In our daily subscriber reports we often talk about the “Options Expiration [OPEX] Cycle” and its influence on the S&P500. This cycle starts on the third Friday of each month, wherein its typical to have >20% of total S&P500 options* expiring. Our view is that options market maker hedging begins to concentrate around the strikes with the most gamma, and that causes a pinning effect.

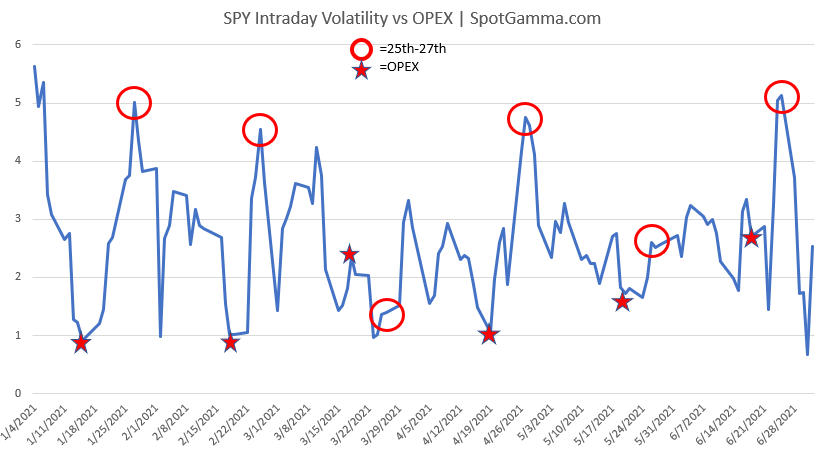

To substantiate this claim we’ve plotted out the intraday volatility of the SPY ETF. This metric reads the high and low of each trading day in an effort to portray daily price movement. We’ve marked each OPEX with a star, and circled the reading for the end of each month. A higher reading indicates the markets are having larger swings on the day, and a low reading infers a tight trading range.

As you can see most of the OPEX days correspond with periods of low intraday volatility. The week after expiration the market tends to experience its largest intraday volatility which corresponds to the reduction in large options positions, and the hedging associated with them.

If you want to learn more about the OPEX cycle try a free 5 day trial of SpotGamma.

*on a gamma weighted basis