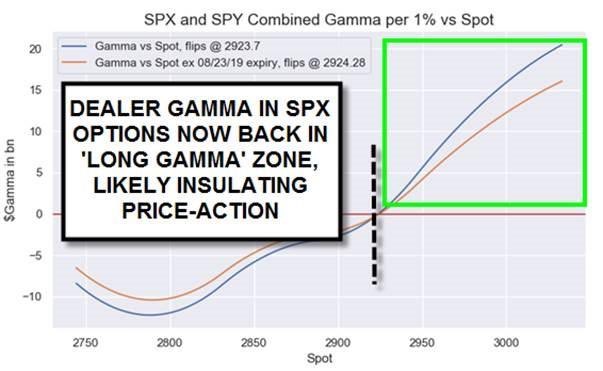

Nomura published an updated gamma chart showing that options dealers are now “Long Gamma…likely insulating price-action”. Nomuras options gamma estimate of 0 at 2923 is essentially the same level as our “Volatility Trigger” which is 2920. The issue with their analysis is that appears to be jumping the gun. Zero and positive are not the same thing. See below for more.

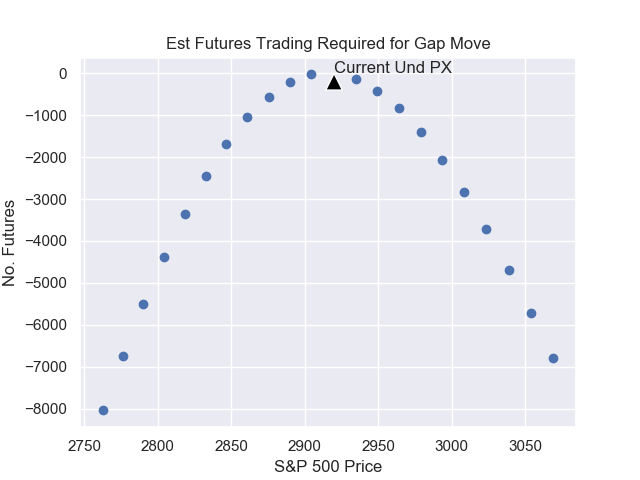

At 0 gamma dealers have no volume to trade. 10 or so SPX points below here and dealers are back to short gamma which means they are likely “price escalating” aka selling futures as the market sells off. This expands volatility. This chart below gives an estimate of what futures trading by market makers might look like given a move in the S&P500. You can see that selling kicks in pretty quickly as we move down.

Therefore it appears that Nomuras options gamma estimate has a bullish narrative, rather than just supplying data.