Look Out Below: Volatility Trigger Breached and Call Wall Holds Strong

Macro Theme:

- A sustained rally is unlikely to occur until 5/4/2022 (FOMC). Due to this, volatility (i.e. large puts) is unlikely to be meaningfully sold. This prevents an extended rise in equities.

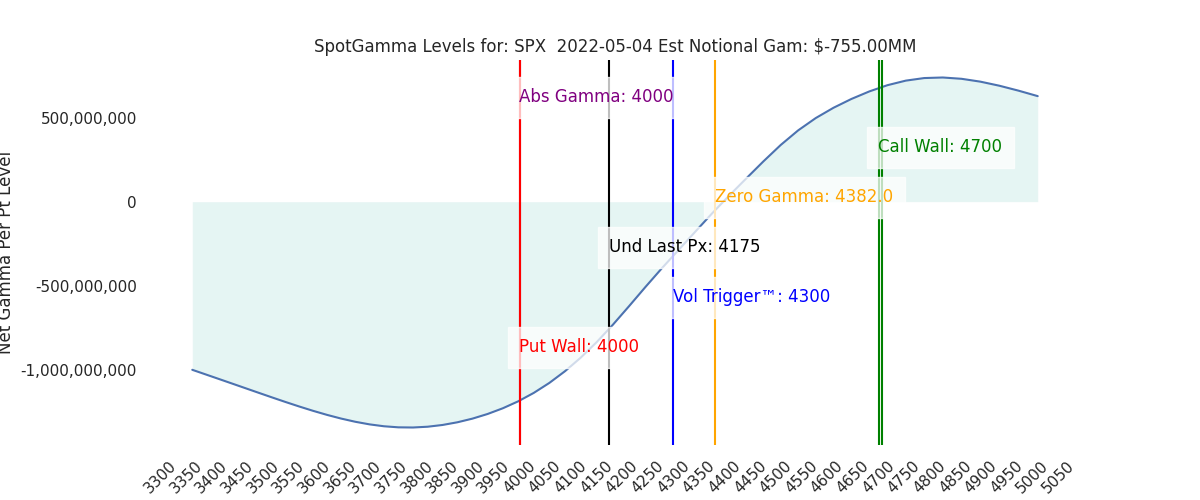

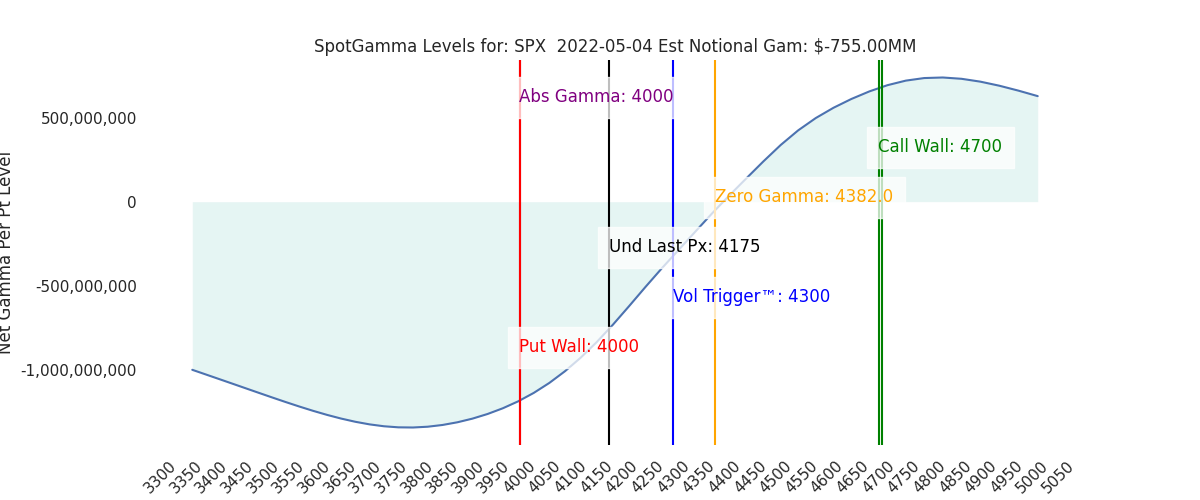

- A break of $4,200 invokes our “lower bound” concept, valid into 5/4/2022.

- We see substantial, longer-term support at $4,050 due to large open interest at $4,000.

- $4,300 (Vol Trigger) is our key resistance line into Friday 5/6/2022.

Daily Note:

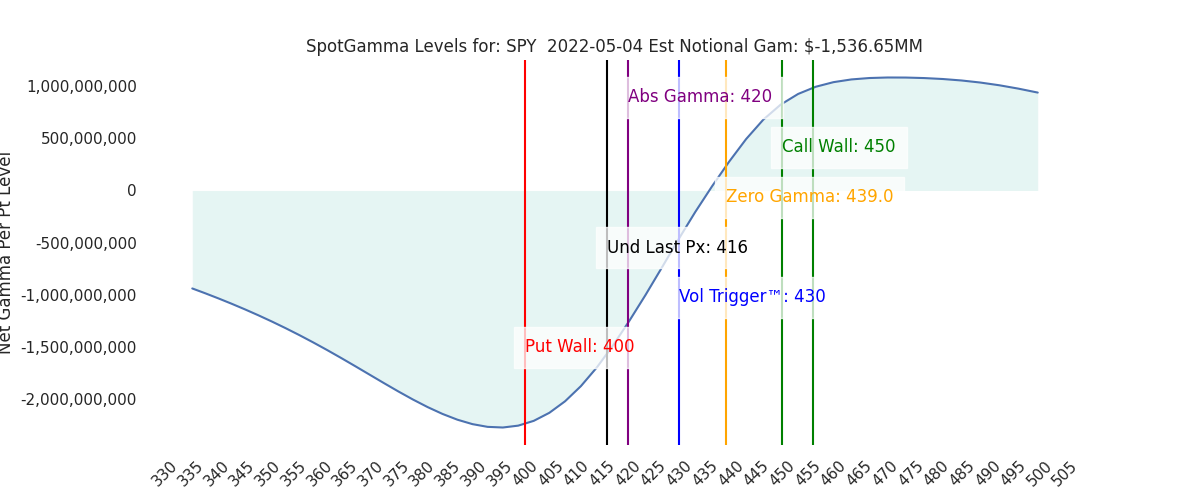

Futures were quiet overnight, and are up slightly to 4185. We expect a calm session today up until the 2pm ET FOMC events. Following that, we see key resistance at 4200-4210(SPY 420 equivalent) with 4284 the next resistance point from our models. Support shows at 4125, then 4110 (SPY 410).

As we’ve noted for some time now, we’re looking for a strong directional move out of the FOMC statement. Yesterday we discussed that the markets reaction likely leads to a reduction in “event vol”, assuming Powell doesn’t come off as overly-hawkish. In our note yesterday, we also outlined that there is not a large options expiration around this FOMC. We measure less than 15% of total S&P/QQQ gamma expiring this week (between todays exp & Fridays). This small expiration reduces the “put burn” and in turn may reduce the velocity of a rally (again, please refer to yesterdays AM’s note).

In yesterdays post we highlighted 4400 as a big resistance point, due to the Vol Trigger appearing at that strike. The Vol Trigger has today dropped lower to 4300, which is also another large open interest point. For this reason we are marking down our key post-FOMC resistance line from 4400 to 4300. We think this level would be possibly in play for tomorrow or Friday.

Further, our OPEX tables show that large put positions don’t start to roll off until May OPEX (5/20), with a more significant expiration on June 17th (quarterly OPEX). As many of you know, we flag large expirations as key market turning points due to the fact that they trigger changes in dealer flows.

Assuming Powell does not spark fear in markets, we are looking for a relief rally in markets which will function to provide some breathing room to the downside (vs current position of “max put”). Ultimately if the market fails to recover the Vol Trigger (currently 4300) level then we’d view any rally as simply short covering, with a high likelihood of reversal. In sync with this would be markets re-testing lows into large expirations.

If Powell does drive stocks lower, we look for a rather quick test of 4000-4050. This would push the S&P into large 4000 support and full “lower bound”. With that setup, we’d anticipate large, violet swings akin to late Feb early March, with 5/20 OPEX a turning point.

Two quick administrative items:

- Many of you have asked about the subscriber Q&A replay, it can be found here (and on the portal page, near the bottom). Note there are topic specific time stamps included in the description.

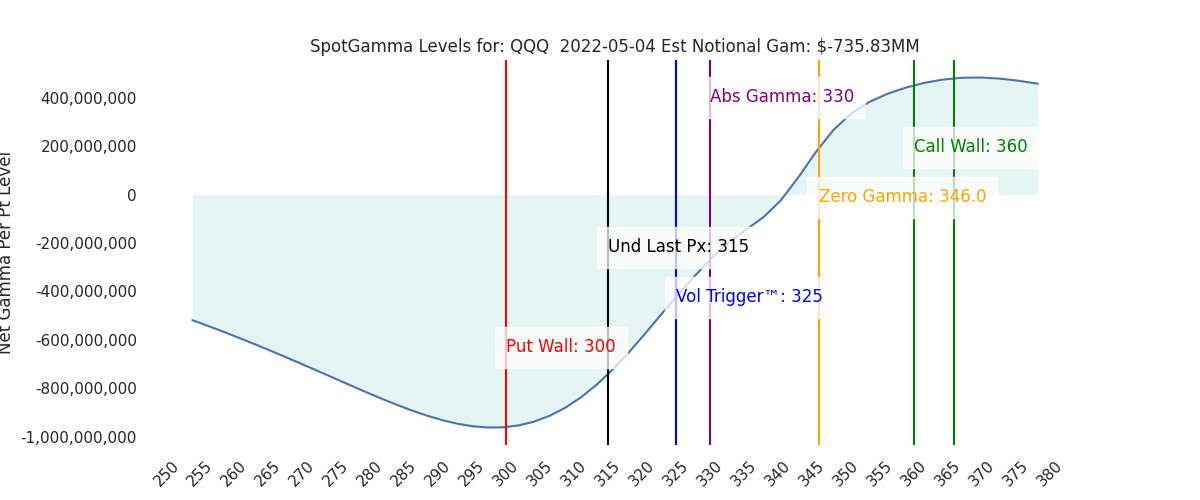

- The “QQQ Popup” with key levels is now updated at the top of the portal page.

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 4175 | 4174 | 416 | 13075 | 318 |

| SpotGamma Imp. 1 Day Move: Est 1 StdDev Open to Close Range | 1.18%, | (±pts): 49.0 | VIX 1 Day Impl. Move:1.86% | ||

| SpotGamma Imp. 5 Day Move: | 2.81% | 4128 (Monday Ref Px) | Range: 4013.0 | 4245.0 | ||

| SpotGamma Gamma Index™: | -1.44 | -1.6 | -0.33 | -0.01 | -0.11 |

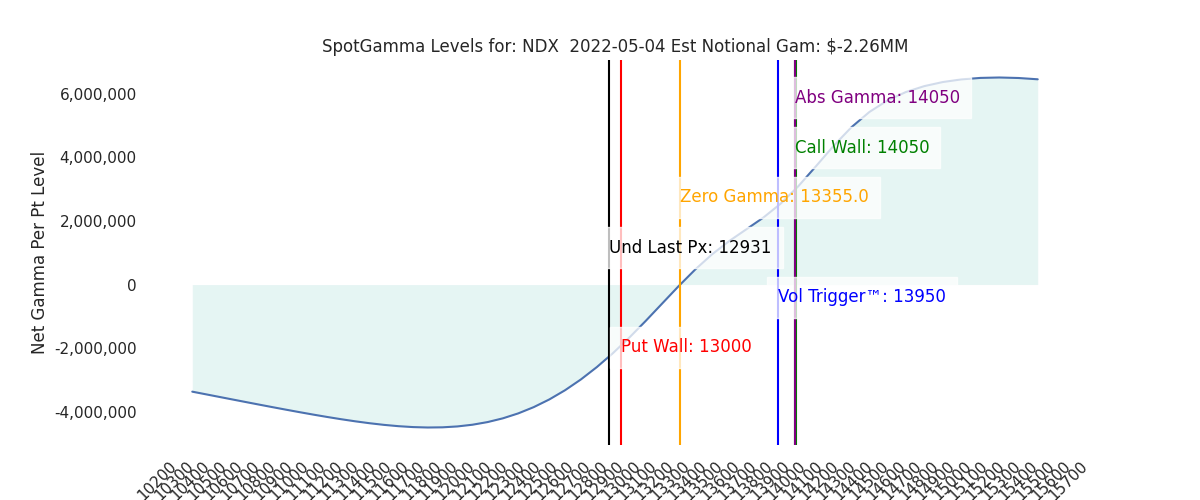

| Volatility Trigger™: | 4300 | 4350 | 430 | 14000 | 339 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 420 | 14050 | 300 |

| Gamma Notional(MM): | -755.0 | -733.28 | -1537.0 | -2.0 | -645.0 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4382 | 4436 | 0 | 0 | 0 |

| Put Wall Support: | 4000 | 4000 | 400 | 13000 | 300 |

| Call Wall Strike: | 4700 | 4700 | 450 | 14050 | 360 |

| CP Gam Tilt: | 0.64 | 0.6 | 0.48 | 0.82 | 0.56 |

| Delta Neutral Px: | 4332 | ||||

| Net Delta(MM): | $1,580,954 | $1,644,343 | $167,377 | $40,714 | $105,231 |

| 25D Risk Reversal | -0.09 | -0.1 | -0.07 | -0.08 | -0.08 |

| Call Volume | 345,698 | 514,914 | 2,156,196 | 3,736 | 909,664 |

| Put Volume | 752,006 | 1,119,882 | 2,663,328 | 3,301 | 1,198,883 |

| Call Open Interest | 5,271,323 | 5,186,085 | 6,114,733 | 48,890 | 3,899,902 |

| Put Open Interest | 9,752,514 | 9,689,904 | 10,281,433 | 48,981 | 6,181,186 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4300, 4200, 4125, 4000] |

| SPY: [430, 420, 410, 400] |

| QQQ: [330, 325, 320, 300] |

| NDX:[14050, 14000, 13500, 13000] |

| SPX Combo (strike, %ile): [4100.0, 4201.0, 4150.0, 4125.0, 4284.0] |

| SPY Combo: [408.89, 418.88, 413.88, 411.38, 427.21] |

| NDX Combo: [12736.0, 13155.0, 13352.0] |

| ©TenTen Capital LLC d.b.a. SpotGamma Please leave us a review: Click Here |

| See the FAQ for more information on reading the SpotGamma graph. |

| SpotGamma provides this information for research purposes only. It is not investment advice. SpotGamma is not qualified to provide investment advice, nor does it guarantee the accuracy of the information provided. This email is intended solely for subscribers, please do not distribute the information without the express written consent of SpotGamma.com. |