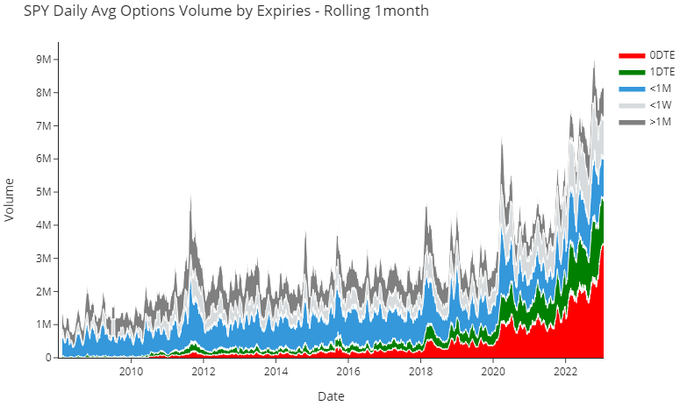

“Nomura’s Charlie McElligott on 0DTE options: Volumes aren’t inherently a sign of apocalypse: flow can exacerbate intraday moves, BUT much of the volume likely electronic market makers trading for risk positioning, creating noise that can ‘net out’.”

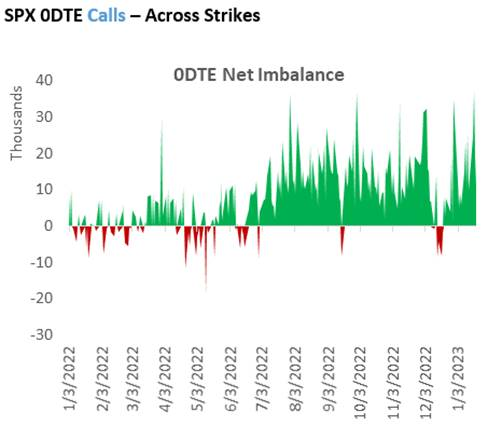

“However, potentially an arbitrage opp because no need to post margin with prime brokerages (no EOD position) and may be better tool than futures. Also, right tail risk remains–customers heavily buying calls vs selling “at highest level of imbalance” since introduction of 0DTE”

From ZeroHedge:

Source: Nomura

While many see this as a pending “sign of the apocalypse” – McElligott notes that volume in-and-of-itself does not necessarily signal any sort of increasingly unstable risk-taking, despite the flow’s ability to exacerbate intraday movement through these extremely convex instruments being traded directionally… because, as he explains, much of the volume / flow is electronic market makers slicing-and-dicing these as vehicles against their intraday risk positioning needs, meaning massive noise and ‘netting out’ effect

That said, there are “technicals” here with the aggressive uptick / deployment of 0DTE Options too:

1) these vehicles are potentially allowing for a “regulatory- / risk-management- arbitrage” for sellers of Options, as with a 0DTE, you would theoretically not need to post margin / collateral with your PB, as by EOD there is no trade to see; while

2) in a purely neutral sense, 0DTE’s are now just a better alternative or surrogate for trading in Futures as well, as you don’t have to put stop limits out there as you would in your Futures positions as a risk mgmt tool… which with a Futures position vs a risk-management “stop out” could see you get knocked-out of your trade, only to then rip back in your face in original direction of your view…so in this case, they simply help avoid “stop-outs” without being a pure-play read on anything sinister about “risk appetite run amok”.

In the past, much (negative) focus was on 0DTE Options being bought to create “Gamma Squeezes” and goose the market in either direction on buyers of “wingy lottery tickets”.

That said, and inline with the Vol crunch of the past few months—it should be noted that we have too been getting a lot of anecodotal information that “Theta Gang” and “Dispersion” books (against single name long vol) have increasingly been SELLING TAILS / DEEP OTM INDEX PUTS on same day expiries, which have simply not been realizing in this “crashless sel-off”—which IS something that should make us uncomfortable as a potential source of building instability / asymmetry in the system to be monitored.

But here is McElligott’s bottom line – tieing the above points back-into this current risk environment: looking at the IMBALANCE of 0DTE flows from “Customer” flows only, per CBOE—and particularly, in the case of 0DTE CALLS in SPX (i.e. a proxy for trade pressure, or whether these are buys or sells) – there has continued to be a VERY clear preference for buying SPX 0DTE Calls / Upside of late, with the “net imbalance” of Calls BOT vs Calls SOLD from “customers” category tilted clearly towards BUYING CALLS at the highest level of imbalance we’ve seen since the introduction of 0DTEs – and further iterating the same “Fear of the Right Tail” grab into Upside Optionality since mid-year last year.