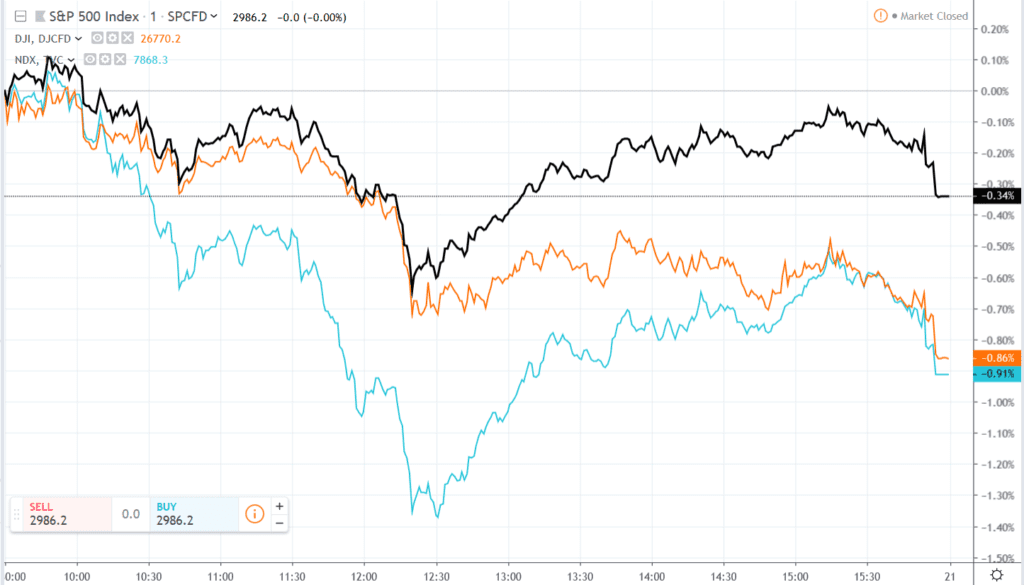

Lets classify this as what it is: speculation (at best) but its quite interesting on days like yesterday when the S&P is down only 34bps while Nasdaq and DOW were down ~90bps. Yes, Boeing (BA) hurt the DOW in particular but that wouldn’t explain the Nasdaq performance. The theory that should be bookmarked here is that the gamma effect seen in index movement is due positive gamma (the S&P gamma was ~$750 million vs $25 million in QQQ & $14 million NDX) kept a bit of a lid on S&P volatility and thats why we see less movement.