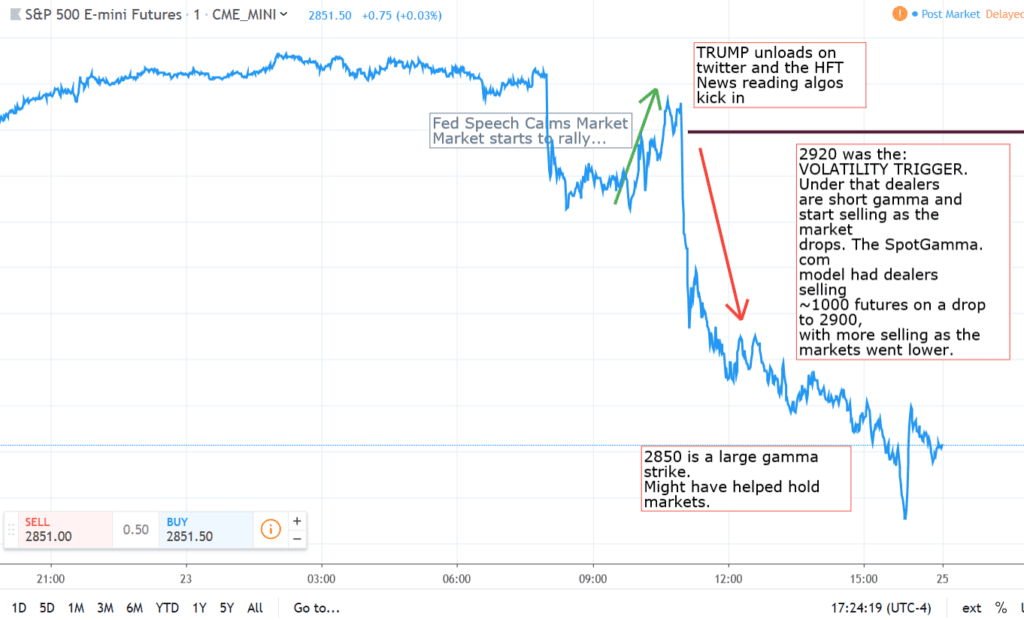

Fed gave a speech that was “volatility dampening” at 10AM. Trump didn’t like what the Fed had to say so he started tweet-trashing the Fed and China triggering a “gamma trap“. Stock markets were just at the volatility trigger level of 2920 (black horizontal line) so the gap down flipped the trigger and dealers were short gamma. This means they had to sell along with the market as it dropped. This created a self-reinforcing cycle and drop in stock markets.

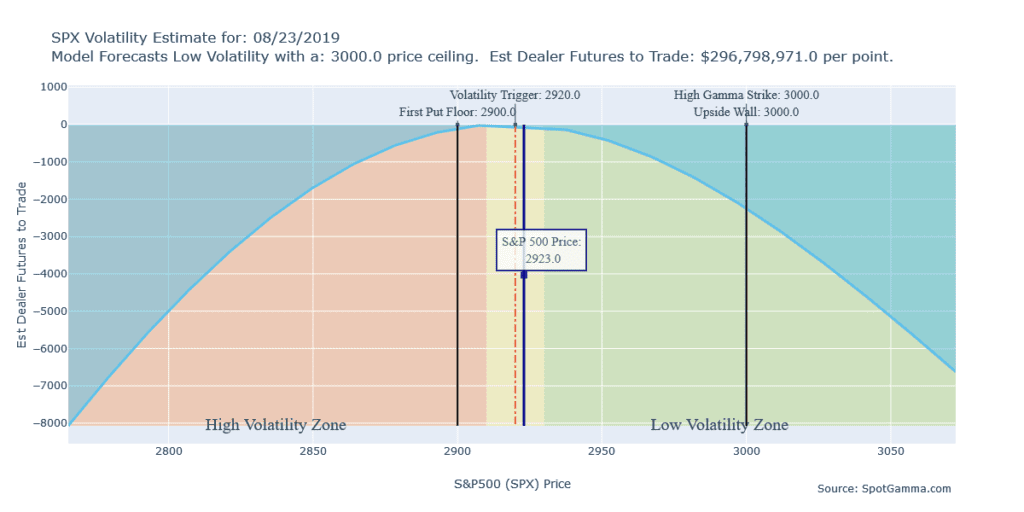

Here is the SpotGamma market gamma snapshot before the open. You can see the market sat right at the “volatility trigger” which is where we dealers are “gamma neutral”. To the right of that trigger market we calculate dealers are “long gamma” and suppressing volatility, to the left they are short gamma and amplifying volatility.

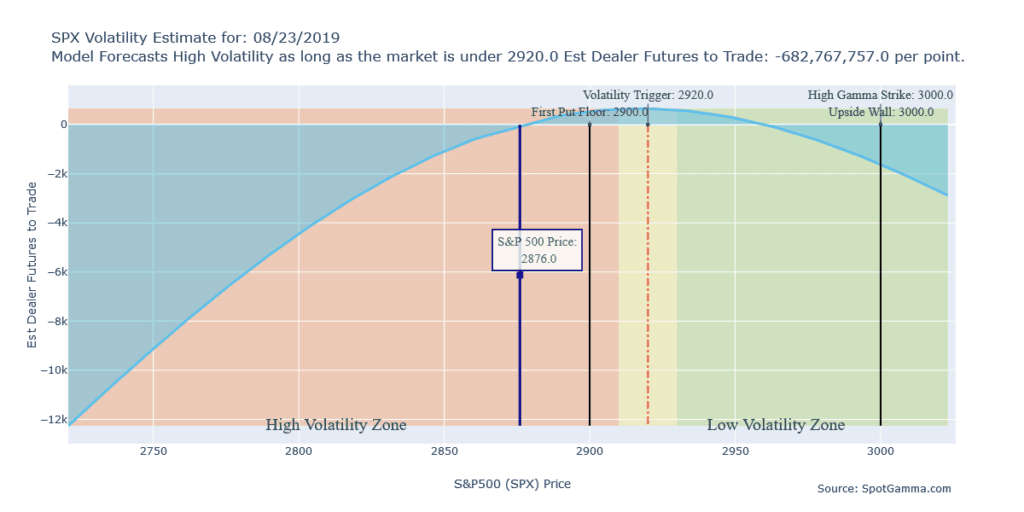

Below is the chart after the Trump tweet-storm. You can see quite a drop into the “High Volatility” zone, well under the 2920 volatility trigger.

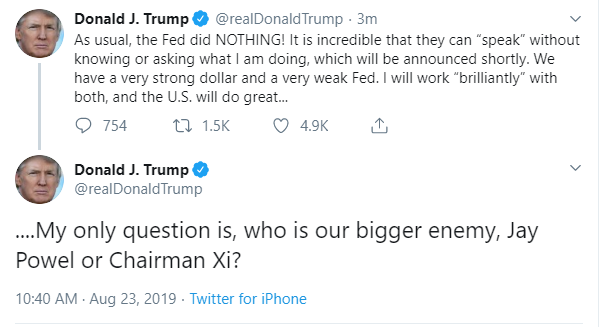

Here is Trumps tweet, which caused the gamma trap: