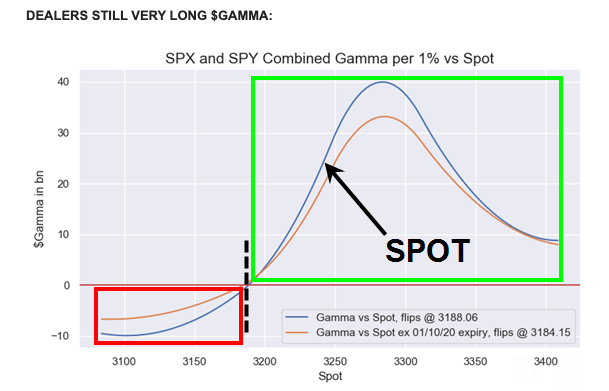

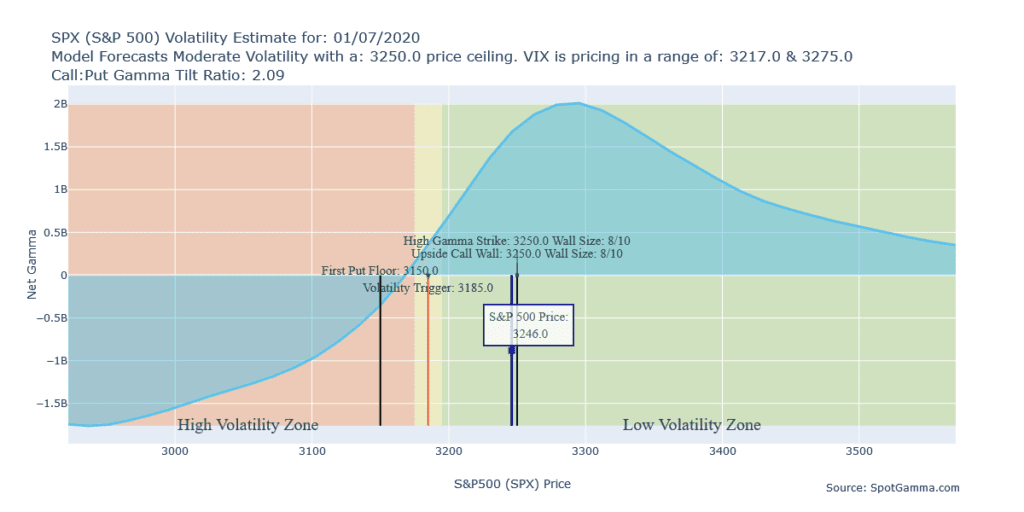

Here is an updated Nomura gamma snapshot to compare vs ours. Note we both have gamma flip at ~3185 with peak gamma around 3275. He also sees 3250 as a “pin” much as we’ve shown in subscriber reports. Thanks to Heisenberg report.

“And the same song remains—SPX Dealer ‘Gamma flip’ level is meaningfully below market”, McElligott writes, noting that the dreaded “flip” point is around 3,188 on the S&P.

Meanwhile, Charlie also reiterates that US equities have to plunge meaningfully to push spot below key levels that would trigger CTA selling. Specifically, Nomura’s QIS model doesn’t see the potential for systematic trend deleveraging until way down at 3,147. “The +100% long position remains deeply ‘in the money’ and in-trend”, he writes.

There are some countervailing factors, even as they’ve been overwhelmed by the above. McElligott notes that the gamma long has kept things largely pinned near the 3,250 strike despite negative flow impulses from the following:

L/S, MF and Macro Funds all took their “Beta to S&P” down last week

Options positioning data showed the $delta decline pretty significantly (still $333B which is 91st %ile since 2014, but down from $392B)

Futures positioning data shows that Asset Managers did in fact begin selling from their prior “100th %ile” notional

VIX ETNs showed small net Vega buying +2.1mm and net long remaining 93rd %ile after last week.