With huge levels of volatility in markets, Brent Kochuba, Founder of SpotGamma, spoke with Scott Nations, Founder, Nations Indexes about their options indexes. Brent & Scott discuss these innovative options metrics including: NOTE: Below is a searchable transcript of the discussion, with timestamps. As its an automated transcript, please forgive any grammatical errors. Nations Index […]

nasdaq

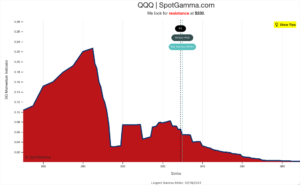

Trade Analysis: QQQ (August 15, 2022)

The following is a guest post from Doug Pless. At SpotGamma, our community uses the SpotGamma AM Founder’s Note when preparing to trade index products such as the QQQ (Nasdaq 100 ETF). Specific levels to note include the following: Volatility Trigger, SpotGamma Absolute Gamma Strike, Put Wall, and Call Wall. Additional levels are the CP […]

Gamma Levels Can Reveal Huge Forces Driving The Nasdaq

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The equity markets have had sharp drawdowns and extremely high volatility in 2022. While this dynamic has created a difficult backdrop for traders, the options market is playing a big role during these tricky times and SpotGamma indicators may provide an […]

The Sell-off For The NASDAQ May Not Be Over Yet

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. With the Fed pivoting to a very hawkish stance starting in 2022, the Nasdaq has witnessed a dramatic decline of nearly 18% since peaking in November. The drop may only continue in the weeks ahead as market participants try to figure out the potential […]

Nasdaq Whale Resurfacing?

From Bloomberg: On Thursday, a combined $74.5 million worth of Amazon call options expiring in January and March changed hands, divided between two block trades. Almost $52 million worth of bullish Facebook options expiring in the same months traded in two transactions. Roughly $25 million was spent on similarly dated Netflix calls in two blocks, […]

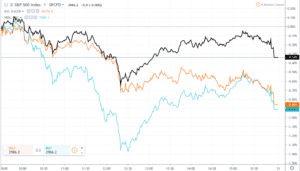

Gamma Effect Seen In Index Movement

Lets classify this as what it is: speculation (at best) but its quite interesting on days like yesterday when the S&P is down only 34bps while Nasdaq and DOW were down ~90bps. Yes, Boeing (BA) hurt the DOW in particular but that wouldn’t explain the Nasdaq performance. The theory that should be bookmarked here is […]