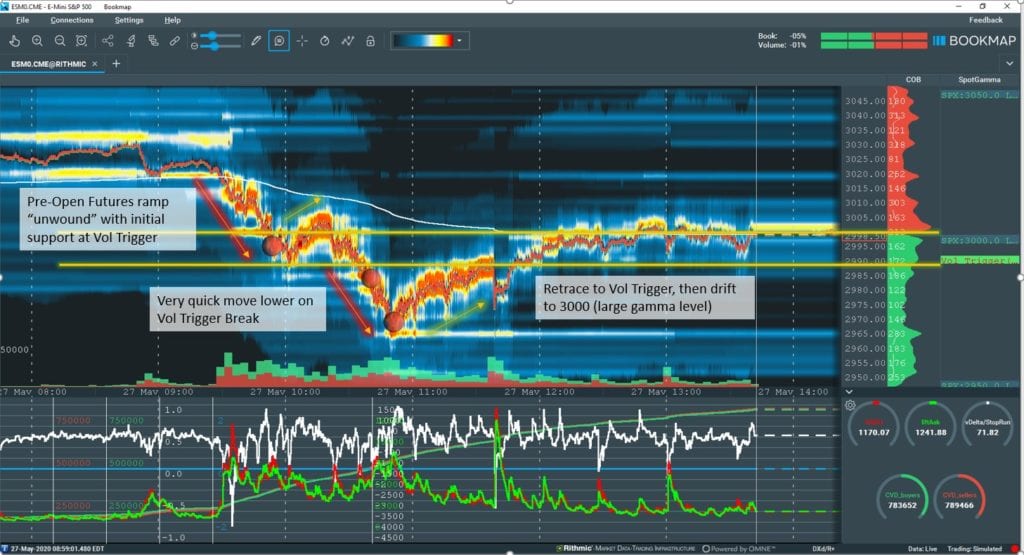

Wednesday 5/27 was a great example of how the Volatility Trigger can be a key level in trading. The concept of the volatility trigger is that when the market moves below the Trigger, options dealers are short gamma. This may mean that they start to sell futures as the market moves lower, and but futures as the market moves higher.

This manifests as a high level of market volatility, just as we saw in the image below.

The Volatility Trigger is a bit different from standard zero gamma levels as the Trigger identifies the last major level of support, as opposed to where dealers may have no position. This may be several handles above where standard Zero Gamma readings are.

Conceptually if you think about the Zero Gamma level it infers that dealers have zero hedging to do at that SPX level. The Volatility Trigger is our propriety method to calculate where dealers last major level of positive gamma support is.