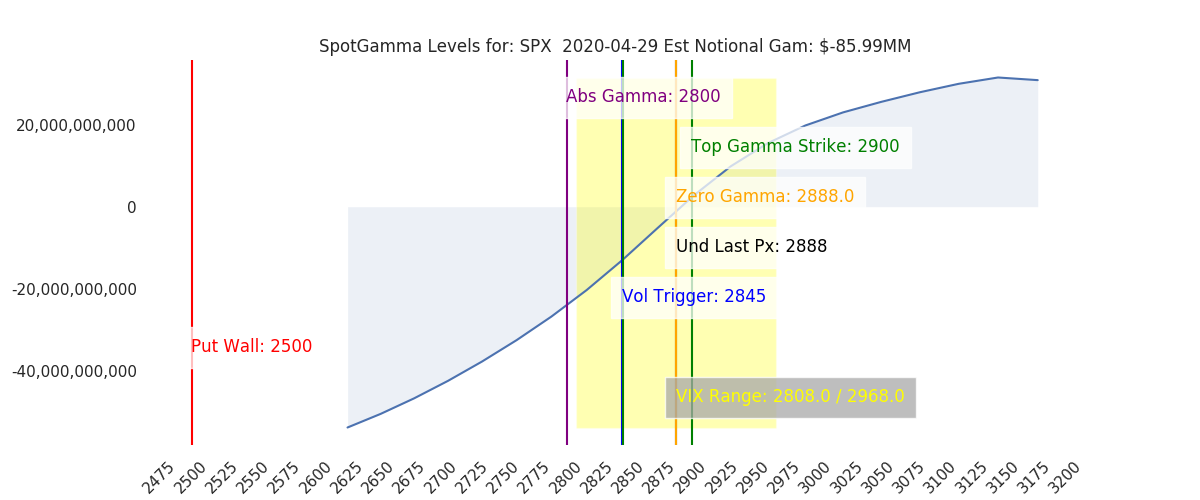

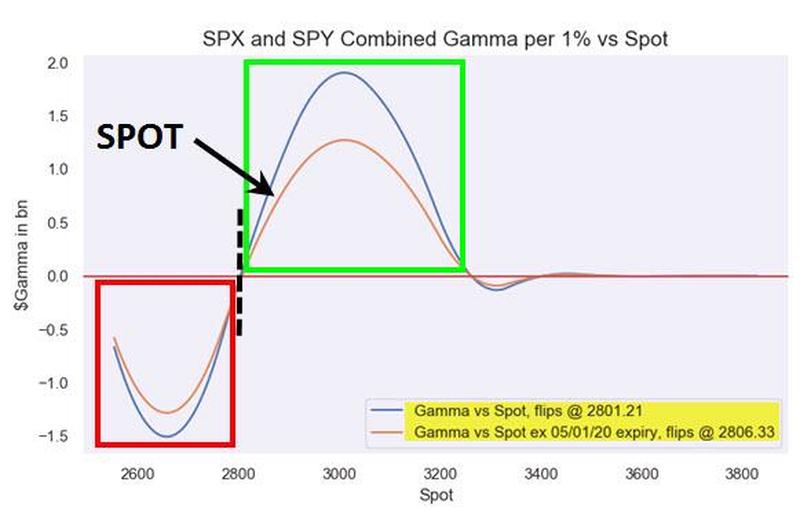

We note to subscribers today that the market is at a key “gamma crossroads” around 2900 where we see sustained positive gamma above that level and the possibility of a strong move into negative gamma if the Fed disappoints today. For the past week we have been consolidating around the zero gamma level and options volumes have been waning. The Fed & FOMC decision today should break this market gamma stalemate. Below you will find gamma charts and commentary from Nomura and Morgan Stanley.

the Nomura strategist notes “the return of heavy overwriter (vol selling) flows in US Equities, a trend that has accelerated in recent weeks, and has helped normalize US Equities single name- and index- Vols”, and now, with the VIX curve term-structure too normalizing yesterday from the multi-month inversion in the front-end (i.e. again upwardly-sloping), Charlie believes that “it is likely that the return of systematic roll-down participants will further escalate the repricing / compression of Vol even lower.”

Focusing on the last point of normalizing/compressing Vol, something which McElligott has previously called a “Crash DOWN, Crash UP” cycle, he points out that “it matters as a second-order slingshot in dictating a mechanical RE-LEVERAGING across the Vol Target universe into re-establishing or growing their Equities positions.”

There is no clearer example of this than today’s Nomura QIS CTA Model, which estimates that the CTA position in S&P 500 futs would flip from “-69% Short” to a “+100% Long” on the close above 2901 (right on top of spot), with Charlie adding “that anecdotally on these days where the model indicates a “flip” potential, said buying to cover and go long is likely already part of the flow creating the current move (ES1 +1.2%)“

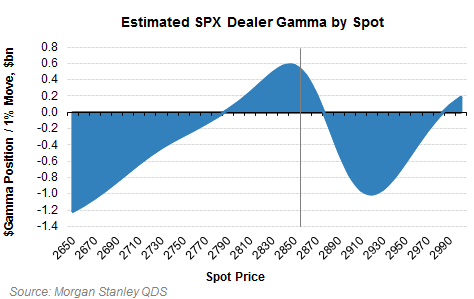

The “gamma flip”-“Based on recent flow QDS estimates SPX dealer gamma would flip to negative above 2880, which could add further upside momentum to an already frothy market if crossed.” Just as we wrote earlier on marketear, recent implosion in vols, makes especially gamma look cheap. The “rational” investor should look at replacing longs with calls, or playing the upside via cheap optionality. So, if the rational investor buys (or protects shorts or whatever strategy they might have where they end up buying upside calls) upside calls, the dealer (market maker) will become short options. Unless the dealer hedges with options, the need for buying delta (stocks or futures) will spike as we move closer to the 2880 level and time passes. Gamma explodes as we near maturity. Depending on how market makers decide to hedge (delta or options hedging) moves could get magnified as we reach the 2880 level.

marketear