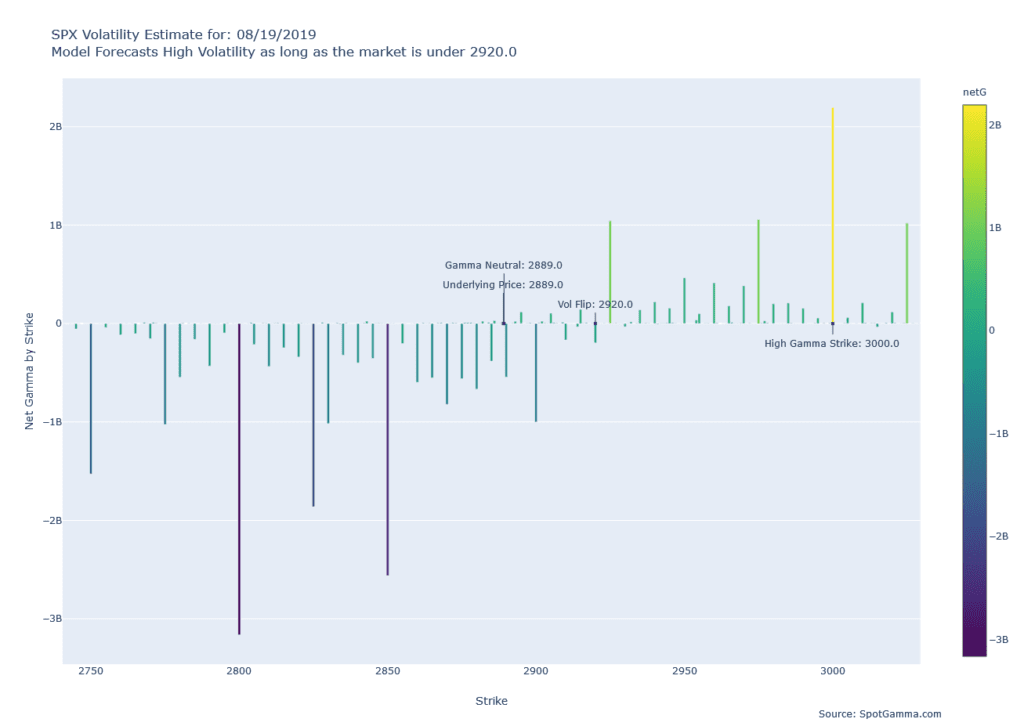

Volatility will continue to reign until (if) the market recaptures 2920. There is a ton of fuel ready to burn and one headline (or tweet) will send the market flying. The only recommendation that is safe here is to not sell any options, being short volatility is very dangerous here, as a >3% rally is just as easy as a >3% drop. If you want some type of range use 2920 as a top and 2800 as a low. Yes thats a huge range but with all of the gamma fuel it wouldn’t take more than a day or two to hit.