We posted a few days ago about the “right” tail risk and the possibility of a market rally. In a note to subscribers we added to this, suggesting the market may be in an airpocket. Specifically: “zero gravity”. Most of you are probably familiar with those flights which take you to the edge of space and allow you to experience zero gravity for a minute or two.

We think the market may be in this “zero g” now. After a vicious drop we’ve had a strong rally in equities fueled by the rockets of stimulus, fund inflows, short covering and negative gamma. Overall options volume has also been declining and we are past the major stimulus announcements, and “month end” is today which may slow fund inflows.

Gamma levels have come in sharply suggesting options dealers aren’t offering much of a push to markets here (read about negative gamma here).

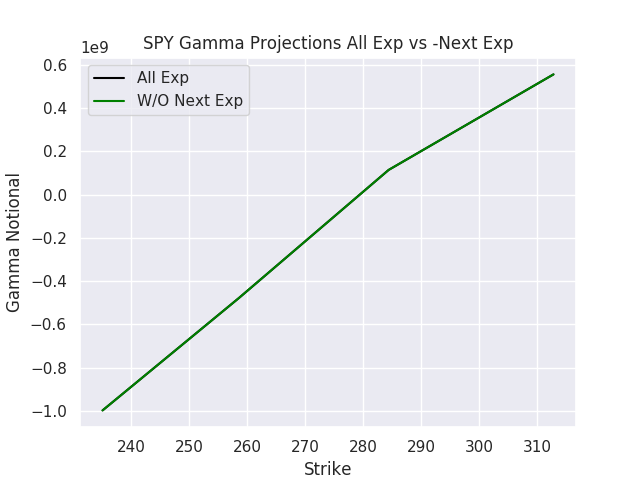

If you see in the graph of SPY gamma below, we are approaching the zero gamma flip point, but still have several percent to go (Current SPY = ~260).

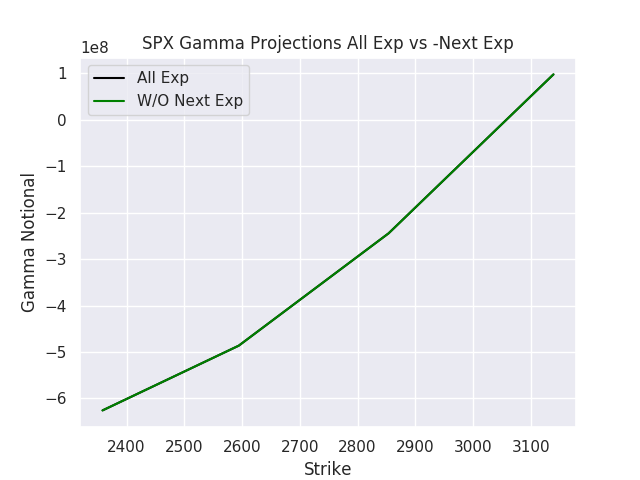

The flip point for SPX is even higher, closer to the 3000 point level. As options volumes are low, we are not seeing much appetite for calls which would help to decrease negative gamma. We are also seeing a fairly flat volatility term structure, if volatility would drop it may also help to reduce negative gamma. We obviously want to see positive gamma enter to help decrease volatility and offer some support to the market. The next options expiration with any decent size is 4/17/20, and that may have a decent impact on gamma levels.

We therefore view this market, at least from an options perspective, as in “zero gravity”. This does not necessarily mean we see a large drawdown or spike higher. It does suggest that more “fundamental” elements of the market may now enter the fray, particularly with earnings season starting.