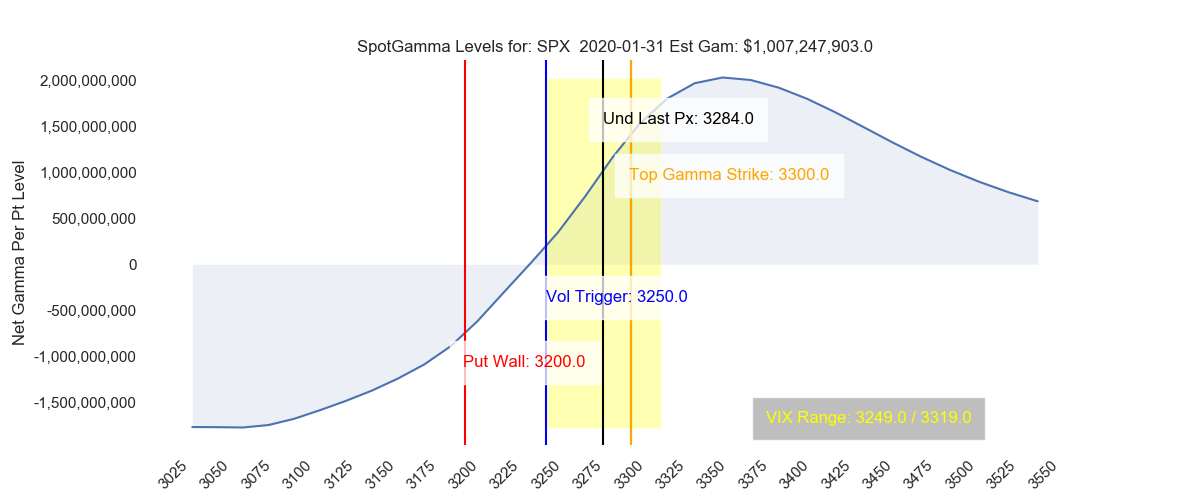

A quick note, particularly for documentation. Currently (1/31/20) the market awaits a slew of catalysts including: coronavirus updates, Iowa caucuses and the Chinese market reopening. For the last few days we’ve been contained in this fairly volatile range between ~3300 (our high gamma strike) and ~3240 (zero gamma). Above we can bask in the comfort of high gamma, below may set the gamma trap.

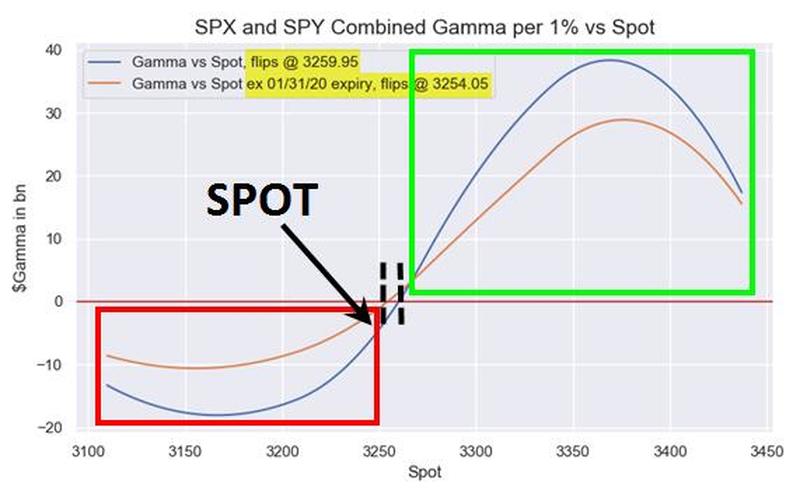

ZH released the latest Nomura gamma charts, showing the calculate zero gamma at ~3255 meaning we are currently in negative gamma territory (SPX=3240). Our model shows 3234, as seen below.

Here is our gamma chart for JUST the SPX. Nomura combines SPY/SPX.

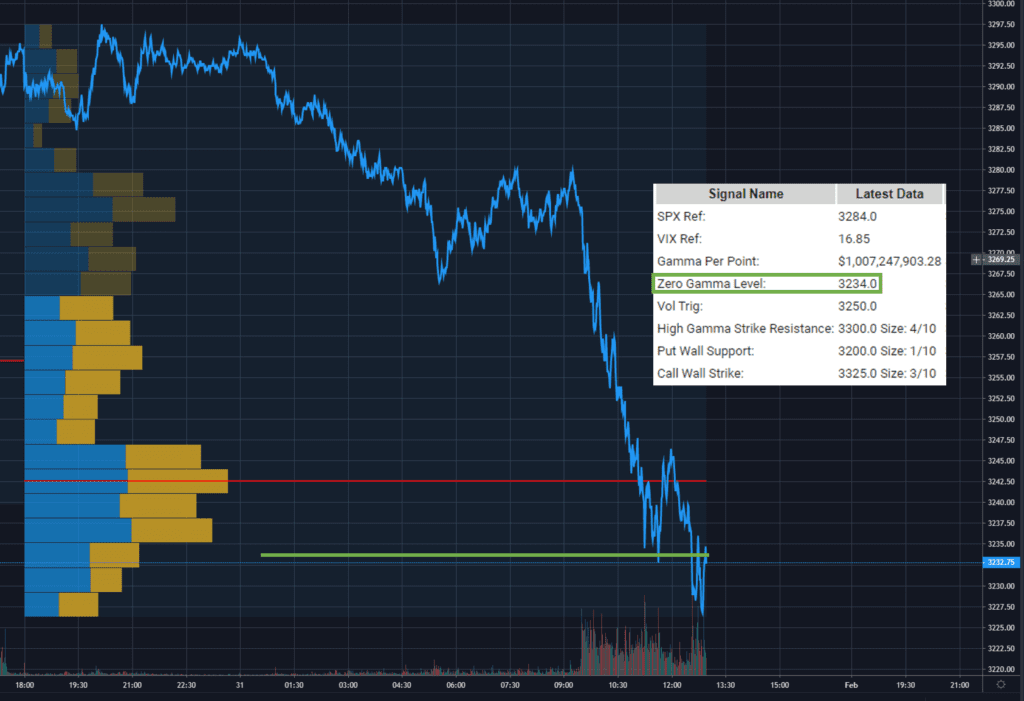

Currently its clear that the zero gamma level is playing into things. Note the ES futures chart with an inset of key levels from our 8AM report.

Closing Update: Large move lower after breaking zero gamma, kick-saved into the close.