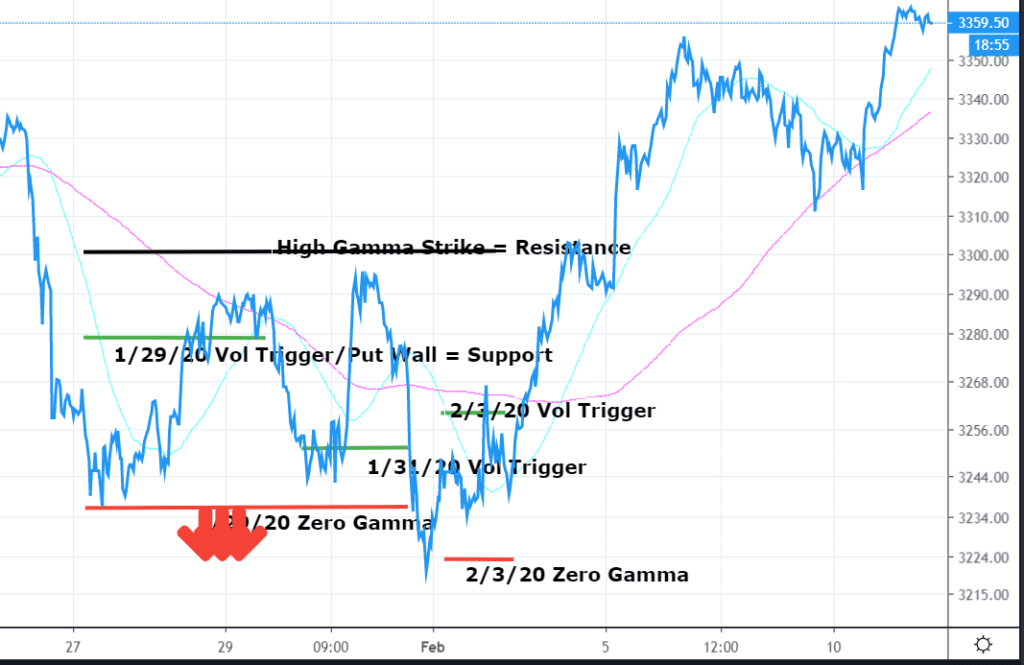

There has been quite a rally of of recent lows as the market has been digesting Coronavirus headlines. A bit over one week ago the market was testing the “zero gamma” level – which can present a challenging choice for traders. The chart below shows ES futures with our levels noted from the first week of February – and the subsequent move back to all time highs made yesterday (overnight session).

Low to negative market gamma can fuel volatility: but as we try and emphasize volatility is not directional. Yes, gamma can happen both ways.

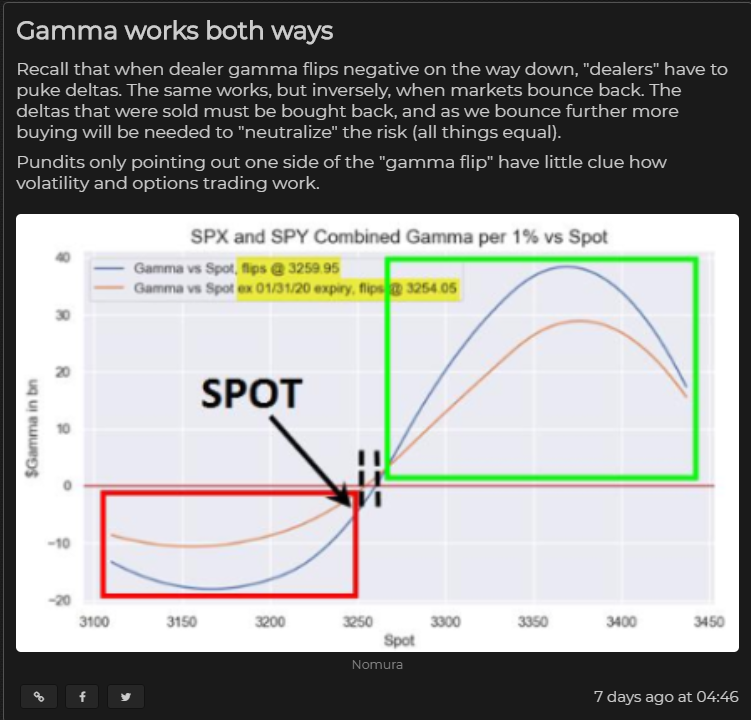

Note the chart below which shows Nomuras gamma estimate from early February – and MarketEar’s note regarding “Gamma works both ways.” The idea here is that all of the hedges placed to protect against a Coronavirus impact are unwound – putting pressure on the market to move higher. This is because when long puts are puchased dealers are short those puts – and must hedge shorting futures. When those long puts are closed, dealers have to buy back those short futures.