The S&P 500 closed the week at 6,661, posting a 1% weekly gain as markets navigated through the highly anticipated FOMC. What made this week particularly noteworthy was the extreme complacency at its start: one-month realized volatility sat at a meager 8%, and implied volatility hit basement-level 5% for this past Monday.

These are some of the lowest readings we’ve seen in the past six months. This compressed volatility environment created the perfect conditions for the grinding upward momentum that characterized most of the week.

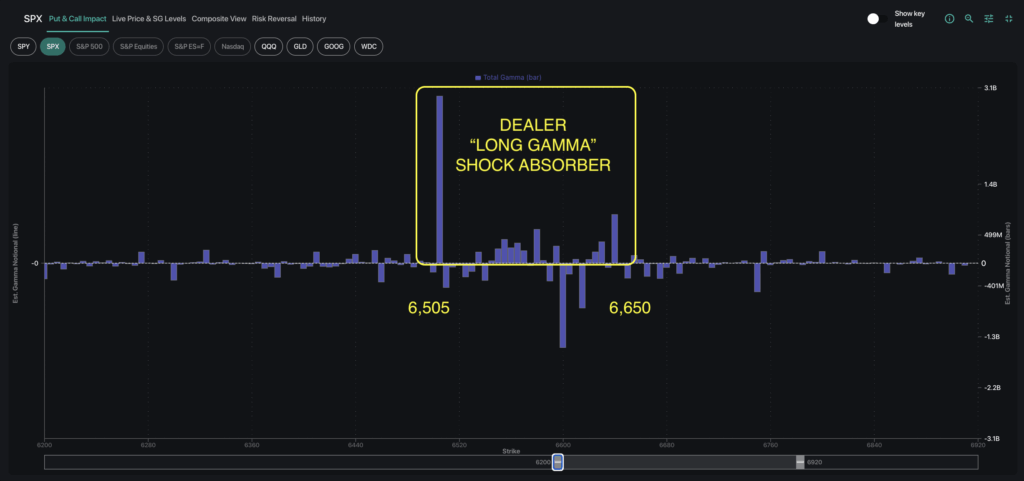

Much of the market’s resilience throughout FOMC can be attributed to the current positive gamma positioning from dealers, which has created a powerful shock absorber for volatility.

Substantial positive gamma concentration in the SPX 6,500-6,650 range – largely due to the massive JPM 6,505 call position – anchored the lower bound with stabilizing dealer support.

Over $1.7 billion of positive gamma explains why Wednesday’s FOMC-induced selloff found immediate support, and why the subsequent recovery was swift. However, this protective gamma umbrella is largely tied to September expiration cycles, including September 19 (Friday’s) OPEX and the September 30 JPM collar expiration.

How does this set us up for October? Substantial long gamma dealer positions will expire at the end of the month – meaning there is potential for a meaningful reset and higher volatility than the market has grown accustomed to.

September Expiration Dynamics & Positioning

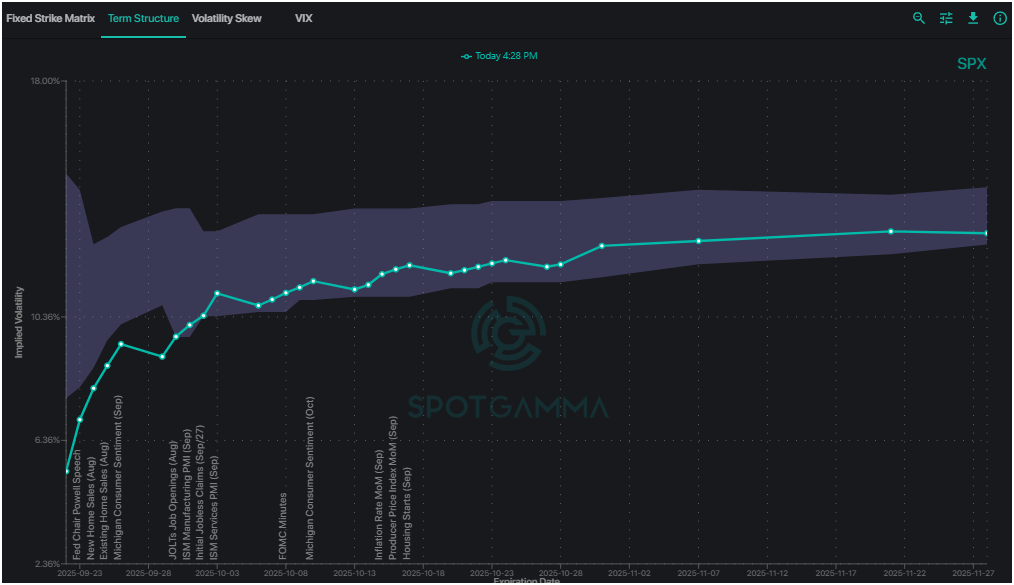

The SPX term structure reveals an interesting divergence: pre-9/30 expirations have compressed significantly, while longer-dated expirations are seeing more middle-of-the-road IVs, at least compared to their 90-day history (shaded region below).

While traders are not pricing in full-blown turbulence, the term structure does point us to October as the next likely timeframe for elevated realized volatility.

As we shared last week, 0DTE flows have played a major role in reinforcing the current zombie market as traders sell short-dated options and spreads, forcing market makers to hedge against price action.

However, this mechanic is entirely dependent on traders being comfortable repeatedly entering these short vol positions. Were the market to get spooked, these 0DTE traders may be absent – or may even enter long vol setups – which would amplify price action instead of dampening it.

There are two things traders need to watch for over the next two weeks: dealer gamma exposure, and the prevalence of short-dated flows. If dealer gamma remains positive following the September 30 expiration – particularly outside of just 0DTE – then the low-vol regime has room to continue its grind. If dealer positioning does in fact reset and market gamma flips negative, then we would anticipate a jump-start to vols.

The current vol compression means that any unexpected catalyst could trigger a sharp move in either direction if IVs expand enough. While existing market positioning favors continued upside, appropriate risk management remains paramount to account for these possibilities.