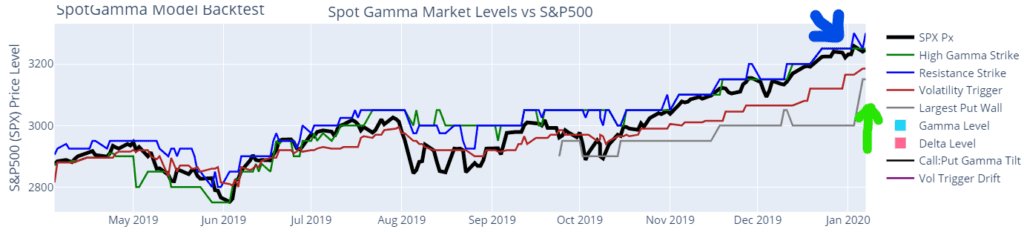

We’ve been tracking very high levels of call gamma the last several weeks that has recently stalled as we’ve hit heavy resistance around 3250 (blue arrow in chart below). During the last several days the zero gamma flip point has moved higher to ~3185 as you can see (green arrow):

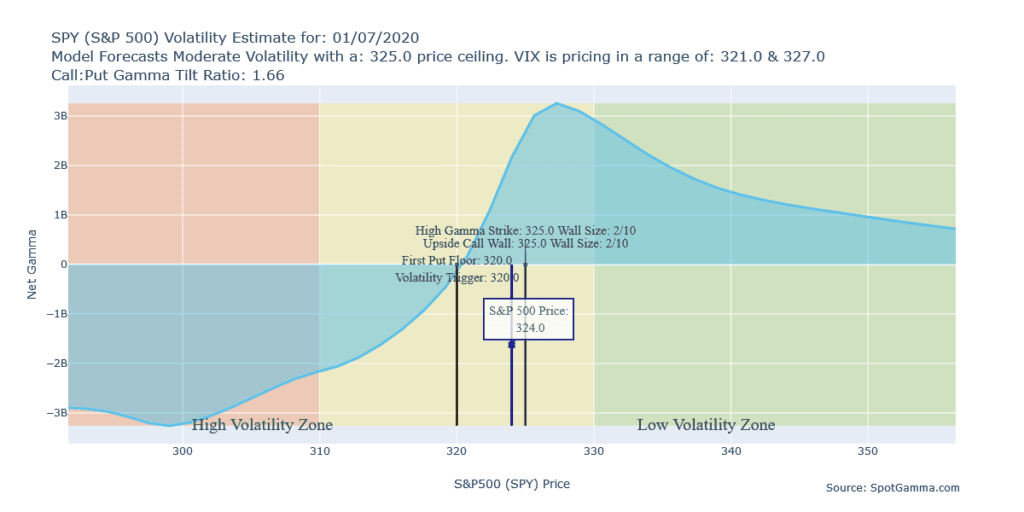

Iran has started launching missiles, and at the time of this writing (7PM EST Tuesday) futures are down >1% and the SPY has broken 320 which we see as its flipping point.

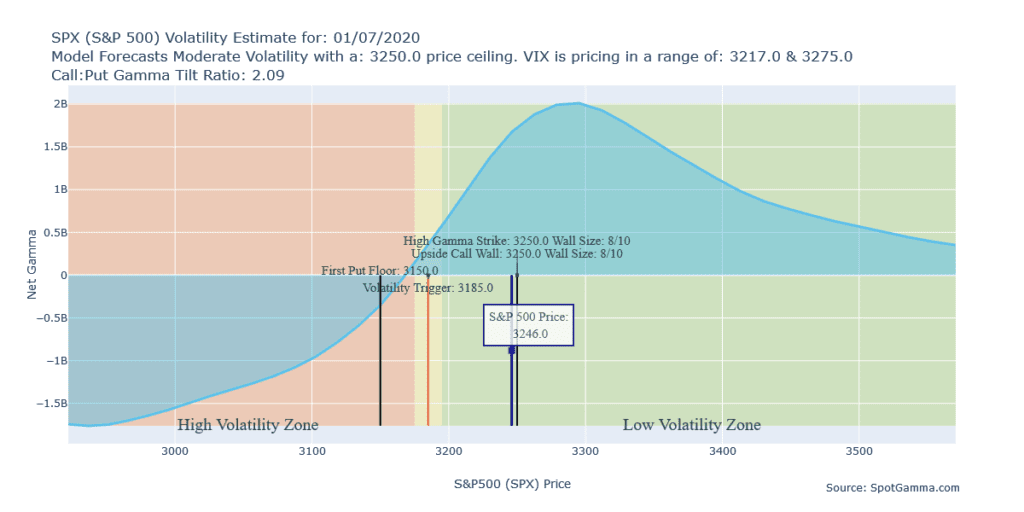

The SPX is a much larger market than the SPY, and we’d need to see lower prices in futures to get in the gamma flip area for SPX. However, due to the movement of futures and the increased implied volatility the SPX gamma flip level may increase overnight.

Should futures open under the 3200 level we would anticipate the market gamma “flipping” from positive to negative (gamma trap or gamma flip). This could put options dealers in the position of selling futures as the market moves lower, increasing volatility. We have 3150 as the first level of support due to large put open interest there. Our theory with put walls is that when the market moves toward that strike it becomes a pivot at those who own puts monetize, hedge or roll them.

Above 3200 we would anticipate the market remaining long gamma and moving back towards the closing levels of the last several nights ~3240.

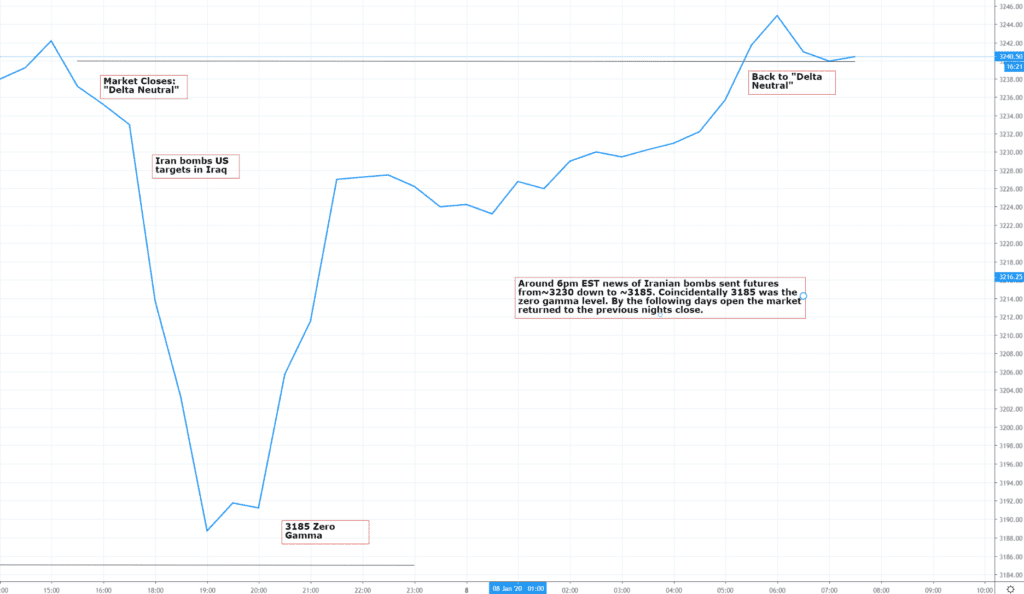

1/8/20 Market Update

A huge bounce of of the 3185 gamma flip level erased any overnight losses and puts the market right back to where it closed on 1/7/20.

NOTE: This is not a trading recommendation, as we have no idea what futures will do overnight. Its simply an analysis for research purposes.