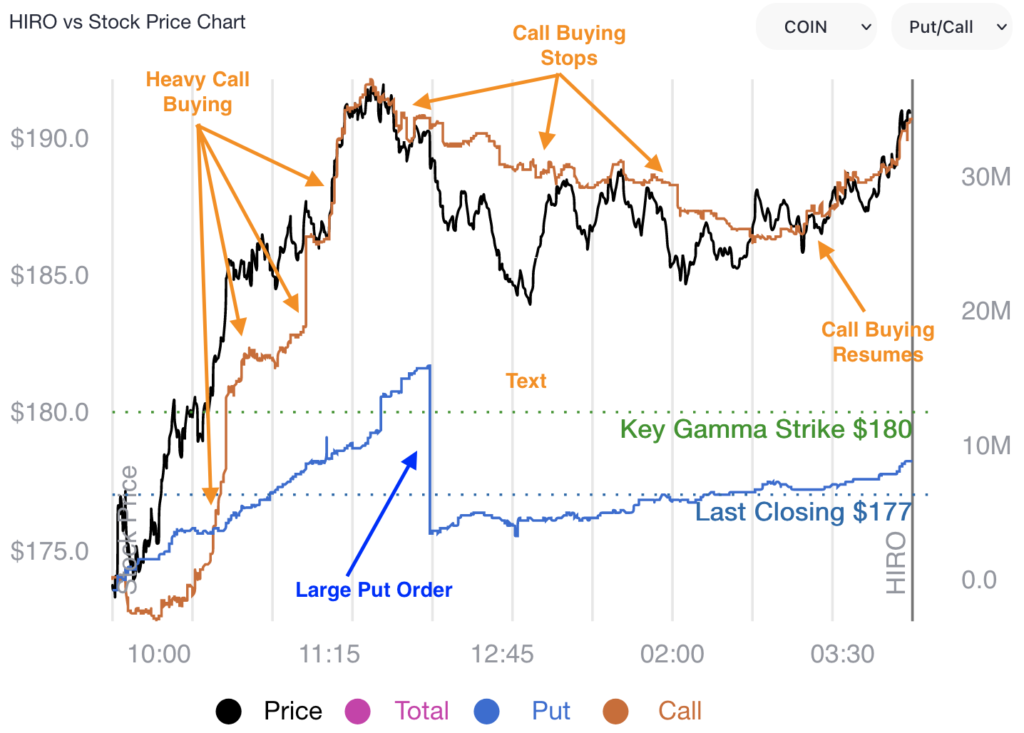

Today we noted strong call buying to start the day in COIN (Coinbase). This call buying is shown below, in orange, in the form of estimated hedging impact. The hedging impact, or HIRO signal, is tied to the right Y axis. The signal suggests that as traders buy calls, market makers are likely selling those calls and needing to buy stock as a hedge.

Note that shortly after 11:15ESt the call buying subsides, and the stock reverses off of its highs. We believe that once the call options flow flipped from bullish (positive HIRO signal) to neutral/bearish, dealers were no longer needing to buy the stock. Therefore, the stock lost one of its key drivers and momentum faded.