We wrote a few days ago about the importance of tomorrows 3/20 options expiration because of 1) its sheer size and 2) its amount of deep in the money puts. ZeroHedge adds to this sentiment with some notes from Nomuras McElligott:

this “large decline in the gamma post-expiration” should allow markets to pivot back to a much more “neutral”/less extreme hedging stance for Dealers, “meaning incrementally less sensitivity to changes in underlying Delta and thus, forced hedging “momentum” (selling into selloffs, buying into rallies). McElligott expect tomorrow’s “Quad Witch” expiry to have the potential “for nearly 47% of the $Gamma to drop-off.”

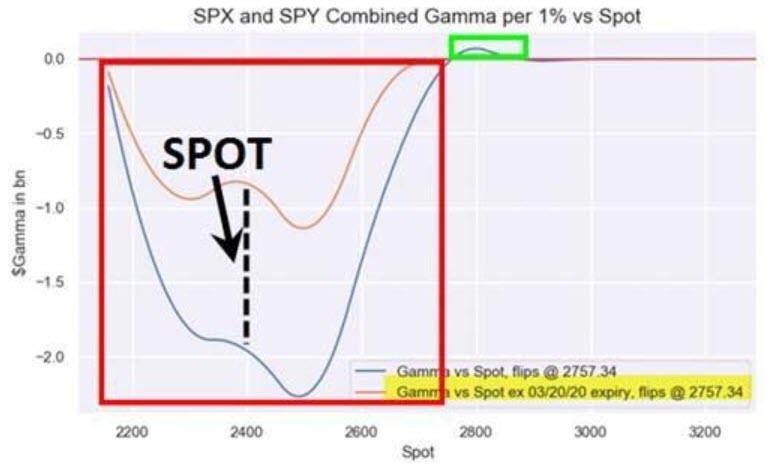

While Nomura sees gamma flipping close to the 2800 level our initial indication was a bit closer to the 3000 strike. But our sentiment is similar to Nomuras as we wrote in our client note this morning:

this OPEX may help lower negative gamma and add some stability to markets. If you look at the current largest call positions they are all over 2925. Calls provide the “positive gamma” to our models, and I have to believe we get calls added much closer to at the money after Friday. Also those large put positions will get rolled out in time and down in price and that should help remove some of the negative gamma input. If we can drop negative dealer gamma closer to zero, that could help reduce the dealer influence on volatility (gamma closer to zero means less dealer trading). This in turn may help lower implied volatility (VIX) and that may help the market rise.