In a recent Member Q&A session SpotGamma discussed how traders can analyze implied volatility and potential stock movements by comparing the relative moves and reaction of stocks in similar sectors. Here we look at the volatility & setup into SMCI’s earnings report, and its subsequent reaction, to guide us on what may happen for AMD […]

earnings

INTC Post ER

Update: We posted this to twitter last night after INTC missed earnings and was down -10% after hours. $INTC is -10% after ER’s. There is a lot of OI at 50, particularly in puts. The bulk of those positions sit in the 11/20 exp, so there could be extended pressure into low 40s. (Often in […]

PRPL Mattress Fire – Options IV Burn

PRPL is a major retail WallStreetBets favorite, causing a huge runup in to 8/13 earnings. After reporting an ER beat the IV in the stock likely got crushed, which caused long OTM calls to decline sharply. This leads to dealers unwinding hedges, and a stock drop.

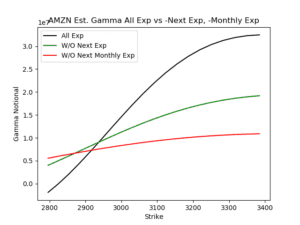

AAPL, FB, AMZN Earnings Gamma Chart Pack

Below we show two styles of charts. The first (red, black, green lines) show how much gamma is tied to various expirations. The more gamma there is the more volatility these stocks may have. This is due to our assumption that stocks maintain a negative gamma stance as traders are primarily call buyers (and dealers […]

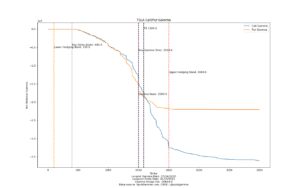

TSLA Options Pre Earnings

TSLA reports earnings tonight, and there is a ton of options gamma to generate a large move tomorrow. We define key levels for the stock as follows: Lots of Gamma at 1500 – thats the “pivot” area where stock remains a bull above, bear below. There are a ton of in the money calls at […]