We produced these levels in real time for subscribers, but if you’re a bit behind here is the update from Nomura via ZH. This note comes after the SPX tested 2950, and sold off toward the 2800 level on Friday 5/1/20.

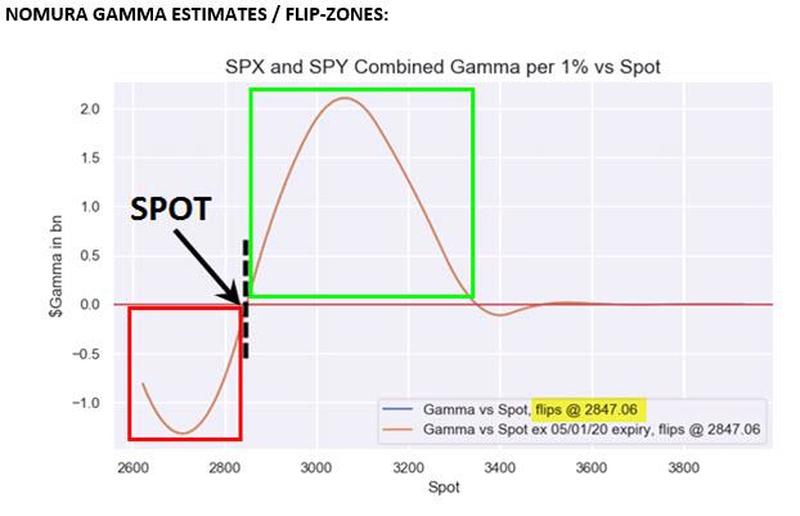

The gap also shocked the also just-established Dealer “Long Gamma” position (when ref was ~2940 yday morning) now all the way back down to the exact “Neutral Gamma” level (2847, basically right where spot is now)—while any push lower from here then risking a move deeper into outright “Short Gamma” territory which would elicit heavier-handed Dealer hedging flows that likely dicate “selling-into lows”

NOMURA

As Nomura concludes, the extent/velocity of the selloff in Spooz matters because:

ZH

it has sent the S&P back below the trigger level where CTAs would again pivot back -“short” as the 84.6% loading in the 6m window would “flip” (a close below 2926 has signal to -69% short, while below 2805 goes back -100% short—albeit all on smaller gross $ exposure)’

this current spot ref ~2840 level is actually back (lower) to the “Gamma Neutral” level from yesterday’s typically insulating “Long Gamma” position for Dealers…but certainly now capable of slipping into outright “Short Gamma” on another surge lower

NOMURA

To the second point above, McElligott adds that impulse shifts lower in the Dealer “long gamma” position – think of its a third derivative of prices – tend to corroborate with larger trading ranges, especially as we get deeper into “short gamma” territory and Dealer hedging behavior is altered, having to “sell into the hole.”

ZH

a bleed deeper into “Short Gamma” territory now that we are slightly below the “Gamma Neutral” level at 2847 (with $1.1B $Gamma at the 2850 strike)…things get especially frisky into an approach of 2805 (CTA’s going deeper short from “-69% Short”- to “-100% Short”- signal) and the “Short Gamma” more aggressive options Dealer hedging flows (selling into lows), all of which could conspire and accelerate this market reversal–particularly in light of weaker holiday volumes.

NOMURA MCELLIGOT