Earlier this week we pointed out a bizarre divergence in the “greeks” – while the Nasdaq had slumped into negative gamma territory, which is where dealers are forced to sell more as the Nasdaq slides lower creating a feedback loop where selling begets selling, even as the S&P still remained in positive gamma as a result of the rotation into value names which propped up the index.

Well, the divergence is no more.

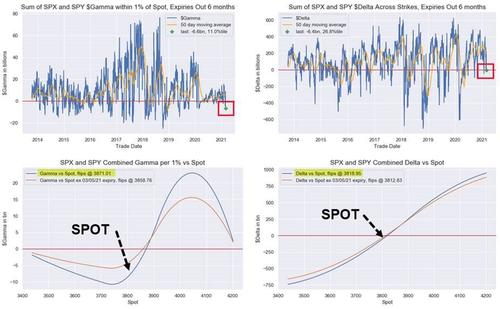

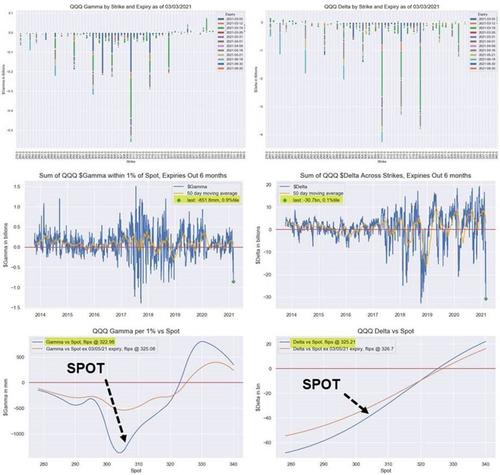

After yesterday’s marketwide rout – which was launched by yet another powerful blast of bear-steepening as yields surged following the latest “scorching inflation” comments out of the latest round of ISM and PMI surveys – and which saw further unwinds as expensive “secular growth” longs where smashed – Nomura’s Charlie McElligott notes that the Nasdaq/“Secular Growth”/Expensive Stock pain dragged SPX into “negative gamma & delta” territory with it (dealers negative gamma vs spot below SPX 3871, negative delta vs spot below 3819). However, as the Nomura quant notes, “it is the extreme magnitudes of the current QQQ’s greeks which make this market so fragile” with a huge short gamma overhang chasing every move lower in the Qs.

- QQQ $Gamma -$852mm, 0.9%ile since 2013

- QQQ $Delta -$30.7B, 0.1%ile

And right now with QQQ spot around $308-309 preopen, Nomura warns that we sit almost at “max short gamma” pain point.

That’s the bad news. The good news is that as McElligott critically notes, ~31% of said QQQ Gamma is set to run-off after tomorrow’s weekly expiration, with the most substantial chunks at 310, 315 and 320. Which means that absent another major selloff, the Nasdaq will finally get reprieve as the negative gamma shrinks by a third, and dealers cover forced shorts.

SPX:

QQQ:

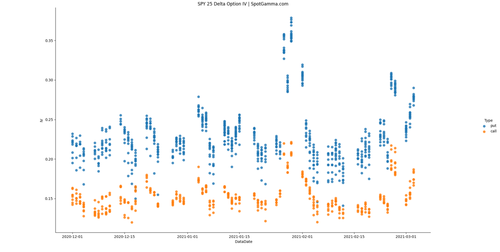

And while the Nasdaq has at least a few more hours of pain to look forward to (any SLR commentary from Powell today will lead to a blast off in all long duration assets), what about the SPX? Here an interesting observation from our friends at SpotGamma, who note that while SPY implied volatility has picked up, it remains below that of late January market spasm – as shown in the chart below, each dot here represents an option with a different expiration. “In other words we are realizing a higher volatility than at any point since June ’20, but downside protection is not being priced at a similar level.”

Their conclusion, which as we discussed yesterday is very much predicated on what Powell says today, is that despite the negative skew to their views, “the SPX has room for a quick move back to 3850 if markets are calmed by the Fed, and implied volatility (ie VIX) comes in.” That said, a more stable bull run starts above 3900 and SpotGamma is “skeptical of any rally until/unless markets recapture that large gamma level.”