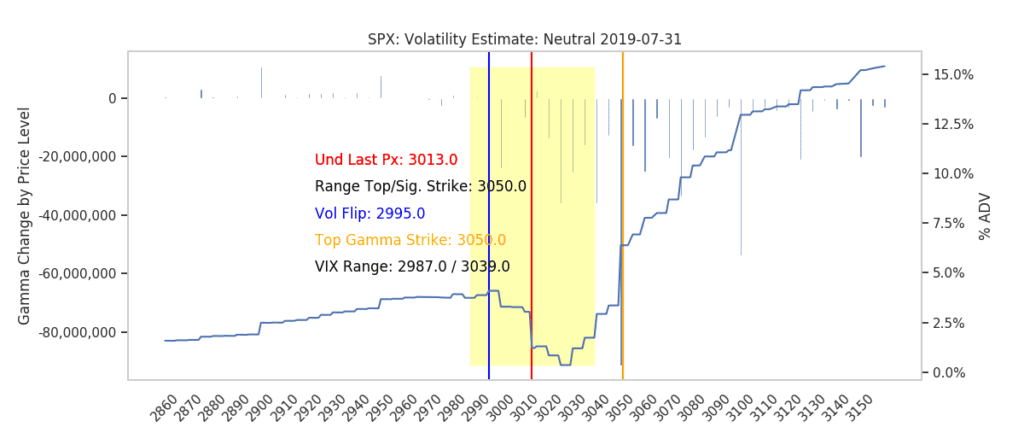

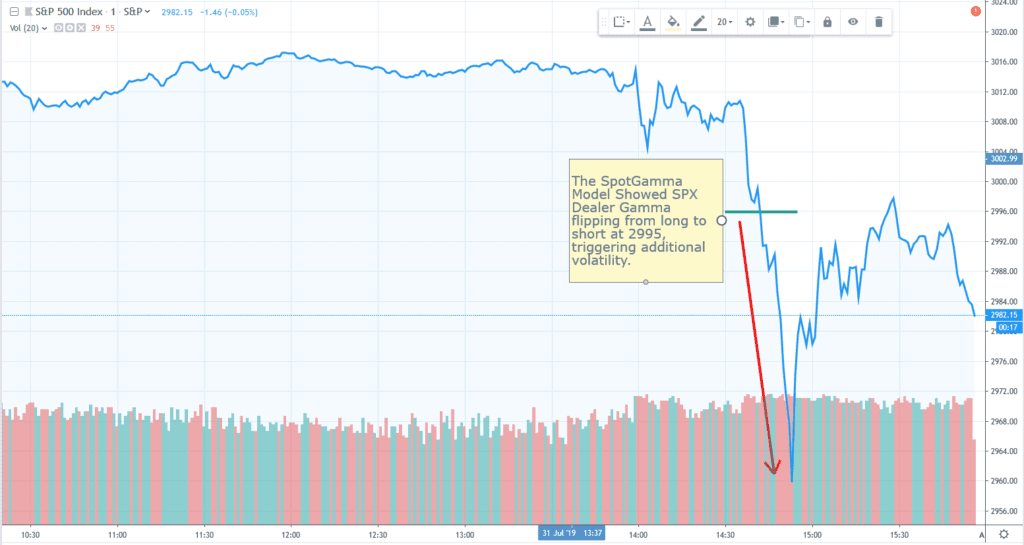

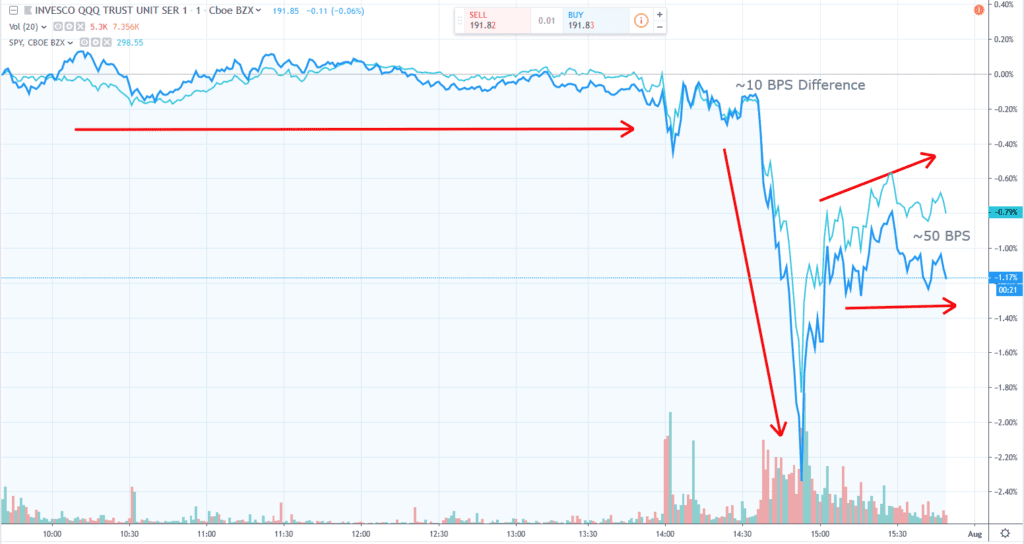

Equity markets had an incredibly volatile day on 7/31/19 triggered by actions of the Federal Reserve. Its our view that the moves were exacerbated by the positioning of dealers in S&P 500 options. A quick wave of selling entered the markets just above 3000, pushing the market under our “volatility trigger” level of 2995. At this level we calculate that dealers were short gamma and therefore traded in large size, fueling the downside move.

There was a very large amount of volume supplied in this period as seen in the chart below.

2:00-3:00pm was the highest-volume hour of the year in S&P 500 e-mini futures

— Luke Kawa (@LJKawa) July 31, 2019

(h/t @followtheh) pic.twitter.com/KWS1HswJnu