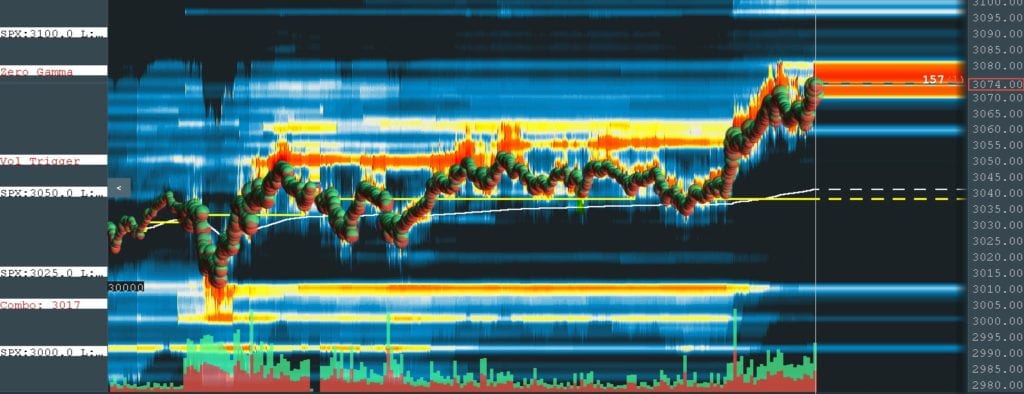

We publish key levels based off of S&P500 options gamma and interest levels before the open. We can push these levels into various trading systems like Bookmap. As you can see in the Bookmap screenshot below the ES futures played off of our trading levels throughout the day.

The market opened and immediately tested 3025 SPX (3013 ES) and then spend the rest of the day testing our proprietary Volatility Trigger level. This is a key resistance level as seen in the image below at just above 3050. Once the market finally broke through that area it immediately traded up to where we calculated the Zero Gamma levle of 3078(ES).

These options gamma levels are key for all traders because they indicate where option dealer hedging may take place. This flow could have major impacts on how the market moves and which levels are key.

Below is a full video of the session: