An otherwise sleepy week awoke with a jolt on Friday, following China’s announcement of restrictions on the selling of rare-earth minerals and susbequent tariff threats.

Within minutes, SPX dropped 80 points from 6,750 to 6,670 – well below our risk-off level at 6,700. The market closed down 2.7% for the day at 6,553.

This sharp pullback was severe, sending implied volatility well above its 90-day historic range with short-dated vol spiking considerably.

So, was it just headline news that sent the market into a sell-off?

We don’t believe so. We believe this pullback came during a particularly unusual market dynamic that was sensitive to exactly this type of catalyst.

The Background: Warning Signs of Volatility

While headlines sparked the move, there were several important signs along the way indicating the unusual nature of the market over the past two weeks.

1. The Great Volatility Gap: Before Friday, there had been a significant discrepancy between SPX vols (realized & implied) and the VIX lingering relatively high at ~16. This gap led us to believe either shorter-dated vols would rise to meet the VIX, or the VIX had to come back down.

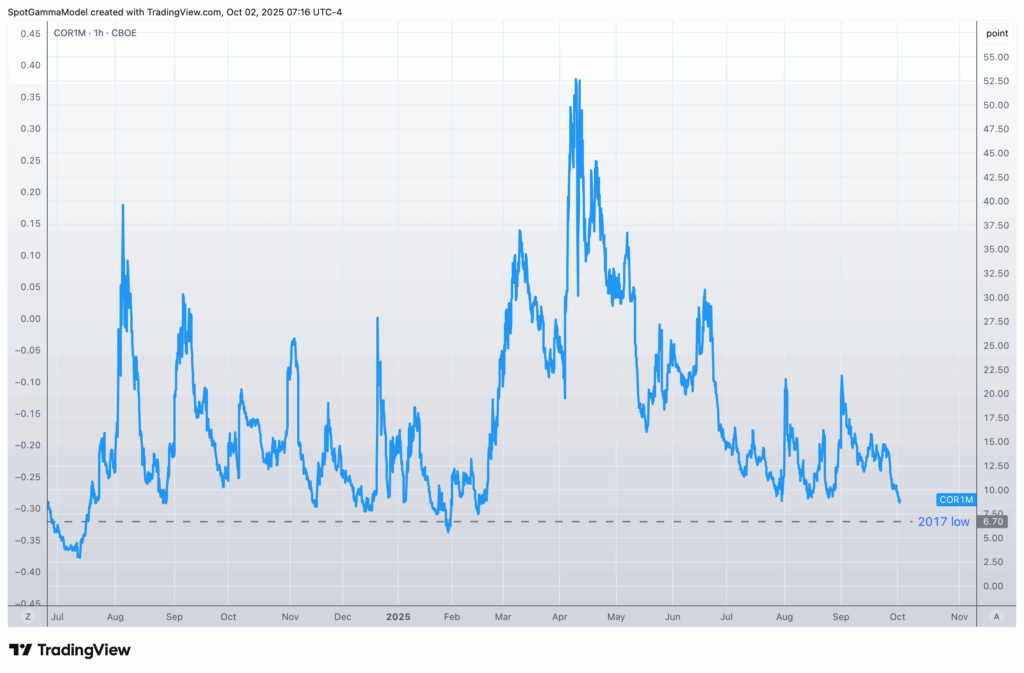

Volatility dynamics became even more unusual as we saw a widening gap between single stock and index volatility, as represented by the COR1M breaking below 8. This was flagged in our pre-market Founder’s Note on Tuesday (10/7):

This serves as a risk off signal that we flagged twice before: in February ‘25 before the “Liberation Day” tariff announcement, and in July ‘24 before the infamous Yen Carry Trade collapse.

The COR1M has only broken below 8 on those two prior occasions since 2017, and Tuesday of this past week marked the third occasion.

2. Growing Reliance on 0DTE: Market stability has been continually reinforced due to 0DTE option selling and subsequent dealer hedging. This has been prevalent throughout the zombie market this past summer.

How this works: These short-dated (typically next expiry) traders begin to sell options (short vol). Market makers who are on the other side of these orders must hedge against price action – buying dips, and selling rallies. This works as a cushion against realized volatility, keeping markets relatively calm.

What happens when the market starts to stir, as it did on Friday? This places these 0DTE traders on alert, forcing them to close out short-vol positions. This in turn accelerates volatility as market makers no longer hedge against price action – meaning the cushion on the market disappears.

On Friday, this dynamic was particularly notable: market maker gamma was negative across all strikes for SPX after factoring out 0DTE options.

3. Lack of Information: Market participants have less economic data than normal due to the US federal government shutdown, meaning traders on Friday were operating in an environment that lacked the usual intel they were accustomed to.

Critical macro data including NFP and Initial Jobless Claims have been missed over the past ten days. Headlines on Friday morning served to fill that gap, as traders were indeed extra sensitive to new information in the absence of the usual data points.

The Trade: Taking Advantage of Cheap Protection

In a market that showed the warning signs outlined above, downside protection was both historically cheap and the market was sensitive to changes in volatility. This provided an asymmetric risk-reward profile given the unusual circumstances.

Ahead of Friday, we had shared our inclination towards protective SPX puts, put flies, and put spreads in our pre-market Founder’s Notes on 9/29, 10/7, and 10/10.

Here is one example of what it looks like to take advantage of cheap protection in this scenario: SPX 6,500 puts expiring 10/17 experienced a return of over 700% between Thursday’s close and Friday afternoon, as the premium for a single contract jumped from $600 to $4,270 in less than 24 hours.

What’s important here is not just that the market was primed for a correction. What is equally valuable is that any sharp price movement would also spike implied volatility — which is exactly what happened Friday. When IV increases, all else equal, so do options prices.

The Aftermath: The End of the Zombie Market?

As the market enters into negative gamma territory below SPX 6,700, the market maker feedback loops will likely intensify any rally or sell-off until the key pivot level is restored. In the meantime, VIX is now flooded with negative gamma after Friday’s leap from 16.5 to nearly 22.

We will have to wait until this Friday’s OPEX (10/17) with over $300 billion in delta notional expiring to determine whether the zombie market is truly behind us, or if last week’s pullback and vol spike were a 1-off scenario.

As the dust settles, we are watching for the gap between short-term vols and VIX to close further. We will also closely track whether 0DTE traders re-emerge this week in force, or if Friday’s crash keeps them out of the market for some period of time.

We continue to stress the importance of keeping an eye on volatility, understanding the impact of market makers and 0DTE, and knowing what is driving your positions.

And to better understand these forces at work, you are invited to join us for Hidden Forces Unmasked – a special event from SpotGamma where we will unveil five new tools designed to help you anticipate volatility, protect your PnL, and trade smarter. Join us October 28.