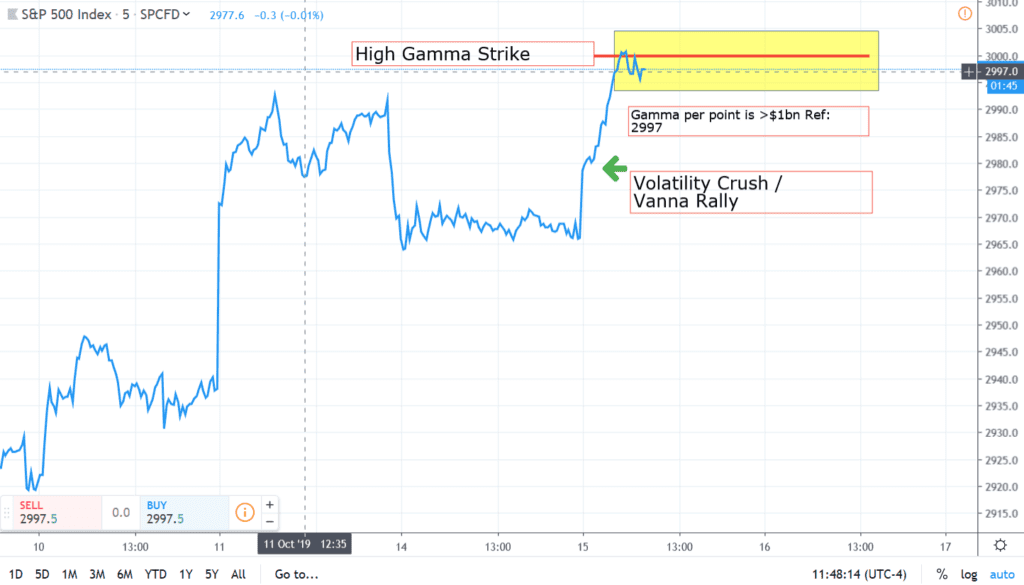

Here is a chart mapping out how we viewed this recent rally back up to 3000 in SPX, along with a bit of a prediction. The volatility crush sparked a rally today up to our “high gamma strike” of 3000. Because gamma is very high (~$1bn per S&P500 point) and 3000 is a high gamma strike we anticipate the market being “locked” into this strike for a day or two. If the market pushes over dealers should SELL into that rally and if it trades lower dealers should BUY the dip.

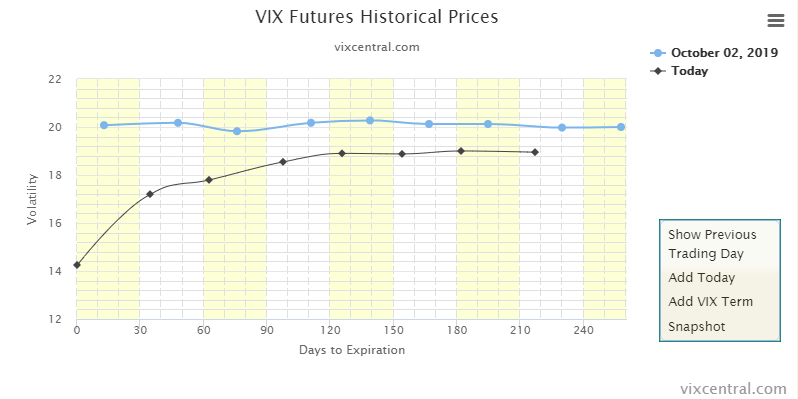

You can see in the chart below of VIX futures that volatility has been crushed ahead of VIX expiration tomorrow. The theory being that as volatility comes down downside hedges lose their value causing dealers to buy stock.

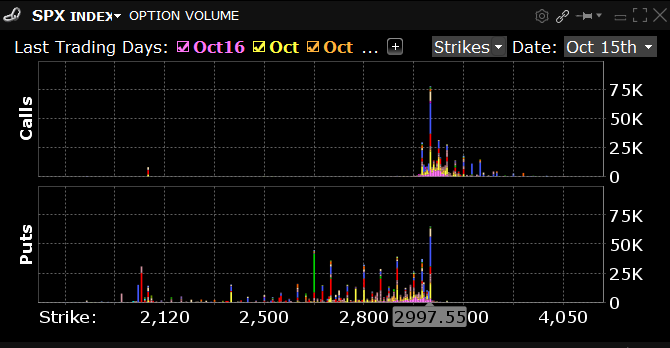

Additionally there was a substantial amount of volume at the 3000 strike today, for both puts and calls. This creates more trading tied to this market level.