The “Heisenberg Report” posts notes from Charles McElligott and his Nomura Options Gamma update for September. Its posted here to cross reference what our model derives.

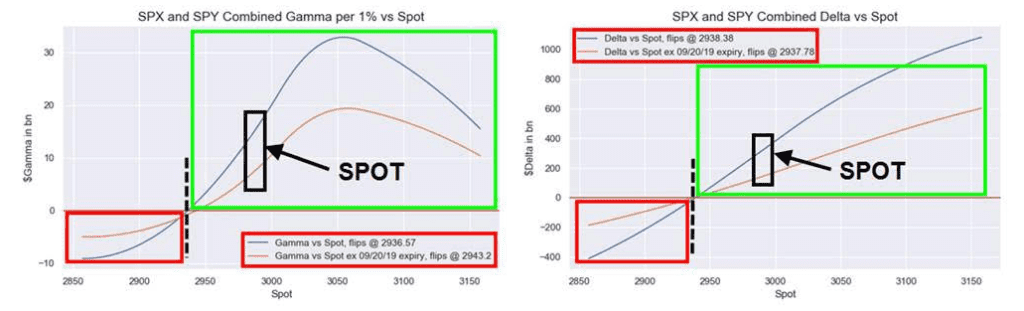

Now that the extreme long gamma dynamic that was pinning the index has rolled off, it’s possible things can start to move in earnest.

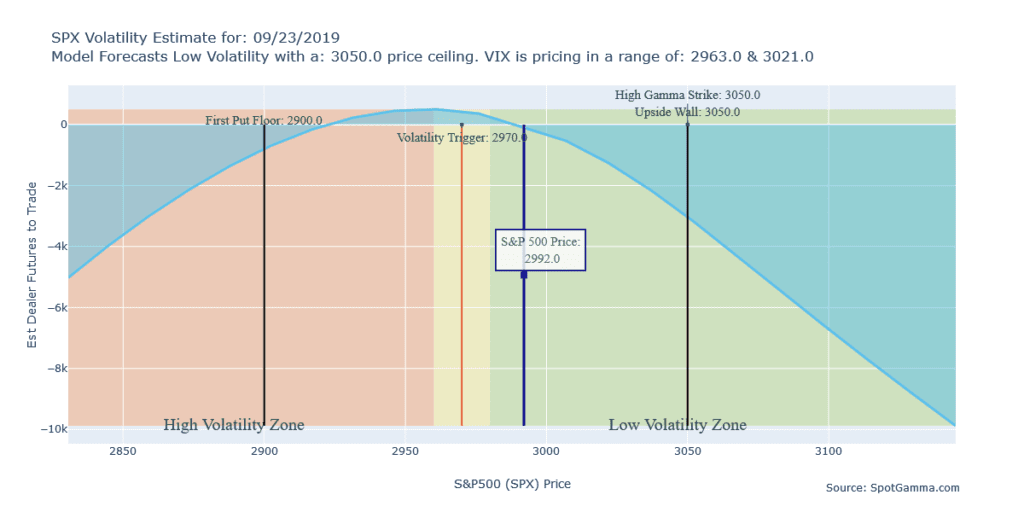

On the upside, McElligott flags large $Gamma strikes at 3000 ($6.5B), 3025 ($5.1B), 3040 ($3.6B) and 3050 ($7.7B). When you consider that with with under-positioning across funds, you’re left with a setup that “could drive ‘chase’ behavior as we approach Q4”, Charlie says.

Nomura combines S&P500 with SPY gamma, while we leave them separate as we think the underlying assumptions about where large players are long versus short options is different. This is what we attribute their “0” gamma currently being ~20 handles under ours (~2970 vs ~2950). We both note 3050 as the highest gamma strike to the upside.