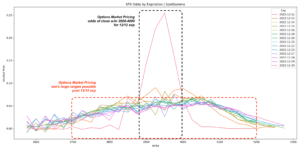

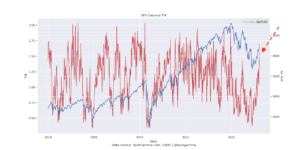

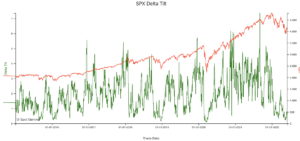

SpotGamma Beats Banks to the Forecast: Post-CPI Thrust Fails To Hold Macro Theme: Key Levels: > Major, longer term resistance is the 4100 Call Wall> Key Pivot in Dec OPEX: 4000> Max downsize target into Dec OPEX: 3800 Put Wall> Critical Pivot dates next week: 12/13-12/14 CPI/FOMC (see 11/25 note) to12/16 OPEX. Ref Price: 3934SG […]

Report Card

Founders Note for: 2022-10-31 06:04 AM EST

Look Out For the “Sucker Punch” Rally Reversing Lower Macro Theme: Key Levels: > New ranges currently forming after Oct OPEX. We anticipate high volatility as markets set a new directional trend > We hold a bullish edge to markets while the SPX is > Vol Trigger (3820) > Range Into Nov OPEX (11/18): Top: […]

Founders Note for: 2022-09-21 06:15 AM EST

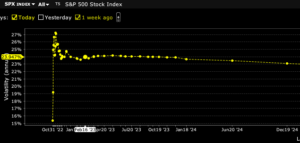

The FOMC Can Send the Market to 3580 in Ten Days Macro Theme: Key Levels: –> 4005 SPX Call Wall is the top of our range–> 3800 Put Wall is at the bottom of our range–> We assign a bearish edge to markets as long as the SPX is < Vol Trigger (3950)–> 9/21 FOMC/VIXexp […]

Founders Note for: 2022-08-15 08:58 AM EST

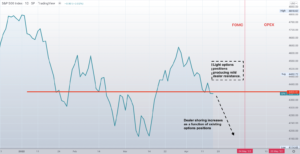

If The S&P 500 Stalls at 4300, Look Out Below Macro Theme: Key Levels: – Markets maintain a bullish, positive gamma stance; withmean reverting price action & $4,300 now the top of our range into August 19th OPEX– This weeks VIX (8/17) + equity expiration(s) (8/17) may trigger higher market volatility and equity weaknessinto month […]

Founders Note for: 2022-07-19 08:23 AM EST

Equity Markets Could Rally into VIX Expiration Macro Theme: Market Context: Rallies should be categorized as short covering and subject to failure. S&P 500 Levels: What To Watch: Daily Note: Futures are higher to 3865 overnight. We once again look for ~1% swings today with resistance at 3900-3910. Support shows at 3850 then 3800. Today […]

Founders Note for: 2022-06-03 08:25 AM EST

Short-Term Volatility is Shrinking as we Approach a Risky Period Macro Theme: Daily Note: Futures are consolidating yesterdays gains, trading back to 4148. Volatility estimates continue to trend lower as the S&P oscillates in the 4100-4200 zone. Resistance remains at 4200, with support at 4155 (SPY4150), 4127 then a major level at 4100. As this […]

Founders Note for: 2022-05-04 07:41 AM EST

Look Out Below: Volatility Trigger Breached and Call Wall Holds Strong Macro Theme: Daily Note: Futures were quiet overnight, and are up slightly to 4185. We expect a calm session today up until the 2pm ET FOMC events. Following that, we see key resistance at 4200-4210(SPY 420 equivalent) with 4284 the next resistance point from […]

Founders Note for: 2022-04-19 07:33 AM EST

Options Expirations Remove Supportive Positions and Create Downside Risk Daily Note: Futures have pressed lower to 4380. Our levels and volatility expectations remain in line with yesterday’s data. We look for a maximum move of 1.19% (open/close) with resistance at 4400SPX & 440SPY (4415SPX equivalent). Support shows at 4365SPX (435SPY). Beneath that level we see […]

Brent Calls for Market Rally Ahead of March OPEX on the Contrarian Investor Podcast

Brent, Founder of SpotGamma, was on the Contrarian Investor Podcast this week. There he discussed how options hedging may impact stock prices, and why he thinks markets may rally into next weeks options expiration (3/18/22). For full audio-only, go here to listen.

After Historic Stock Market Reversal, SpotGamma Calls Arrival at Lower Bound

Market Activity: Monday featured an historic stock market reversal wherein the S&P open down 1.5%, declined another 2.5% intraday, then rallied 4% into the close. Two weeks ago we flagged the January 21st options expiration as a catalyst for volatility, and we viewed Monday as a continued “clearing” of large OPEX hedges. Market Backdrop: In […]