Via ZH: Earlier this week we pointed out a bizarre divergence in the “greeks” – while the Nasdaq had slumped into negative gamma territory, which is where dealers are forced to sell more as the Nasdaq slides lower creating a feedback loop where selling begets selling, even as the S&P still remained in positive gamma […]

mcelligot

Nomura’s McElligott: ‘The VIX Is Broken — Again’

From Heisneberg: “From a Vol market perspective, the issue is that the VIX is broken — again,” Nomura’s Charlie McElligott said Monday, in one section of a sweeping note documenting recent dynamics and detailing what a trio of backtests might foretell for markets on the heels of last week’s somewhat deranged developments. It’s “all demand” […]

Nomuras November Gamma Report

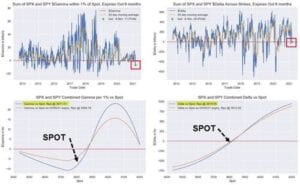

From Heisneberg we get a glimpse into Nomuras gamma view, which seems to coincide with what we see. Namely gamma is about as high as we’ve ever seen, this past week hitting $2.7 billion compared to an all time high of ~$2.9bn in August of 2018. At the same time, investors have leaned into equities […]

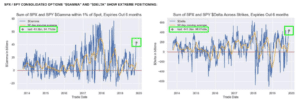

SpotGamma Trading Levels Vs Nomura

Here is a report from Nomura compared to the same days market forecast from SpotGamma.com. Notice the “zero gamma” levels are the same in both reports at 2935 in the S&P500. We call the “zero gamma” level “volatility trigger”. Using this level can help forecast the level of stock market volatility. Under this market price […]