We have been targeting next weeks OPEX 3/20 as a key time in this “volatility cycle” as there is very large open interest. As that open interest is closed or rolled it may allow some calm as call options are re-struck closer to at-the-money and put options are rolled out and down. This could effectively lower negative gamma as large lots of at the money or in the money puts are rolled out to positions with lower gamma. We of course also have a fed meeting on 3/18, amplifying the importance of next week. Keep in mind what we are looking at here is a short term view of a few weeks out. Also note here that we refer to “volatility” as price movement and this isn’t associated with a specific market direction.

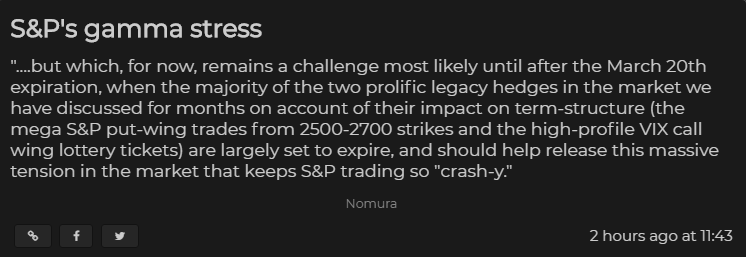

Note our report from last night (3/9), and the similar note from Nomura, posted today (3/10) from “the MarketEar”:

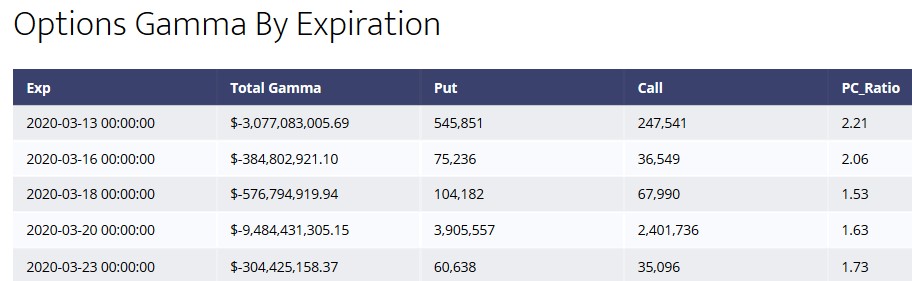

What we believe is key about 3/20 is that we see almost 4 million in put open interest expiring on that day. Much of this interest is in the money, and is causing this negative gamma situation we are in. Using our theory options market makers are short most of these puts and are therefor short gamma. This requires them to sell futures as the market goes lower, and buy futures as the market rises. This expands price volatility.

If you look at our OPEX Tables you can see there are about 3.9mm puts expiring 3/20 – a solid chunk of which are in the money. These put positions are supplying us with a lot of the negative gamma we are experiencing now ($~-1.8bn).

Whats also interesting about theses positions is that the decay will start to pick up as we move forward to 3/20 which will really effect the value of these put positions – especially if implied volatility (IV) stays flat or comes in. If you consider the VIX as a measure of implied volatility you can see it is currently around 50. Should VIX break lower it may cause some dealer buying in futures in excess of gamma hedging.

Regardless – as OPEX nears and all of those positions are closed or rolled that can often create delta imbalances which can often create volatility in the week after OPEX. The imbalance can arise from new positions being initiated which have a different hedging requirement than the current options positions. For instance we have roughly 100k puts at the 3000 strike for 3/20 OPEX. If those puts are simply closed that would create a sizeable number of deltas to either buy or sell (depending on if the puts are bot/sold).

The 20-Mar SPX expiration is one of the largest-ever non-December expirations (Only Sep 2011 higher)

— Joe Kunkle (@OptionsHawk) March 12, 2020

$1.7 Trillion Notional OI

Most open interest was added in the last three months w/ strikes above 2900 which should limit Gamma impact

– GS

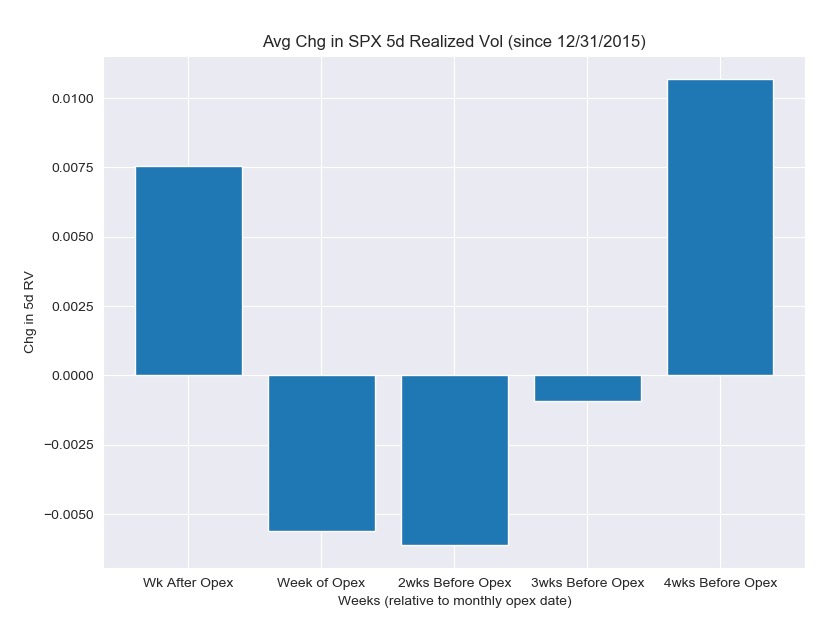

Ignoring for a second how much volatility we have been experiencing, and reference the chart below from @PatHennessey which shows the change in 5d realized vol around OPEX. As you can see the week into OPEX typically sees lower vols, then the weeks after experience expansions in volatility. However the bulk of this data is sourced from when we have positive gamma in markets, not negative. We may therefore get something of the opposite effect – large, volatile swings going into OPEX, then a drop in volatility in the weeks after as the bulk of this negative gamma expires and/or is rolled out.