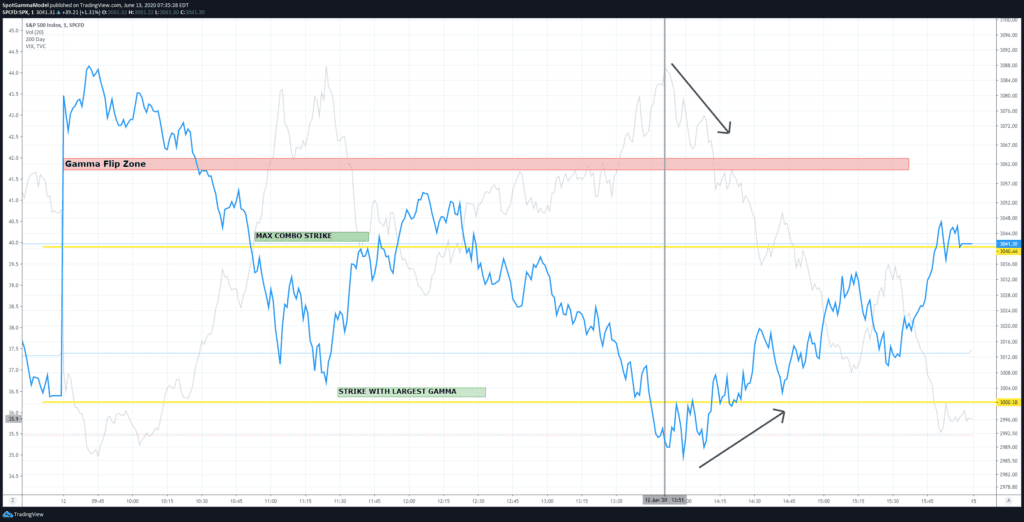

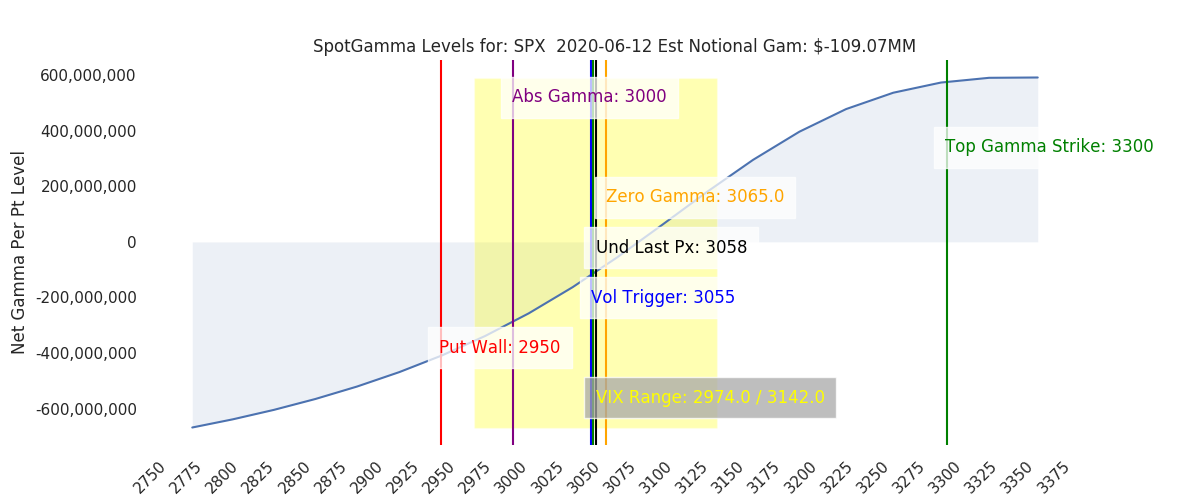

Markets were unable to hold gains on Friday after a sharp selloff on Thursday. While we initially opened over the gamma flip zone, markets broke that 3075 area and immediately sold down to the 3000 strike. This 3000 level is where we calculated the most options gamma and served as support. All of these levels were published pre-open to our subscribers (see chart at bottom).

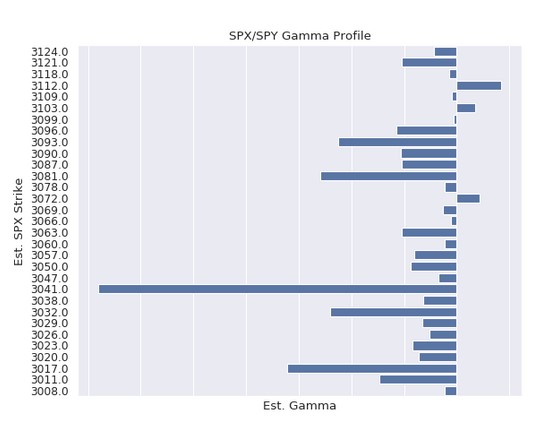

To the upside markets tested our volatility trigger level of 3055 and closed directly at the largest combo strike of 3041. You can see the very large bar in the chart below which suggests thats where the most options gamma sits when combining SPX & SPY gamma.

When markets shift from positive gamma to negative gamma in infers that options dealers will start selling as the market moves lower. Conversely if the market can rally, dealers will need to buy back shorts. This can expand volatility as dealers push prices.

Here is our subscriber chart from before the market open on Friday, which shows the key levels for the day.

Subscribers get a free 5 day trial which includes two daily emails, dozens of charts and a historical download of gamma data.