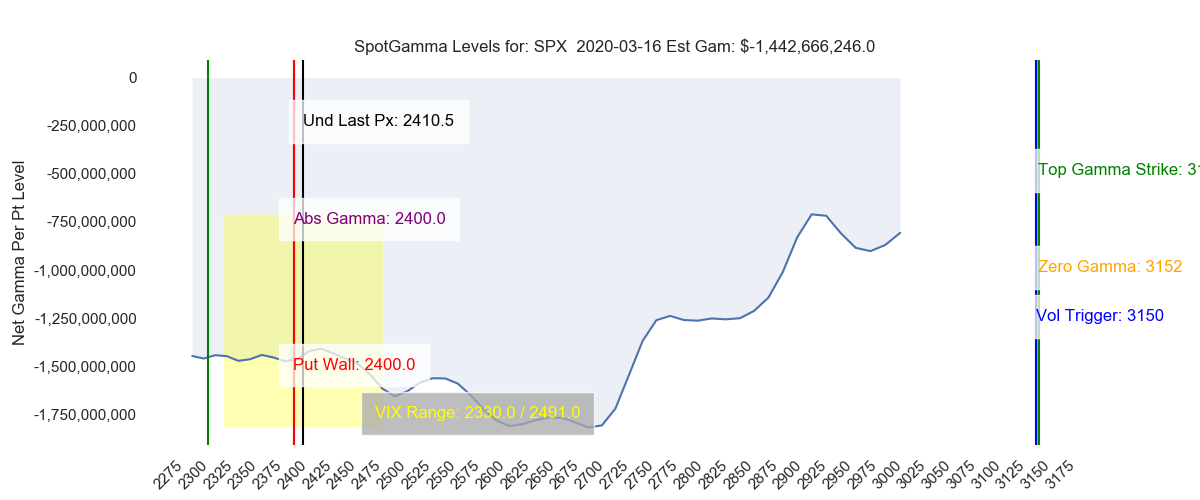

Options expiration for this Friday 3/20 is getting a lot of attention because it is so large. It may also hold the key to a major change in our “negative gamma” situation. As you can see markets remain in negative gamma territory unless we move up towards 3100-3150 in the SPX.

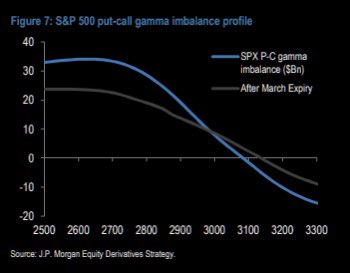

The other way we can greatly reduce negative gamma is through Options Expiration. This is because there are many chunky deep in the money put positions which will be closed and or rolled to lower strikes into this Fridays expiration. As you well know near term options also have higher gamma. As the chart below from JPM shows negative gamma should drop after march expiration.

What this chart does not estimate is for new positions added which would theoretically be lower in value and farther out in time. We may also see the addition of call options which are closer to at the money – which would add some positive gamma to our models forecast. As the prior Feb OPEX was at such higher prices, many of the calls written are at substantially higher prices.

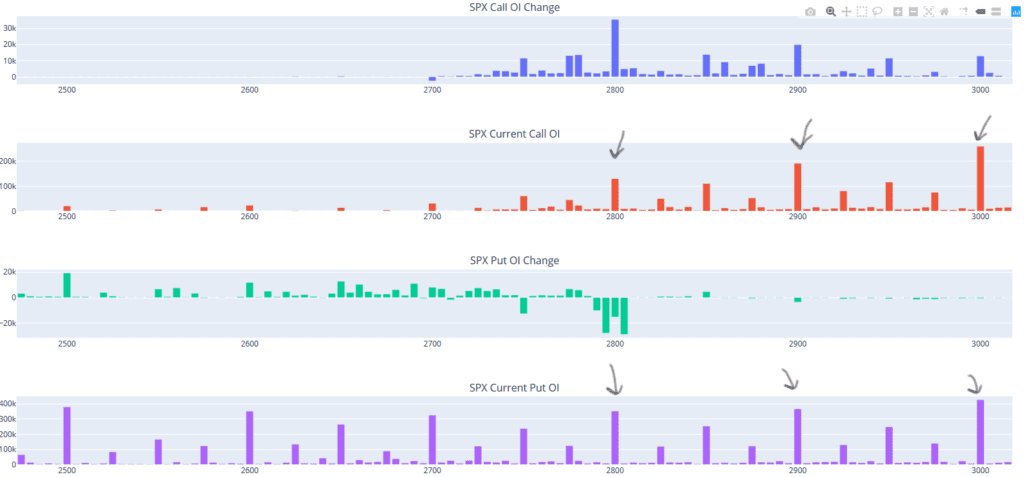

If you look at the chart below you can see where the bulk of open interest sits (This is a chart that is available in real time to subscribers). You can see both call and put concentrations are at strikes that are now well away from where the S&P500 is currently trading (~2425).

Its possible that after all this OPEX shifts down, it may “collar” the SPX market and help to reduce volatility. The idea here being that gamma will be reduced causing less hedging activity from dealers. Since gamma is currently high and negative, we are getting lots of hedging activity from options dealers which may be pushing volatility levels to expand.

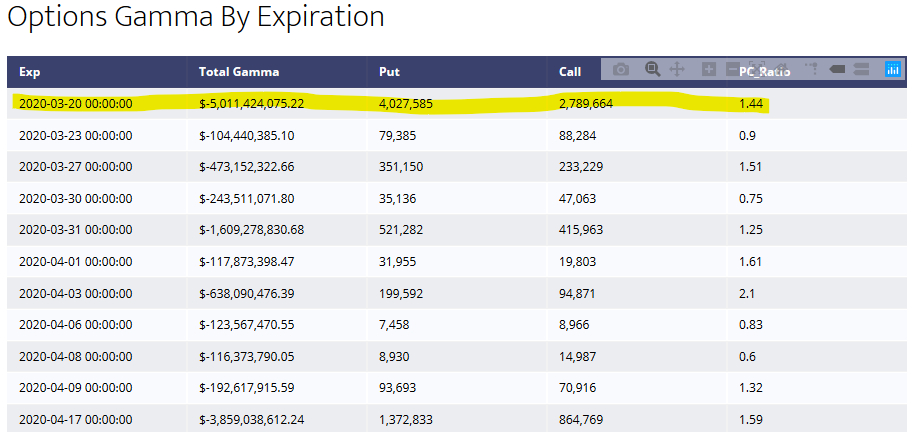

You can see that we currently have about 4mm put options set to expire on 3/20 and that is roughly -$5bn in gamma, and this level is much larger than other listed levels including the April Monthly.