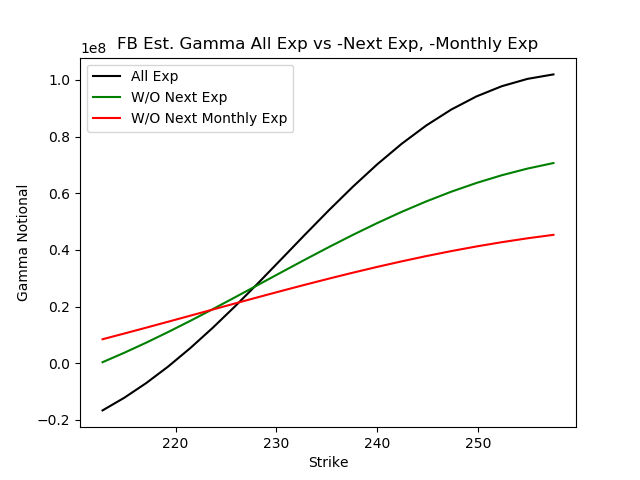

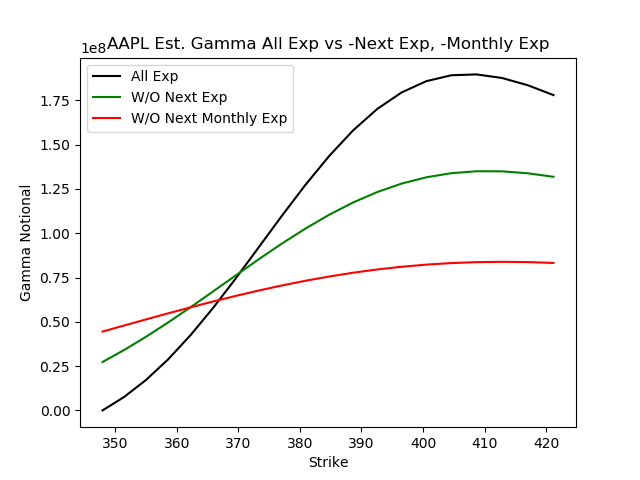

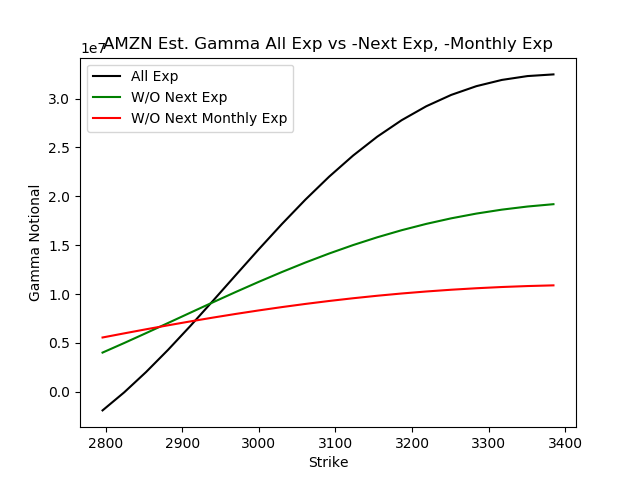

Below we show two styles of charts. The first (red, black, green lines) show how much gamma is tied to various expirations. The more gamma there is the more volatility these stocks may have. This is due to our assumption that stocks maintain a negative gamma stance as traders are primarily call buyers (and dealers are short).

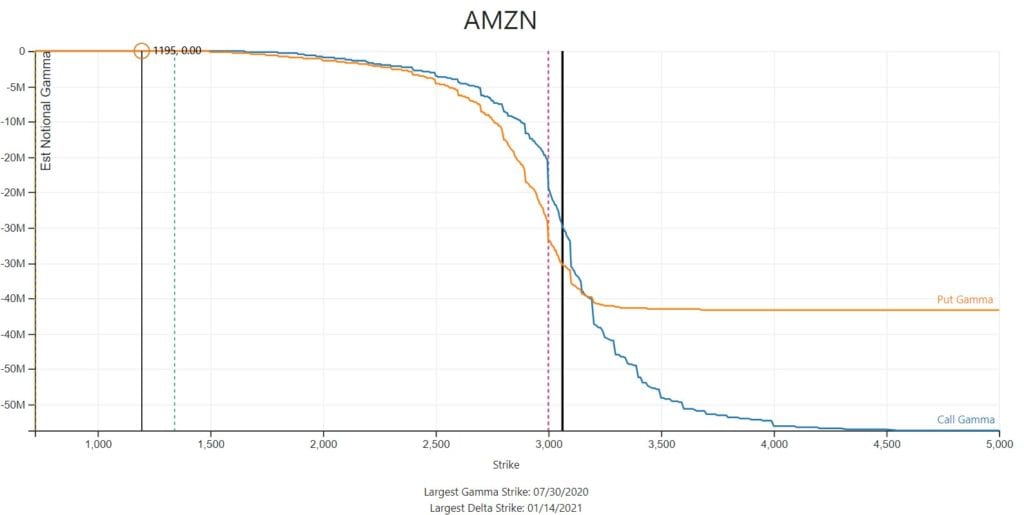

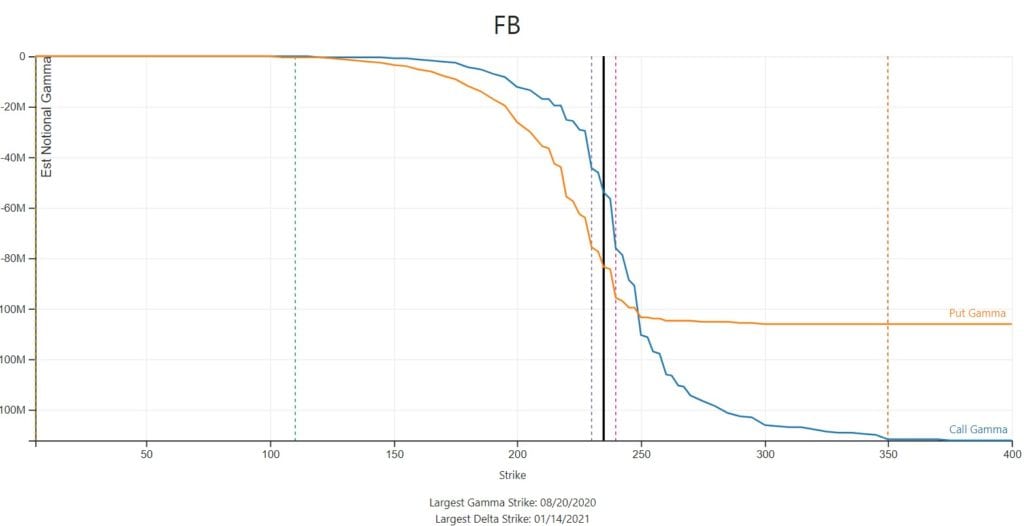

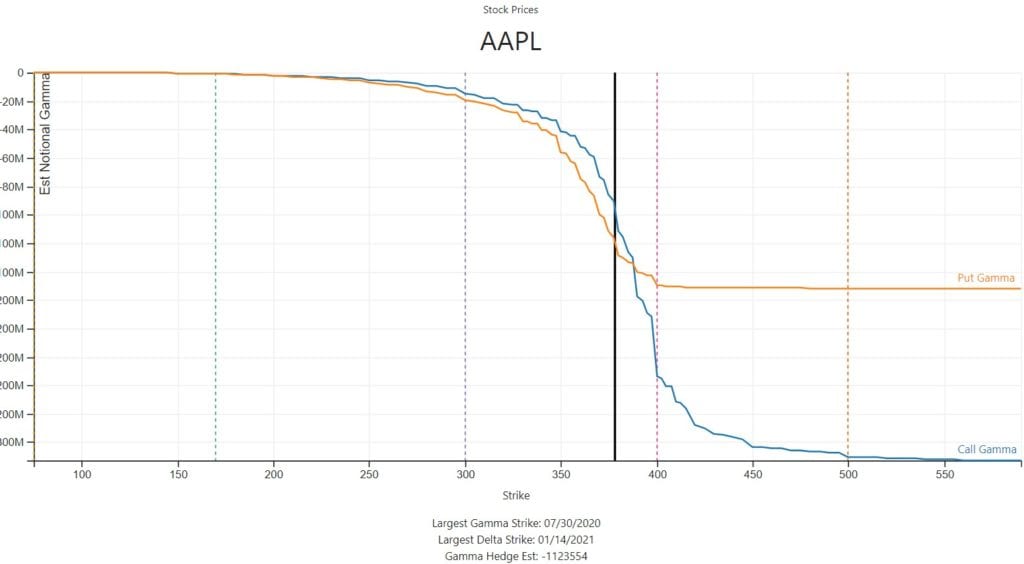

The second type of chart highlights where hedging flows may kick in, and we look at where put gamma and call gamma levels diverge. For example around the 3200 level in AMZN.