From ZH: Indeed, according to Nomura quant Charlie McElligott, after last month’s near-record Op-Ex, things are far more calm now and “3300 looks like the truth in Spooz, with nearly double the aggregate $Gamma ($4.5B) of the next closest line (3250 with $2.4B) as we head into expiry, thus exhibiting some “gravity” with Spooz up nearly 90 handles in just over 3 sessions and right between these two big strikes (ref 3277).”

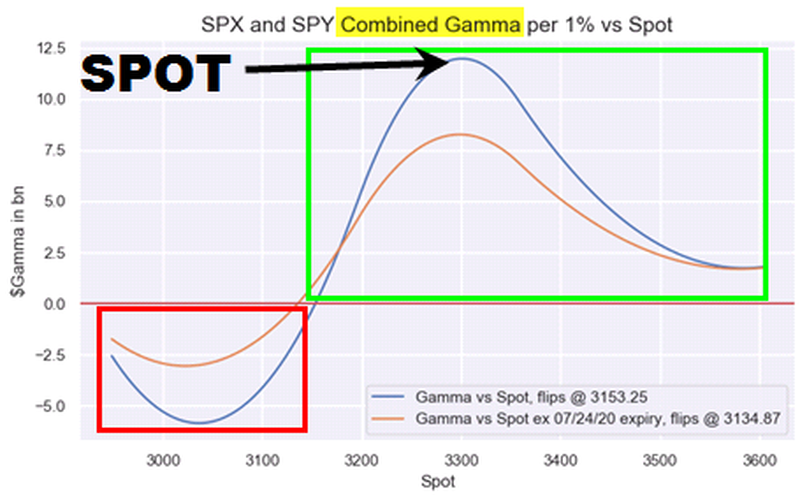

Providing an additional layer of comfort is that SPX/SPY options Dealers are very long Gamma and are In the Money, with Nomura not expecting much of drop in Gamma afterwards as only 14% of options come-off post-expiry

It’s slightly more exciting in the tech space, where not only do investors remain really long (with Delta in the 90th percentile) but we also see nearly 31% of the Gamma coming-off after expiration “so it is likely opening-up to a larger distribution of outcomes range thereafter (in either direction)” according to McElligott.