders – who will be eager to ride the biggest momentum names in any of today’s gamma turmoil – a little easier, below Goldman lists the 40 stocks with the highest open interest expiring on Friday. Notably, TSLA, GME and CMG are among the large names where put open interest exceeds calls.

Separately, Vivek notes that today’s expiry could be important for stocks with large open interest in at-the-money (ATM) options; market makers delta-hedging their unusually large options portfolios will be active. This flow is likely to dampen volatility in some names while exacerbating stock price moves in others. He explains further:

At major expirations, options traders track situations where a large amount of open interest is set to expire. In situations where there is a significant amount of expiring open interest in at-the-money strikes (strike prices at or very near the current stock price), delta-hedging activity can impact the underlying stock’s trading that day. If market makers or other options traders who delta-hedge their positions are net long ATM options, expiration-related flow could have the effect of dampening stock price movements, causing the stock price to settle near the strike with large open interest. This situation is often referred to as a “pin” and can be an ideal situation for a large investor trying to enter/exit a stock position. Alternatively, if delta-hedgers are net short ATM options (have a “negative gamma” position), their hedging activity could exacerbate stock price moves.

So in case any traders want to piggyback on any outsized moves, Goldman has identified stocks where option activity will have a big impact, as “expiration-related trades may cause trading activity to pick up for stocks with a significant amount of ATM open interest.” The table below identifies possible focus stocks with the highest ATM 19-Feb open interest, and compares it to the average daily volume of the underlying stocks. Expiration-related activity is likely to have more of an impact if the open interest represents a significant percentage of the stock’s volume.