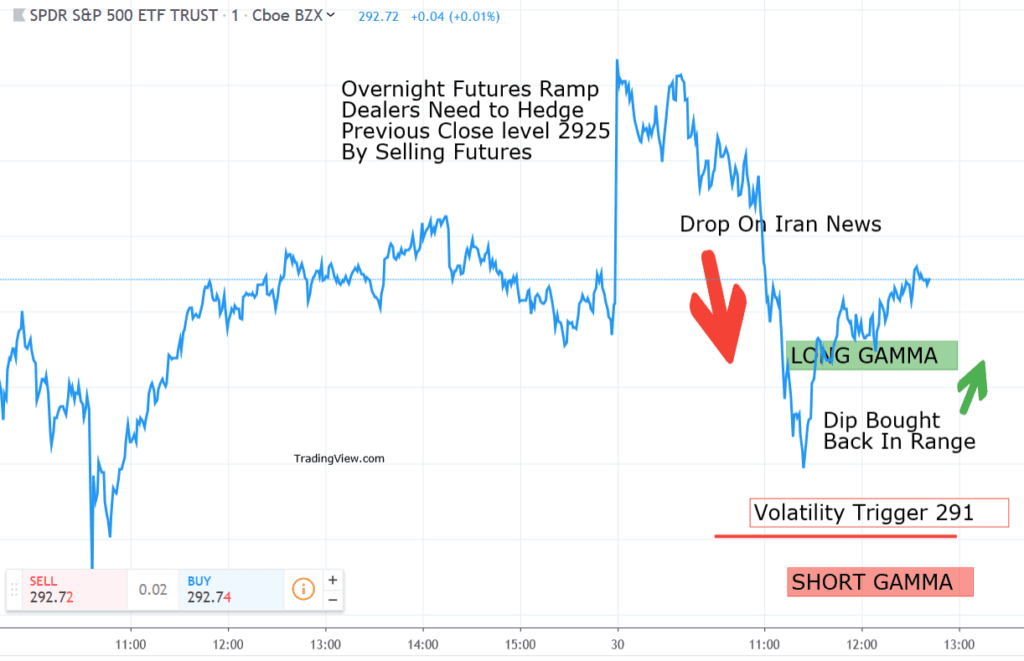

There have been lots of short gamma charts lately but today’s action looked like a long gamma kick save. News about Iranian enrichment pushed the market down at ~11EST and there was a decent drop to ~291 – a dip that was bought. The previous close was 292.5 and we model that because of the gap higher overnight dealers would need to sell futures to be back to neutral. This meant the market had some natural selling pressure, and a little piece of negative news was all it needed to drop pretty quickly. On the converse side we hit an “oversold level” where dealers need to start buying to get back to the “neutral” level of 292.5. This is the long gamma environment where dealers sell into rallies and buy dips pushing stock back to “neutral”. Had this market been pushed under 291, well then may have triggered a gamma trap.