The big question: Was that rally all put covering? Signals in SpotGamma’s custom SPY GEX say “Yes” This week the S&P500 rallied ~3% to close the Liberation Day downside price gap (red horizontal line). This led the S&P500 to notch a 9-day win streak – the longest such streak since November 2004. With that, the VIX […]

market makers

RealVision: Excellent Gamma Discussion

Market Makers & Coronavirus: The Mechanics of a Market Sell-Off How do sell-offs actually happen? With the S&P 500 selling off hard and fast, Hari Krishnan, fund manager at Doherty Advisors, breaks down the mechanics of market meltdowns. Krishnan explains the role of different institutional players like market-makers and drills down on the individual components […]

BusinessInsider.com Talks Gamma

A good primer on market gamma from BI: So why do markets move at all if gamma is, like in this example, the big decelerator? Because it depends who owns it. Market makers use their gamma because they must. There is nothing worse than sitting on a position and bleeding white over time as your […]

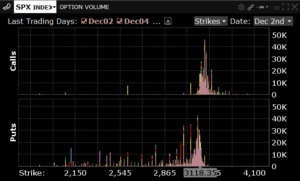

Strike of the Deltas – Can Put Deltas Move the Market Down?

Interesting day in the market today as numerous China related headlines took away a futures rally that was testing all time highs. Its our view that much of the selling today was due to put buying. It seems there was a decent amount of slightly OTM puts trading, combined with a large move up in […]

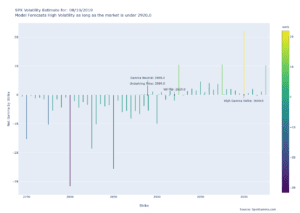

Gamma Market From 8/16/19

Volatility will continue to reign until (if) the market recaptures 2920. There is a ton of fuel ready to burn and one headline (or tweet) will send the market flying. The only recommendation that is safe here is to not sell any options, being short volatility is very dangerous here, as a >3% rally is […]

Dealers Running Out of Gas 8/16/19

After a sharp rally this morning the S&P500 stands at ~2890. This is where dealers buying starts to soften up. You can see their volume profile in the chart below. They were strong buyers up to this level but we calculated 2891 as the level where their buying wanes and 2920 where they flip to […]

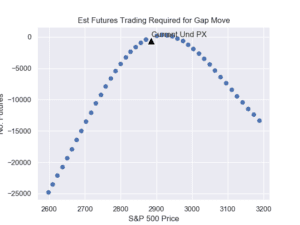

Dealer Futures Flow 8/14/19

Here is a chart estimating the futures action with the S&P500 at 2850. If markets head lower it looks like dealers will sell more futures, compounding the move down. The same works in a rally, but instead of selling those dealers will be buying. All this flips when/if the market moves over the VFLIP line […]

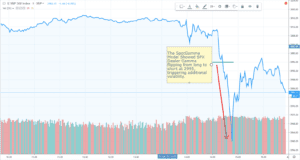

Fed Day Market Move from a Gamma Perspective

Equity markets had an incredibly volatile day on 7/31/19 triggered by actions of the Federal Reserve. Its our view that the moves were exacerbated by the positioning of dealers in S&P 500 options. A quick wave of selling entered the markets just above 3000, pushing the market under our “volatility trigger” level of 2995. At […]